“Markets rise on trade optimism.” Hah. OK. We’ve seen this before. If this is the normal cycle… the markets will jam higher with the anticipation that US-China trade relations will normalize… But then something happens. A wrench thrown into the gears. Gas on the fire. A tweet. And then, just like clockwork, the markets gap […]

Blog

WHAT A MOVE – Here’s What The Market Will Do Next…

A nice an orderly 3% selloff will get your attention. With news that China is bringing currency manipulation into the game, the markets took it on the chin and didn’t stop selling off all day. I put together a video comparing the last time this happened, some context on the overall market, and how I […]

The Next Move in NFLX Will Be Massive

I’ve put together a video showing how NFLX has been in the tightest range ever. When we see tight ranges, the violence after the break will be huge. And it just so happens that the stock has earnings tonight.

Ready to Fade Gold? You’re Too Early…

Yes. Gold is overbought. Yes. It will revert to the mean… eventually. Remember, overbought can get more overbought. And given the technical pattern of gold combined with a more rigorous approach tells me that 131 is too early to start looking at a short. Watch this video to see what I’m looking at and how […]

This Selloff Has No Teeth.

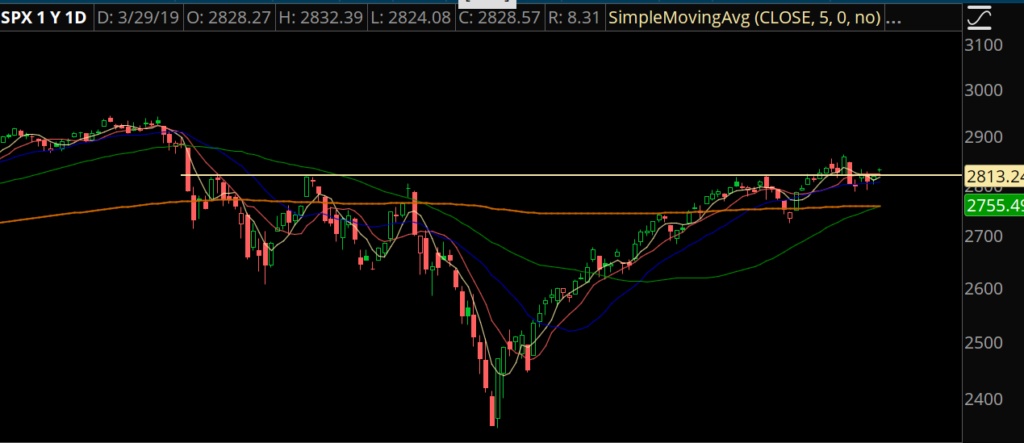

Just like that, the S&P 500 is back above the 2800 pivot level that EVERYONE AND THEIR MOTHER has been focused on. You would think that the selloff would be deeper than this. That all those people who bought from the beginning of the year would take profits. That somehow the yield curve inversion would […]

This Indicator Has Spooked Investors… Does It Even Matter?

In 2007 I lived in the Central Florida area. Housing was hot. All of my friends were getting their real estate licenses. An acquaintance in college, managed to pull down a $400,000 house with an interest-only mortgage. We know the end to this story, but there were warning signs.. Around this time is when the […]