A note from Goldman is out today suggesting that now is the best time to buy S&P 500 calls in over 20 years.

That's quite a bullish call, right? It sure sounds like they're sucking people into the long side after the markets have already seen a strong move.

Yet there is more to the story than a simple long/short bet.

Taking Apart the Call

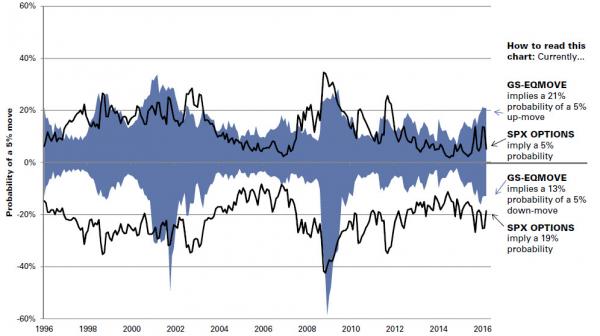

Goldman has a risk pricing tool that shows the expected range of the market, both to the upside and downside.

It's not about being bullish or bearish but it shows us the expected standard deviation of price movement.

The VIX operates in a similar manner. If the VIX is at 15% that means the expected movement over a year's worth of trading is 15% higher and 15% lower.

It's statistical expectancy over a timer period. Can the market go higher than that? Yeah. Can it go lower? Sure. But that's the current risk pricing available.

Now, if you have an indicator showing you that the odds of upside movement is greater than what the options market is pricing in, then you take that bet.

Why This Is Showing Up Now

Let's talk quickly about option skew.

Not all options have the same risk pricing. That's becaouse the majority of investors are scared about downside movement.

That means the normal action in the options market is for investors to buy puts and sell calls.

Think about what just happened. The market hit correction territory earlier this year, and we've seen an incredible squeeze back to SPX 2000.

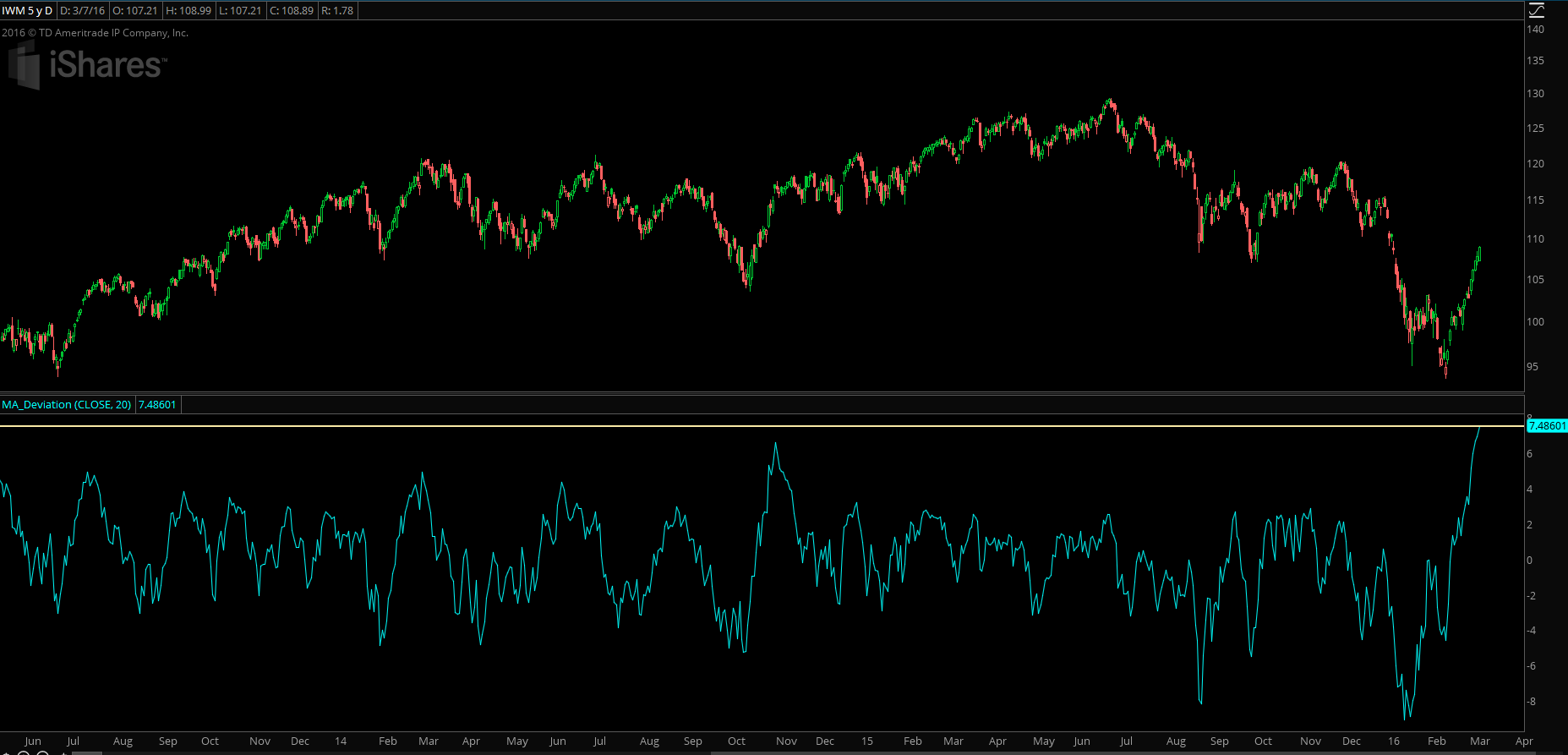

It's the same on the Russell 2000... it's currently 7% above the average price over the past month:

So if you're an investor and you're still holding stock, and you want to continue to hold that stock, what do you do right now?

You sell calls against your position. Because we're running hard into key resistance levels and the market is quite overbought on the short term.

Too Many Leaning One Way

If you have a bunch of people selling calls, that drives down the premium available in out of the money options.

I can "feel" this in the market right now because on many stocks I'm looking to short, selling call credit spreads isn't offering the best risk/reward.

It's a crowded trade.

With call premiums so low, that means the expected risk pricing to the upside is also very low.

It makes sense for Goldman's reading to be extreme, because we've seen extreme price movement and investors are using that as an opportunity to reduce their basis in the markets.

Now, is that the right call? Possibly. It's also possible that all those people who are shorting calls get squeezed even higher. That's what I'm expecting in the market.

That's a decent bet to take right here.

How To Use This Information

If you managed to buy the dip and have good positioning on in stocks, then it doesn't offer good risk/reward anymore to sell a ton of calls. The premiums aren't there.

Instead, consider some alternatives.

Call conversions - sell your stock, buy some upside calls. It takes a ton of capital off the table and still allows you to profit if we squeeze higher. Because call options are so cheap relative to potential upside expectations this is a reasonable setup.

Sell puts - sell your stock and sell some puts. Ideally you get a little more juice to sell as investors are buying puts and you are taking the other side. Synthetically it's the same kind of risk as a covered call but it offers a little better risk reward

Risk reversals - sell puts and buy calls at the same time. This will give you stock-like exposure and you can take advantage of the "cheapness" in the options market