At the time of this writing, the VIX is at 11.15.

It's low.

Hilariously low.

And with so many talking about the death of volatility (which isn't true) you might want to take a contrarian bet and get long the VIX.

So you open up your brokerage account, pull up the VIX, and place a buy order.

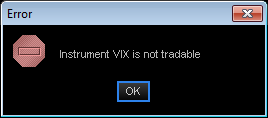

You'll probably see this pop up:

Well that's not good. It turns out, the VIX is a non-tradeable statistic, derived from SPX options pricing.

What do you do now?

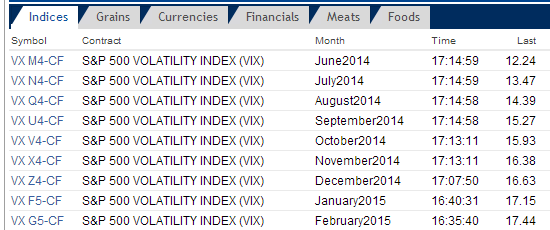

You could trade VX futures! Let's have a look at the current prices:

You could buy the June VX future for 12.24, but those only trade for one more week and converge on the spot VIX. If nothing happens you could see a buy of 12.24 drop all the way to 11.

Instead you could buy July VX futures... for a higher price. Because more bad stuff can happen in a month. The more time to expiration, the higher the cost. In fact, buying a July VX future at 13.50 isn't the best deal in the world because we haven't traded above 14 in 2 months.

So you move on to VIX options... except the underlying of VIX options isn't the VIX, it's the expected value of what the VIX will be in the future, as reflected in VIX options.

Maybe buying a July 12 call for 1.75 is a good bet (which I think it is)-- so if the VIX pops, you'll see a move.

Here's the problem with that-- if and when the VIX does move to the upside, the VX futures (and the corresponding gain in the options) will be dampened because much of that will have already been priced in.

If the July VX future is at 13.47 and the VIX pops up to 16, that doesn't mean the future will pop up 5 points as well... the futures market may in fact trade at a discount to the spot VIX, which often happens during market pullbacks.

You could then look to vol ETP's like VXX and TVIX, but those come with roll yield issues and structural inefficincies.

And so on.

The point here is not that long volatility is a bad trade-- in many cases long vol is a great trade here.

But thinking you can just get long the VIX because it hit 11 is a much more complicated idea than what it seems.