Bill Luby over at VixAndMore is showing us some unprecedented action in the volatility futures market:

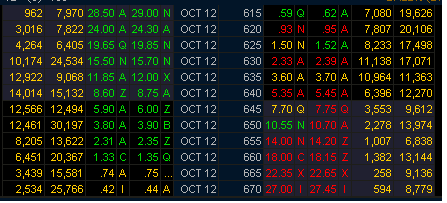

[...] for the first time in their history, the VIX futures persist in being in violent disagreement with each other. Prior to 2012, for instance, the average difference between the front month and seventh month VIX futures was about 16%. This year that number has surged to more than 38%.

This is pretty incredible, and to find the cause has been difficult to find.

Pointing Fingers

The first "obvious" culprit would be the rapid introduction of volatility ETPs-- names like VXX, UVXY and TVIX are very heavily traded and seem to have a ton of demand from the zerohedge crowd. The top is just around the corner, I promise.

And while that is an entertaining narrative, there's very little evidence to suggest that the tradable vol products are to blame. This is due to the fact that relative to the overall options market, the volatility transactions in these names are a small fraction of what occurs on a daily basis in the risk exchange markets.

A Proper Cause

But there could be another driver of this-- the introduction of weekly options.

Short duration options have been eagerly embraced by the trading community. They offer cheap ways to gain leverage in intraday markets, and there are more pronounced price distortions as we head to options expiration.

Every week is opex week? What fun.

But there could be another issue-- the psychology of premium sellers.

One of the main problems with selling options is that you have to wait for a long period of time for the time decay to really kick in-- this is a function of the exponential time decay function of options.

With weekly options, time decay is nearly immediate. While this may not be the most appropriate in terms of risk and reward, it gives the option seller instant gratification with any profitable option sales.

No Love for the Long Term Hedgers

If you're an institution that is looking to purchase protection, odds are you don't want to use weekly options because it affords downside hedging for only a short period of time. Those with larger accounts tend to think in terms of months and quarters, not days or weeks.

If you're an institution that is looking to purchase protection, odds are you don't want to use weekly options because it affords downside hedging for only a short period of time. Those with larger accounts tend to think in terms of months and quarters, not days or weeks.

The hedgers then go further out in time to buy premium, only that there are no premium sellers-- they've all flocked to the short duration options for that instant gratification. In order to find sellers, the market has to raise implied volatility to bring back in option sellers. This is a major driver of the imbalance in the options market.

Weekly options have most likely distorted the supply and demand as a function of time. There is no right or wrong to this problem, but it means traders willing to sell premium in longer duration options will, on a relative basis, have a better risk/reward balance compared to those selling weekly options.

IWO Premium has successfully traded off this theme in 2012, selling longer term premium to help finance directional trades. This theme will most likely continue to work well into 2013.