It's so pretty to look at.

You setup an iron condor trade, that has great reward relative to your risk, and because the odds are so high you think there's no way you can lose on this trade.

But somehow, you end up disappointed, more often than you think.

Not because the trade was the wrong choice, but because you didn't recognize the hidden problem with iron condors.

In this post you will learn the massive risk with iron condors and what you can do to fix it.

So What's The Problem?

Let's take a look at an example in Russell 2000 options.

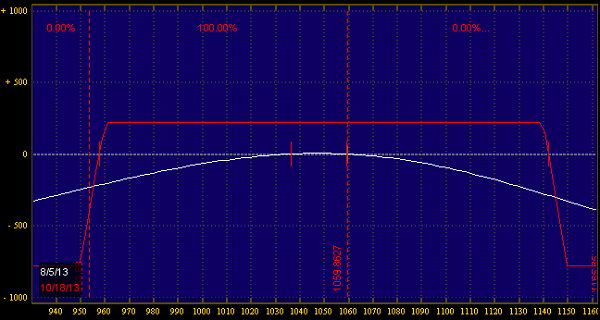

This iron condor is a 950/960 1130/1140 iron condor.

For the 950/960 bull put spread you can get a credit of about 1.20.

For the 1140/1150 bear call spread you can get a credit of about 1.00.

This is a pretty good looking trade. You have plenty of room on both the upside and downside.

But if you notice, the trade does not start off as a "non-directional" trade.

There's some short deltas already built in.

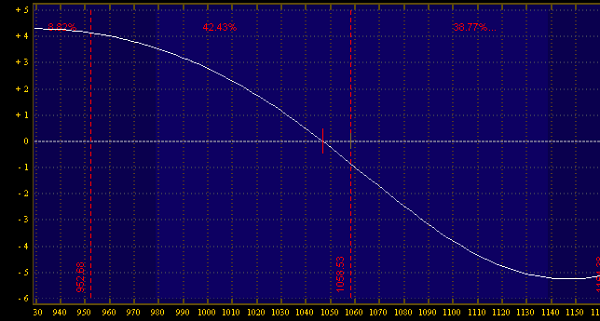

We can look at the delta of the position as a function of price:

So even if you construct the "perfect" iron condor, you're going to start off net short.

(The reason for this is related to the option skew and the delta sensitivity to implied volatility. Just take my word for it.)

Now you might say "well, being short 1 share of RUT doesn't really matter that much."

That's only because I'm showing you a single iron condor. If you put on 20 of these, your delta goes to -20, which is equivalent of -200 short on the IWM.

And on top of that, since you are short gamma, you can get more short as the market rallies.

And when we're in a rip-roaring bull market, your risk can get ugly really quick.

What You Can Do?

Iron condors do best when there is a drop in volatility or when we have mean-reverting volatility.

That means when the market grinds higher, that's the true risk. You may not think that the upside risk is the real risk, but in this QE-driven market, non-directional upside volatility tends to be a big problem.

This is where you need to accept lower rewards in exchange for reduced risk.

In other words, whenever you initiate iron condors, immediately hedge to the upside.

There's a few ways you can do this:

- Buy stock. You don't even have to stay in the same stock. For example if you're in the RUT options with a delta of -10, you can buy 100 shares of IWM to get neutral.

- Buy calls. Because upside IV is cheap (due to the skew), then you can easily pick up some long calls to reduce risk of a big upside move.

- Buy call spreads. If you don't need a ton of hedging, then a couple call spreads can be enough to reduce your risk.

Keep in mind-- you don't have to hold onto these hedges all the way through options expiration. If the market pops to the upside, then you take off the upside hedges off, and adjust the trade as needed.

Do you want comprehensive Iron Condor Training? Get the Iron Condor Intensive to make smarter trades with iron condors.