Short term, markets are in meltdown mode. It's just 5% off the highs, and it's been a while since we've seen a decent selloff. But boy, does it feel ugly.

As markets have tanked, volatility products have shot through the roof.

The $VIX is at its highest level since Brexit. Yes, that Brexit. A year and a half ago.

The VXX is a product that looks to own short term volatility futures. There's some other mechanics here, but if you're looking to fade this move, the VXX is a reasonable instrument to trade.

Here's where it sits right now:

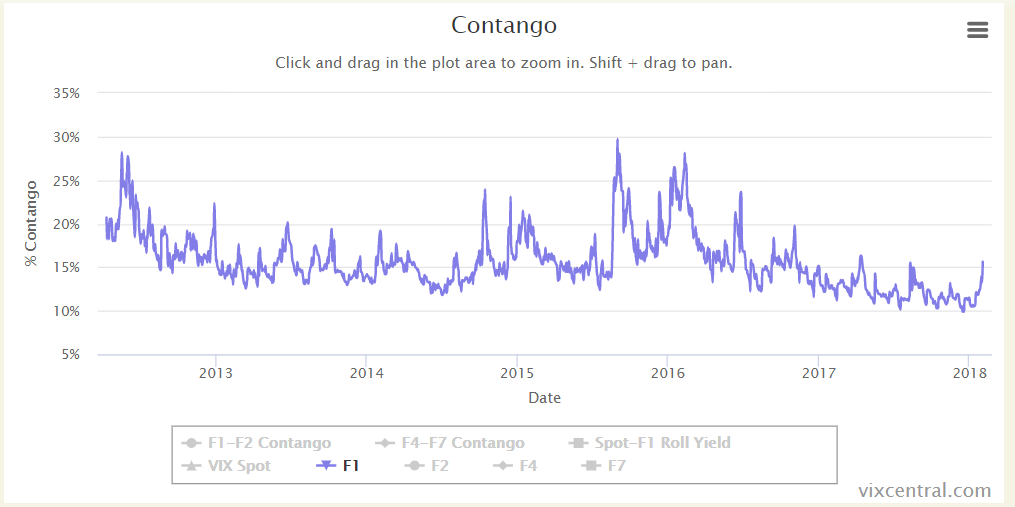

You can't really use past price action as a roadmap for VXX because it contninually churns through different assets. It's better to look at the near term volatility futures... courtesy of vixcentral.com

If "resistance" exists, then we could be pretty close to it.

Here's the reasoning behind this trade setup:

VXX has a tendency to go lower because of how volatility futures trade. Currently, vol futures are giving VXX a "tailwind," but if markets normalize then it shifts back to a headwind.

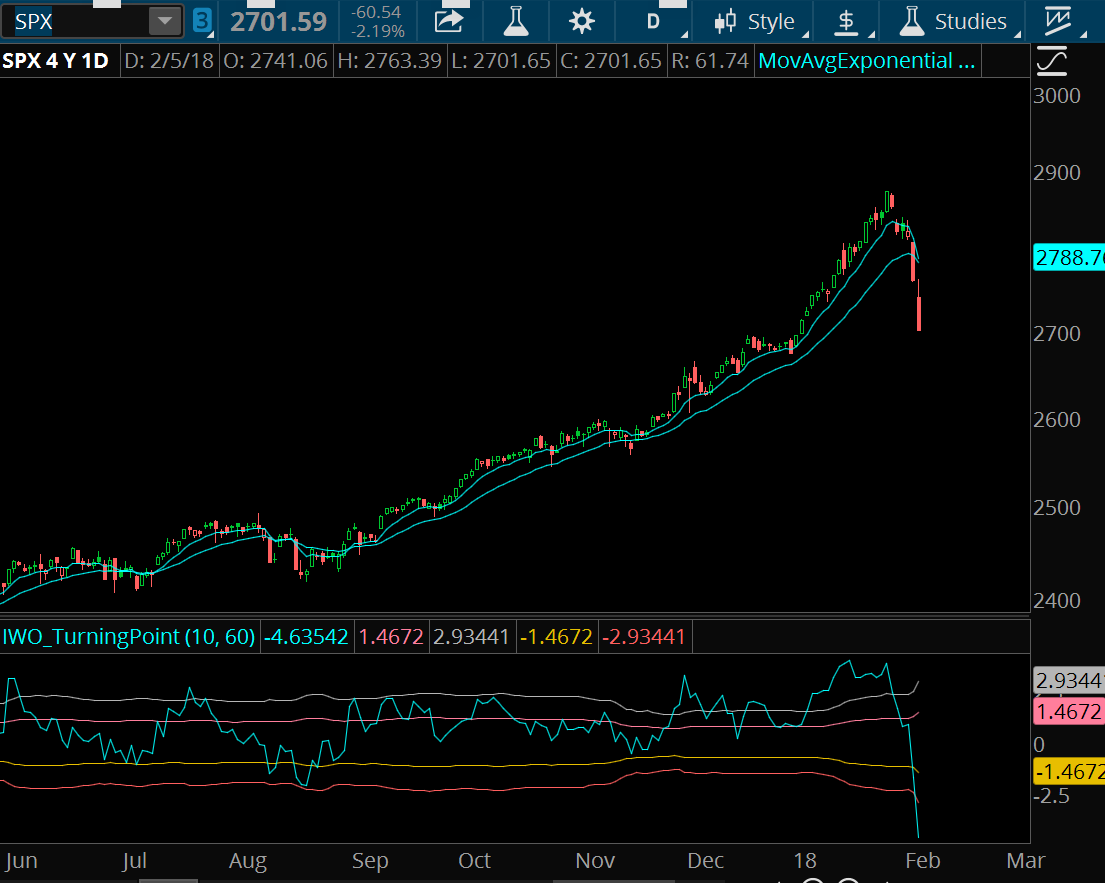

Volatility has a very high tendency to revert to the mean. Spot VIX is currently 134% above its 50 day moving average, so you could say it's a tad stretched:

SPX is down 4.5% in 10 days. We're probably not at *the* bottom, but we're coming into levels where we should expect selling to slow down.

We're currently setup to where it's a reasonable bet to start getting a little short on VXX.

Here's the trade setup I like... it has two parts:

- Sell to Open VXX Mar 35/40 Call Spread @1.90

- Buy to Open VXX Mar 30/25 Put Spread @1.03

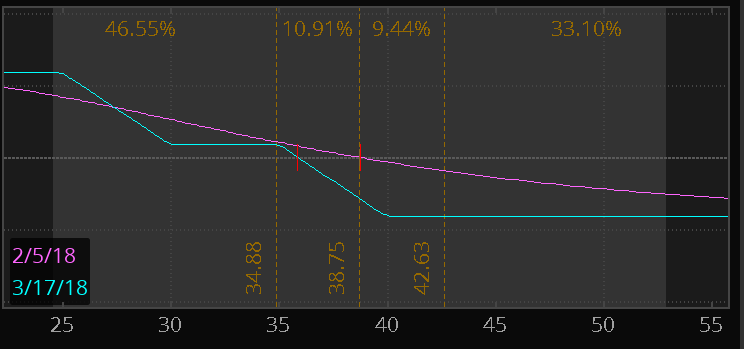

The payout structure looks like this:

A few different scenarios:

- VXX Above 40: Full Loss, which is about $400 per spread

- VXX below 35 and above 30: Decent profits... make money on the call spread sale, lose money on the put spread buy but you come out ahead.

- VXX below 25: Winner winner chicken dinner.

The risk, reward, and odds right here tell me that starting to scale into a VXX short is a great setup right here. Consider this trade if you're looking for a way to keep your risk down.