Iron Condor Trading looks like the perfect strategy.

A "turn-key" system where all you have to do is put on one trade a month and you're on your way to instant riches.

Set and forget it. Like an easy bake oven. As long as the market stays within a range then you can earn simple income trading profits.

It's not that easy.

Well, most of the time it is. Most of the time, the options market overestimates what will happen in the market and the range holds.

When that happens, there's not much to do. Iron condor trading is boring. And boring is profitable.

Yet there are some times where the market starts to move. And it moves big. Let's take a look at the risks involved with iron condors and why it's so important to have an iron condor trading plan before you even put on a new trade.

Want more?

Get Your FREE Iron Condor Toolkit.

You'll see live case studies, free training videos, and my Iron Condor Lifecycle Journal.

Yours, free, today.

What's the Big Deal?

Iron condors are a high odds trade. But with those high odds, it means that the risks are much, much larger than your potential profits.

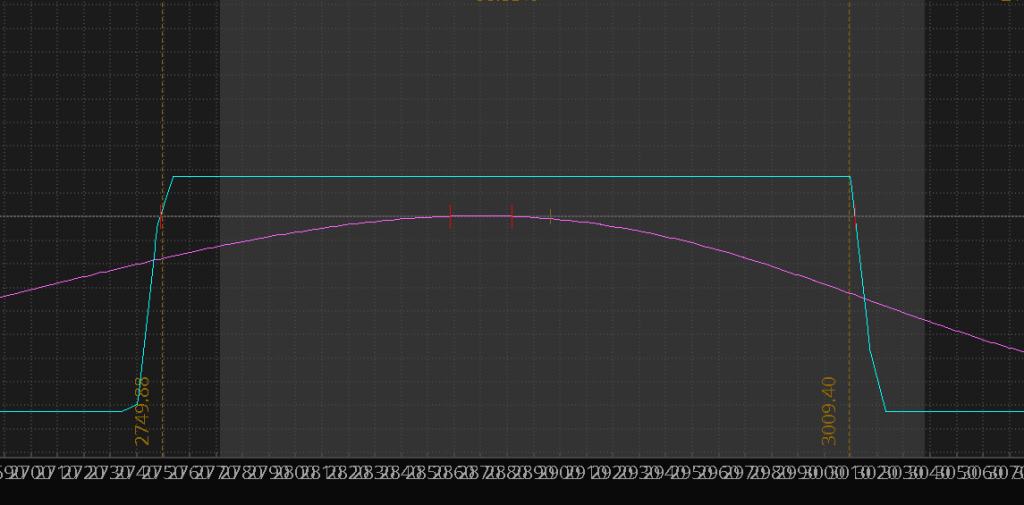

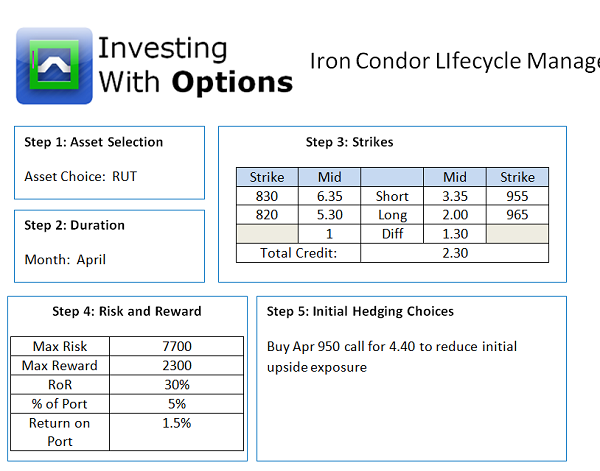

Here's an example of a standard iron condor:

See how your maximum risk is much larger than your maximum reward?

Well, yeah. That's the game. There's always a tradeoff between risk, reward, and odds. You're taking larger risk, which means your odds are good.

Your odds are very good. As in you should expect to win over 75% of the time.

The "wins" are easy.

It's when the iron condor trade gets tested... that's where things can get a little tricky.

There are some option trading educators out there that will tell you to "set and forget" your iron condors. That the odds will be in your favor so it's not a huge deal.

Rubbish. Of course it's a huge deal.

In fact, the "odds" priced into the trade can be a bit misleading. It gets complicated, but just understand that you can have a low volatility market that just moves in one direction, and you'll get runover.

Trust me. I know this from experience.

It pays to be proactive when trading iron condors. You should focus on active risk management, and have a plan before you even put on the trade.

What's the best way to adjust iron condors?

It depends.

It depends on what kind of adjustment you need, what the market is doing at the time, and what kinds of premiums you can get.

Here Are The Risks To Hedge Against In An Iron Condor

There are two things you need to avoid when you are trading iron condors.

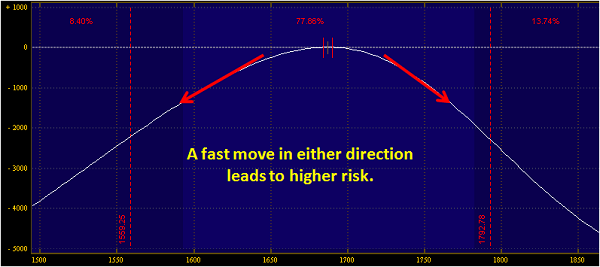

The first is avoiding trending volatility.

This is where the market moves constantly in one direction. This happens in bull markets when stock indexes "grind" higher, and in bear markets during crashes.

The second thing to avoid is fast movement. If the iron condor hasn't been active long enough to generate profits, the risk of a fast move can put you in a bad position.

Believe it or not...

The "grind higher" is the biggest risk. I know that most traders are always on the lookout for some kind of market crash... but from experience I know that, most of the time, your iron condor will have more risk on the upside.

I talk more about it in this post: The Hidden Risk In Iron Condors

So what can you do? Let's take a look at some simple adjustments.

Unbalanced Iron Condor

You know what? Nobody is forcing you to have a "plain vanilla" iron condor. There's a few variations you can use when putting on a new iron condor trade.

The simplest thing to do is don't sell as many call spreads. This will help to neutralize some of your initial short exposure.

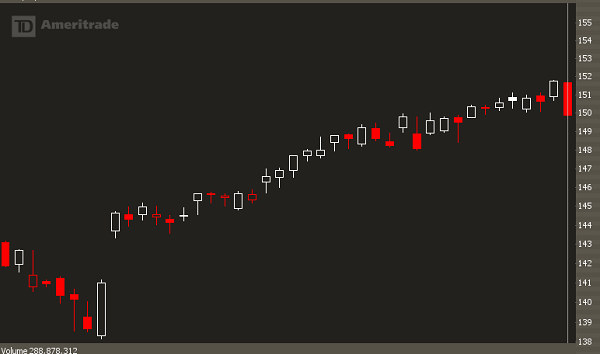

Here's an example of an Unbalanced Iron Condor:

By going half size on the call side, you can start the trade "delta neutral." Then, if the market starts to rip higher, you can add more call spreads, or roll the call spreads higher.

If stocks are in a rip-roaring bull market, you can't afford to start off short, because you will end up with a ton of trending volatility. So consider starting off with some bull call spreads or long calls to hedge your upside.

Embed Long Delta Plays Into Your Trade

Another way to start off truly "delta neutral" is to add another set of options to your iron condor.

These kinds of trades will reduce your time decay profits in exchange for your position not getting blown out by strong movement.

Here are some normal embed strategies:

- Vertical spreads

- Cheap OTM Call Buys

- Ratio (1x2) Buys

- Kite Spreads

All of these have different tradeoffs depending on what the market is giving us.

One of my more favorite "Embed" trades is a little trickier... it uses VXX puts that give the position an extra "kicker" because of how VXX trades. Learn about this strategy here.

Have An Iron Condor Trading Plan

Iron Condors can almost be completely automated.

It's a statistically based trade, and you should treat it as such.

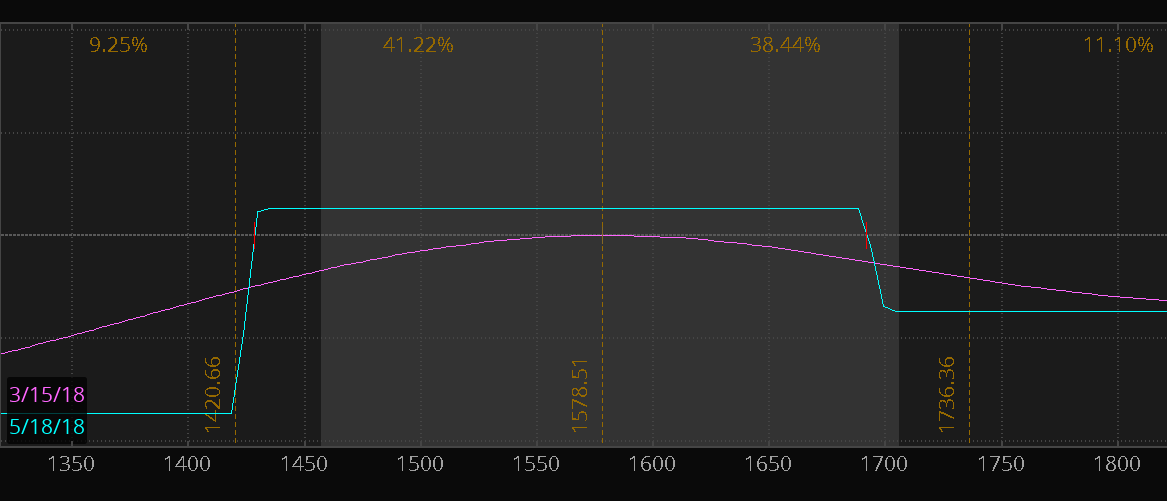

What you should do is pick out points where the market has moved enough to require you to adjust the trade.

How do you pick out your adjustment points?

It depends. There's always a tradeoff here.

If you adjust too late, then you'll be locking in a loss on a trade.

And if you adjust too early, you'll feel like an idiot as the market reverses and you lose out on potential profits.

There's no perfect answer, and there never will be. It's all about what is most comfortable for you.

Some people use delta bands, where you figure out your maximum directional exposure on a position, and adjust if the market sees a move to a certain level of exposure. This is the one I use the most often.

Other people set alerts when the value of one side of the iron condor gets too high.

Or you could eyeball the chart and look for key levels of support and resistance. I'll add this in combination with my "delta bands" to best optimize my adjustment areas.

No matter what your plan is, THE POINT IS TO HAVE AN ACTUAL PLAN.

Know where you'll adjust the iron condor, and if the market hits your level, then adjust.

If you wait too long, you'll get runover. Again, another mistake I know from personal experience.

Here's an example of an iron condor trading plan:

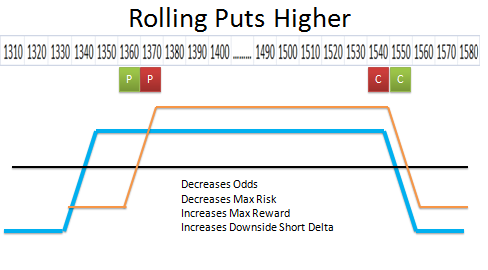

Roll Your Spreads

Nobody is forcing you to go "all in, all out" on an iron condor trade.

A better way to view iron condors is that they are the combination of two vertical spreads.

When the market moves against you, simply roll one of the verticals closer to the current price of the market. This will reduce the cash needed to be in the trade, reduce some of the directional exposure, and increase the potential for profit.

You can then roll the losing side of the trade, and the only cost to you is the commissions required with the roll.

Know Your Greeks

This is a little more advanced, so bear with me.

There will be times where certain kinds of adjustments work better than others. If volatility is running high, it's much more difficult to hedge to the downside because premiums are so expensive, so you have to look at spreads.

The most important thing to ask yourself when adjust iron condors is...

"What risk do I need to get rid of?"

The biggest one will be your directional risk, your delta. And hedging that risk will always come at a cost, so your job is to find the best strategy that minimizes that cost, and to make sure that the hedge doesn't hurt too much if the market reverses back to the mean.

One more thing to understand here...

You Don't Have to Hold Your Iron Condor Adjustments to Expiration

Again, nobody is forcing you to have a "fixed" position in an option trade. If the market is moving against you, go out and buy some protection, and if the market moves big against you again, close out the hedges for a profit and then roll the trade.

This took me way too long to realize. Because many times I would put on a hedge and hold onto it too long, and then it stopped being effective.

Being a little more aggressive with your risk management is what will get you the sustainable iron condor trading edge you need.

Consistency Is Everything

Most of the time, iron condors are an easy trade. You get in, you get out, you take your profits.

Your long term success comes in knowing what to do in case things go against you.

Have a plan ahead of time, know the best kind of adjustment for what the market is giving you, and be aggressive with holding onto your hedges.

If you do this, you'll build aggressive and sustainable returns in the options market through iron condor trading.

Want more?

Get Your FREE Iron Condor Toolkit.

You'll see live case studies, free training videos, and my Iron Condor Lifecycle Journal.

Yours, free, today.