Back in August, we saw an absolute collapse in yields. Remember, when yields tank, TLT runs higher… And if the market is expecting deflation to grip the markets, it will get priced in by a spike in TLT. Strongest move we’d seen in years. Here was the full video of why I thought TLT was […]

Blog

How to Pull 1k Out Of The Market Using This One Weird Options Trade

Let’s play a game. Say I have a coin, and you bet heads or tails. If you guess right, you win $1. If you guess wrong, you lose $1. This is basically a “breakeven system.” After all, with 50% odds, it’s going to be a wash. Yet what if the coin wasn’t fair? What if […]

How to Trade the “Free Trading” News

Robinhood was the catalyst. An upstart broker targeting a younger demographic with the promise of “free” trading… on stock and options. Personally, I thought it was a gimmick and not sustainable. Looks like I was wrong. Last week there was a “race to zero” with the major brokerages — SCHW, ETFC, AMTD, IBKR. Looks like […]

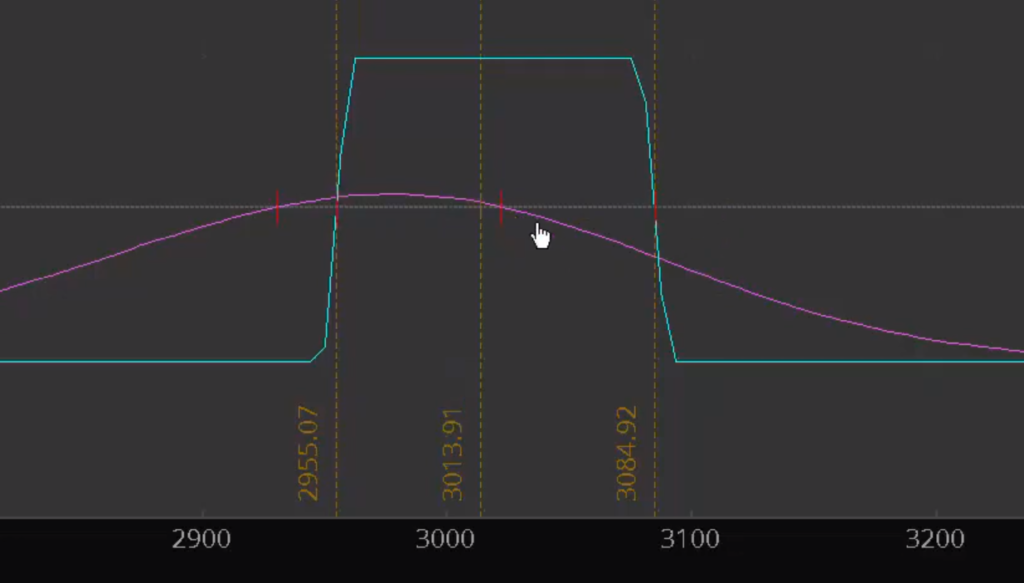

My Favorite Kind Of Technical Setup For Iron Condor Trading

What do we know when we start an iron condor trade? Let’s take a look at the two of the option greeks. First… Delta. I’ve talked about this plenty of times, but iron condors are not “market neutral” trades. They start off slightly bearish. The other greek you have is vega. This is related to […]

Remember Bonds?

Good Lord… the financial markets have a short memory. LESS THAN A MONTH AGO, the long bond went parabolic. TLT ran up nearly 10% in 10 days. Largest rally since the Fiscal Cliff play in 2011. When TLT goes up, it means that rates went down. And rates got low… stupid low… it felt like […]

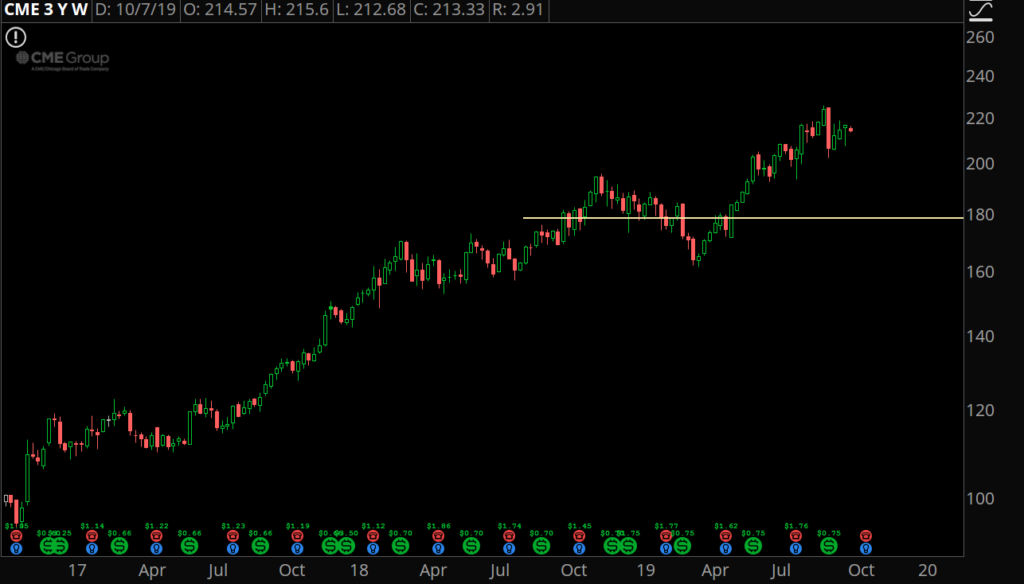

The Chinese Undertaker Trade

If there’s anything I’ve learned from trading this market over the past decade… It’s how narratives will stay quiet for most of the time, but when they shift… markets move fast. We will normally see this to the downside. Take the fiscal cliff from 2011 as an example: The S&P pivots around 1300 for an […]