When a new technology comes along, it can sometimes be hard to explain it.

Google uses a "web spider."

Amazon has a "cloud."

And twitter... well, twitter is twitter.

The best product analogy I can think of for twitter is cigarettes.

We hate that we use 'em. We know it's toxic. Yet every 15 minutes, like clockwork, we get an "itch" to take a twitter break.

Just one more for today, I swear.

Just one more hit.

That's why I'm long term bullish on TWTR. Yet, there is a difference between a company and a stock. You could love eating at Chipotle but that won't help you when the stock gets cut in half because they don't sell queso.

Timing matters. And I do think we're coming into an inflection point for the stock.

My Original TWTR Call

In April of 2016, I made a call that we were nearing a bottom for TWTR stock and that the narrative would follow something along how YHOO traded a few years back.

I even made this sketch of how I thought the stock would trade:

And here's how the stock has traded so far:

That's kinda close, right?

Anyways, the trade thesis still holds true. The stock of TWTR is, until proven otherwise, dead money. It probably won't go bankrupt, but it won't be a shining momentum star anytime soon.

So if you plunk your hard-earned cash into the stock, it may be a while for it to realize significant gains... unless you're actively trading against it. You've gotta be pretty spot on with your timing and know when to take some profits.

The Best TWTR Option Strategy

My favorite strategy? Taking the low end of the current trading range to sell puts into it.

Here's an example of this exact trade setup:

That trade ended up profitable, with about a 10% return on margin over the course of about a month.

I'd like to share with you a similar trade, but first-- a disclaimer. You and you alone are responsible for your gains and losses. I'm not your broker, and you should know your financial needs before you even read investment blogs. This is for educational purposes only. Batteries required.

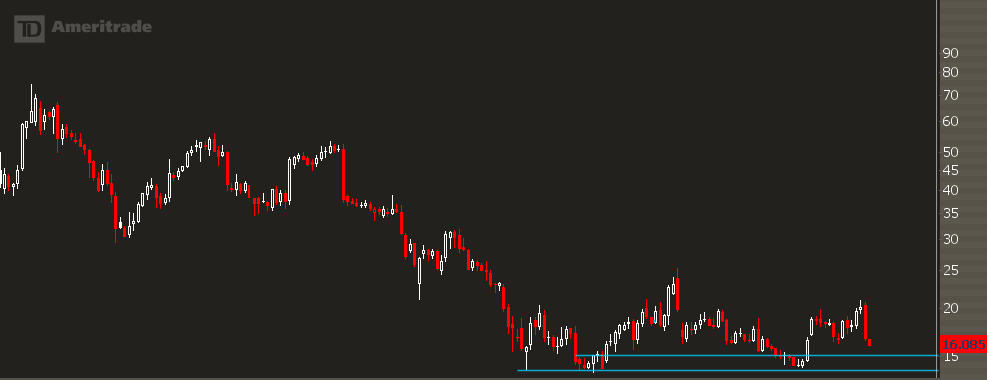

Now we got that out of the way... let's take a look at how TWTR is trading right now:

Nasty move on earnings, breaking some key support levels, and there is a huge area right around 15. We can use that to our advantage.

The TWTR Sep 15 Put is currently going for 0.35. This means when you sell it, you take in a credit of 0.35. If TWTR is below 15 into September expiration, then you get assigned the stock at a basis of 14.65.

A .35 credit on a basis of 14.65 is a return of 2.39% in about a month. Annualized, thats 28%... double that if you assume 50% margin. If you get assigned, then sell calls against your position, then sell puts... basically converting your trade into a covered strangle.

Simply put, into any blood, selling options in TWTR seems like a good bet to me. It's a dead money trade and will most likely be rangebound for quite some time.

There are risks here-- namely if TWTR goes bankrupt. That's basically it. However, if you think this stock is rangebound for a while, then consider strategic plays in the options market.