This has been a wild market, and you can make money on both the long and the short side.

I'd like to share with you two trades we put on at IncomeLab. The first is a bet on long volatility using the VXX, and the second was a breakout bet in NET.

These setups were sent to clients at IncomeLab. Each setup comes with a video fully explaining the trade setup, and those are the videos you see on this page.

Looking for a Volatility Spike

Towards the end of May, the market was on an absolute tear higher.

But volatility wasn't budging! From May 22nd to June 4th, the S&P 500 rallied from 2950 to 3100. That same time, the VIX sold off by about 2 percentage points.

Something was up, and I wanted to find a fairly safe way to get long VXX.

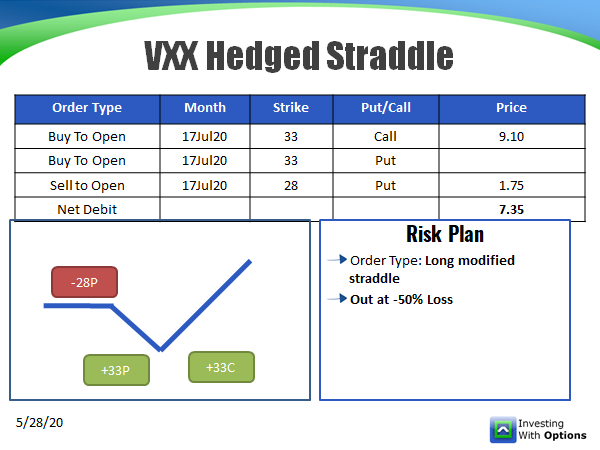

Here was the trade setup sent out to IncomeLab clients:

And here was the video explaining the trade:

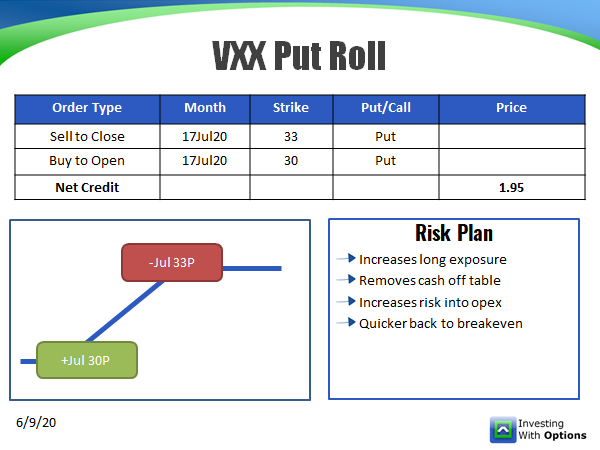

In a few days, the market exploded higher up to 3200, and we adjusted the trade:

Here's the video talking about the adjustment:

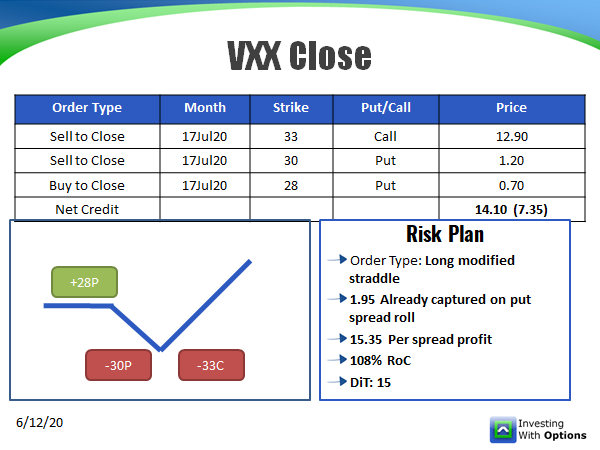

On June 11th, the entire market got smashed-- down over 4% in a single day!

The VXX ran from 30 to 45. I didn't want to hold onto it after the first spike, because I felt that upside vol would soon be capped.

We were able to close out the trade for a tidy profit-- 108% Return on Capital in just 15 trading days:

Looking for a Breakout in Cloudflare (NET)

I'm a big fan of this company. I use their tech on a regular basis and I think they're setup to own an entire layer of the internet.

After its earnings event in May, it just chopped around for about a month-- that's when I started looking to get long.

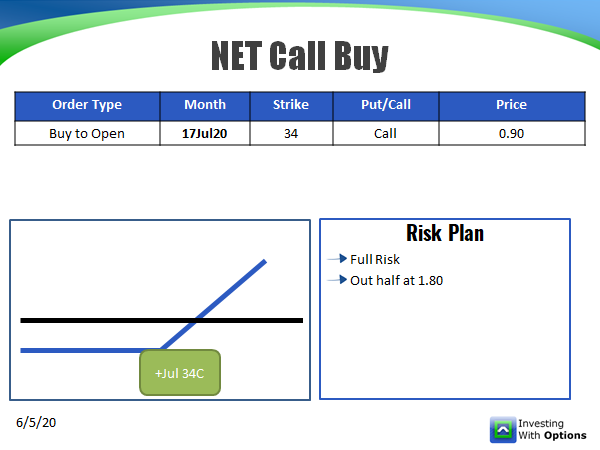

Here was the trade setup:

And here is the video explaining the setup:

About a week later, the stock exploded higher. We closed out half of the trade for a double, and the other half for a 366% return.

You Can Play Both Ways!

There's an investing term called "dispersion." The easy way to think about it is how wide the performance gap is between individual stocks.

And right now, it's huge! If you love shorting stocks, you can short stocks. If you love trading breakouts, those are working too. What matters is your timing and how you structure your risk.

If you like these kinds of trade setups, you can become a client at IncomeLab - you can get started here.