It sounds sexy, doesn't it?

Put on a weekly iron condor trade... one per week, then let it expire and send the cash straight to the bank.

Yet from many clients I've worked with, they've been burned on this exact trade...

What's going on? Why does it seem like such a "layup" trade until you actually try to do it in real life?

Let's take a look...

It's a Crowded Trade

Since weekly options were introduced, more and more trading volume continues to shift towards shorter duration options.

A lot of people out there chasing short options.

And when you get a lot of people leaning one way, it drives the premiums on those options lower and lower.

That means you, along with countless others, will be chasing smaller rewards and taking larger risks.

So the question you need to ask yourself...

Is the "juice" worth the "squeeze?"

A Real World Example

Let's take a look at a weekly iron condor trade:

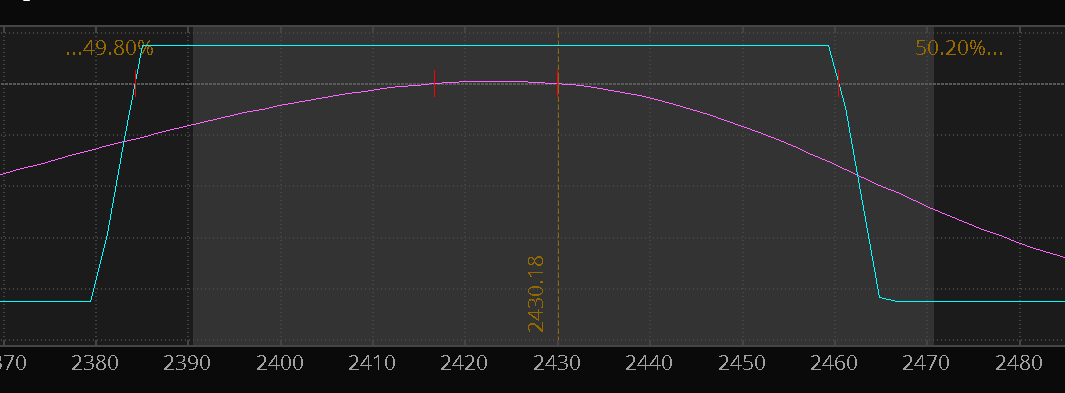

With about a week to go, this iron condor trade gives you .70 of credit for 4.30 risk.

And as long as the market stays above 2385 and below 2460, then you make money.

Seems fair, right?

Well, let's think about this for a second.

You've got about 30 points of upside buffer, and then about 45 points to the downside.

Right now the market is trading about 14 points a day. So all you need is a 2 day rally, and you're nearing your upside risk limit. And all it would take was one more pop and you'd be in serious trouble.

If you want to earn faster returns with iron condor trading, there is a way...

...but you have to be smart about it.

A Better Approach

Weekly options give you the promise of "instant profits" with a hidden cost.

What if I told you there was a better way to earn quick profits?

Allow me to introduce you to the KISS Iron Condor.

This is a short term iron condor with an embedded stop inside of it.

Unlike many iron condor traders out there, we believe that iron condors aren't just "set and forget" trades. You need to have some kind of risk management setup.

Basically, we look at putting on an iron condor about 30 days out, and look to hold onto it for 2 weeks.

So while weekly option traders are trying to force profits out of a 1-week trade, we can get better risk/reward by stretching it out a little more.

Our goal here is to take about 80% of the credit of the trade, and we set a stop at twice the reward.

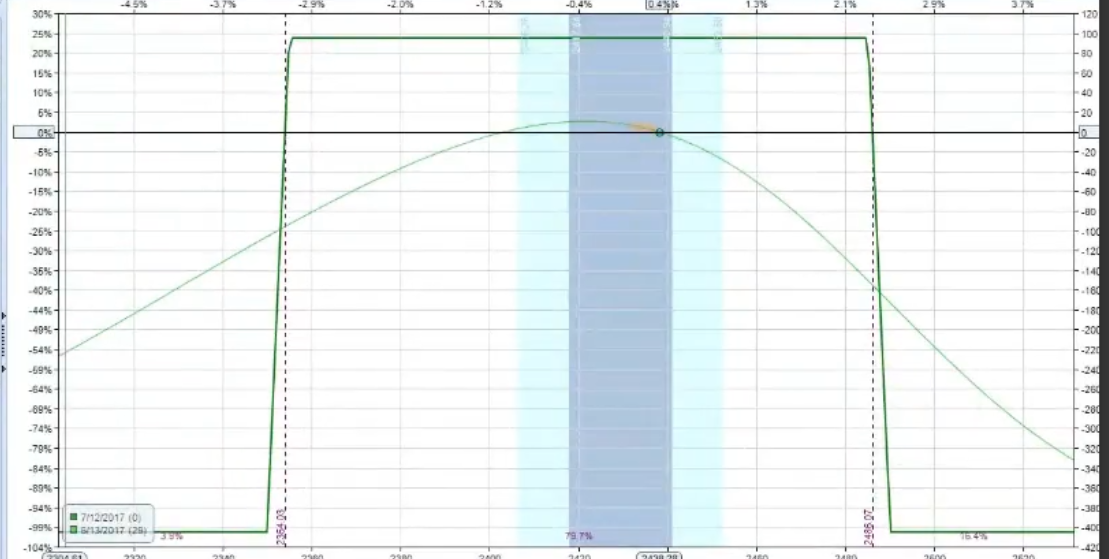

Here's a live trading example:

This is an iron condor for a credit of 0.90.

Our profit target is to pull out 0.70 of the credit, and a hard stop is placed if we hit a loss of 1.40. That will happen if the market rallies to 2490 or sells off to 2340.

We want to be out of the trade in about two weeks.

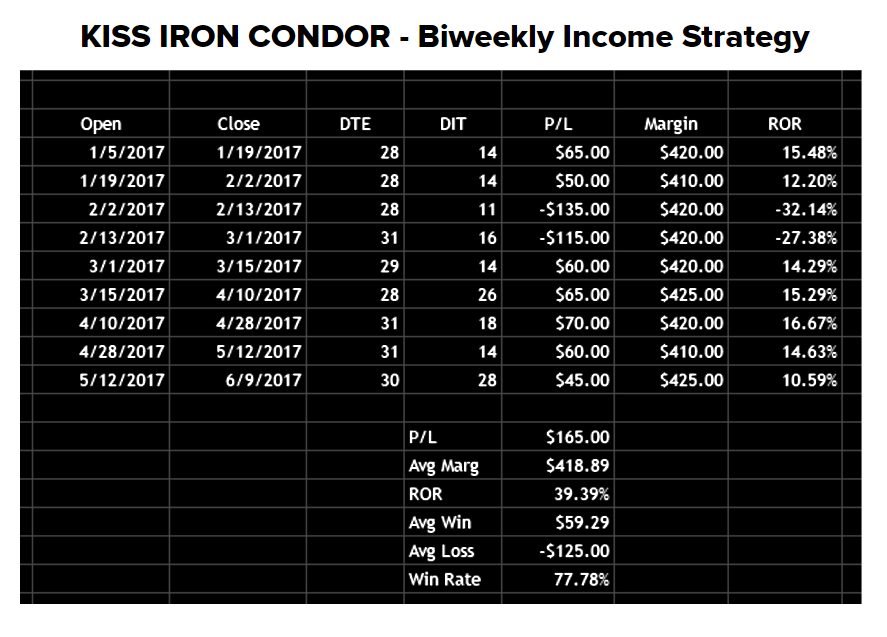

Here are the results from some of the trades beginning in 2017:

This was from just one iron condor, and this setup can easily scale up to 20 iron condors.

The math ends up being simple. If we risk 2 to make 1, and our odds are above 75%...

Then it's a system with the odds on our side.

Learn More About Iron Condor Trading

We've put together a free iron condor toolkit for you, so you can see our approach to income trading and you'll get some of the resources that we use on a daily basis.