So you want to sell weekly options?

Not so fast...

There's a siren song of "instant theta" with selling weekly options and spreads.

But remember there's always a tradeoff between the risk, reward, and odds.

Financial speculation is all about navigating between those three. And I'm here to tell you, the math doesn't add up when selling weeklies.

Comparing Options Over Time

What, you think you're the only market genius out there that thinks you can get instant profits by selling spreads every week?

In fact, because it's such an obvious trade, that it's now a super crowded trade.

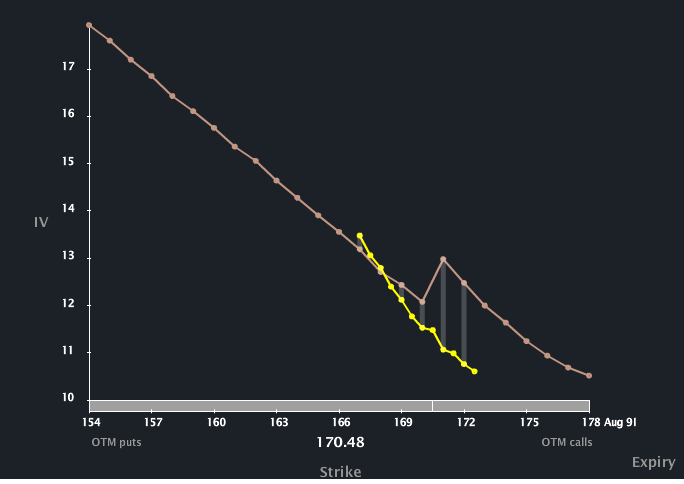

We can actually see this when we compare the implied volatility of options by their different months.

Remember, implied volatility (IV) is the measure of supply and demand in the options market.

If a bunch of people are selling options, IV will head lower. If they are buying options, IV will head higher.

Let's take a look at the implied volatility of a weekly option chain compared to a monthly chain.

The weekly options IV is right around 11.8%, while the options that have 50 days to options expiration are trading at a 13.57% volatility.

And the reason the yellow line isn't that long?

There's barely premium that's available just 2.3% to the downside.

No Wiggle Room

The allure of selling weekly options is that theta super high-- meaning the premium in the options decay very, very fast.

But the tradeoff is that you also have very high gamma. This means your directional risk changes rapidly, and your position variance is stupid high.

This means that you have little wiggle room to adjust or manage risk. Rolling your position gets very expensive, and a 2 standard deviation move against you can cause you to lose many multiples of your potential reward.

And it means that a better trade is going further out in time. Sure, you'll miss out on the theta crackpipe, but you also won't have to deal with super high position volatility.

Is there an exception to the rule?

Sure.

If you're used to playing directionally with leverage, then selling spreads is fine.

If you use them as a replacement for your delta, not because you want that fast theta.

That means you need to treat weekly option sales as you would a leveraged stock position, and don't fall into the trap of thinking you'll make up for your losses by simply letting the option premium decay.