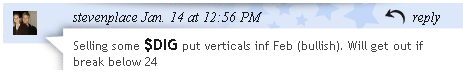

Here's what I called out on stocktwits the other day:

I was basing this purely on techincal analysis. Here's what I saw in the chart:

I knew that at that price odds were in favor of more demand coming in at that price. Now instead of picking up straight calls or stock, I chose selling verticals because:

- The credit spread offered the ability of positive theta

- It has only a slight delta risk that will increase over time

- The statistical odds of success were around 50%, and I think that the odds are higher on this trade

- It provides limited risk

- I can move into an iron condor if we get back up to the 34-ish range

I put my breakeven below 24 because that would be confirmation that demand did not come into the market and I should get out of the trade. It's currently working but might reverse again, but my risk is well defined and I've got bearish trades to offset it so I'm not worried about it.