Income trading is a subset of options trading that is more advanced than the basic call-buy-put-buy trades, but once it is mastered, it can provide you with consistent, reliable trades regardless of what the market is doing.

Income trading is a subset of options trading that is more advanced than the basic call-buy-put-buy trades, but once it is mastered, it can provide you with consistent, reliable trades regardless of what the market is doing.

In under 10 Minutes, you will learn the different types of income trades, the risks in the trades, and why you would trade them.

Why Income Trading Is Different

Most traders get started trading directionally. It could be stocks, bonds, futures, forex, or commodities-- financial speculation occurs when money is put at risk betting on a certain direction.

It's either long or short. Up or down.

But in the options market, you care not only about up or down, but how fast and how long. The ability to structure risk around the concept of how fast a stock will move is a subset of trading known as "volatility trading."

In practice, there is no way to separate direction and volatility-- every trade will have a mix of both.

Income trading is a subset of volatility trading that looks to make money if the underlying stays within a range.

With Income Trading, you profit if the market doesn't move that much, and you lose if the underlying makes a huge move.

With income trading, you are playing the odds. The volatility in the market. If you can understand how volatility works and how you can structure trades in the options market to play against this volatility, then you have a pretty good edge.

Two Types of Income Trades

Options Income Trades can be split into two major categories.

You first have directional income. This includes put sales, call sales, vertical spread sales and other positions that carry a high directional component.

There is also non-directional income. Another name for this set of trades is delta-neutral trades. These trades seek to have little exposure to market movement and instead look to profit from option premium decay over time.

In this post you will only learn about the non-directional kinds of income. If you want more help with directional income, you can start with our guide to covered calls.

The Advantages of Income Trading

Systematic Entries. Income Trading requires fewer inputs when entering a trade. This means you don't have to focus on being right, you just have to focus on managing risk.

Low Directional Exposure. Because most income trades are close to delta-neutral, you don't have to worry about fluctuations in market price. On a strong move in an underlying stock or market, there will be adjustments needed, but they occur infrequently.

Consistent Asset Selection. No guesswork is needed when it comes to stock selection. Income trading focuses on the same assets over and over-- normally equity indexes, commodities, and a select few very liquid stocks.

Hedges Against Other Strategies. Income trading with options can be a great complement to other directional trade strategies. For example, a trader could couple income trading with a trend following strategy. If the market breaks out into a new trend, the income trades will underperform but the directional trades will significantly pay off. If the market is super choppy and the trend-following strategy keeps getting stopped out, the income trades will be there to cushion any losses.

Low Time Commitment. Asset selection and choosing entries can be very time consuming in other trading systems. Because those are taken care of with income trading, you have more time available for other things. Income Trading is a great option for those who have full time jobs and cannot commit full attention to the markets throughout the trading day.

Income Trading is Speculation

If you are looking at income trading as the magic bullet, prepare to be disappointed. Often after using options for leverage and directional speculation, many traders will transition to income trading because it doesn't feel like financial speculation.

But remember this is financial speculation. When putting on trades in the options market you will be exposed to risks known as "the greeks." Any exposure whatsoever is a form of financial speculation.

Income trades make money when markets are rangebound or mean-revert, so when putting on these trades you are essentially speculating that the market will stay within a certain range for a period of time.

The Major Income Trades

Although there's plenty of permutations of income trades, they all tend towards three major structures.

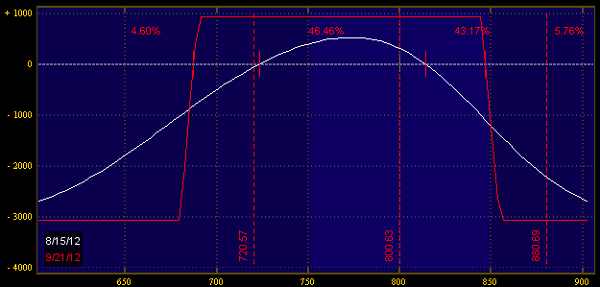

Condors. This trade makes sense when the implied volatility skew is very high, so out of the money options become a sale.

Want to learn more about Iron Condor Trading? Get the Iron Condor Toolkit Here.

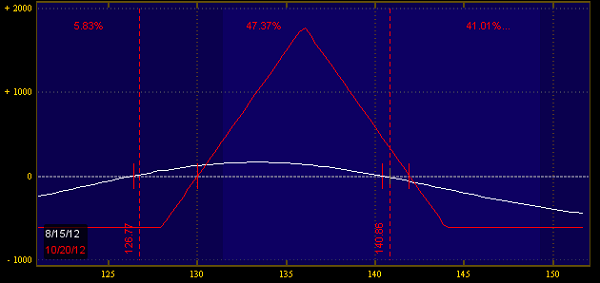

Butterflies. This trade works when realized volatility continues to stay low, but volatility skew is no longer steep.

Calendars. This is the income trade that makes sense when implied volatility is very low. Because it is long a back month option, it is the only trade structure that is net long "vega" which means if implied volatility rises then the trade will benefit.

The Big Tradeoff in Income Trading

The options market is a risk market. In exchange for taking on risk, you get a premium.

With "delta neutral" income trades, you put on a bet that the underlying market won't move that much. Where you lose money is if the market blows out to one side or the other.

In exchange for that risk, you take on a premium. As time goes on, the position works more in your favor-- the longer the market stays in that range, the more money you make.

So that's the big trade-- take a premium to assume bidirectional risk.

How to Make Money with Income Trades

There is one main principle when it comes to income trades:

Manage Your Deltas Until the Theta Kicks In

The main risk that you have is the short gamma of the position. That means any adverse movement in the underlying will increase your directional risk-- your delta--and there will come a point in time where that risk becomes too high and you need to adjust your position.

This is known as "delta-band" trading, where you have an acceptable directional exposure you are willing to have, and if that risk becomes too great you find ways to reduce the absolute value of that delta.

Goals With Income Trading

As with any other set of trading strategies, there is no way to get away from the risk/reward and odds equation. If you want bigger returns in your portfolio, you have to be willing to put more risk on the table as well as reduce your odds of success.

A more conservative trader should expect to make between 3-5% per month on winning months, with very few losing months. If adjustments are done properly and proactively, the "losing" months will be at worst breakeven.

Take the Next Step

The best trade to start with is an Iron Condor. Get your FREE Iron Condor Toolkit Here.