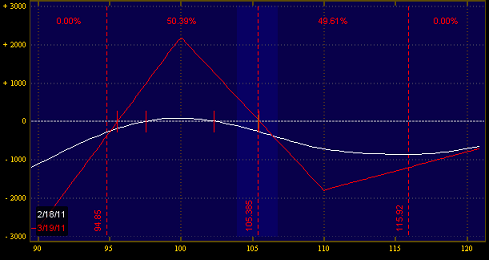

If you saw my post on a potential income trade in CAT, you can see that the trade is in a bit of a drawdown:

And this is why I don't like short gamma income trades, whenever I think about one, it always runs against me!

So the problem is-- CAT is ripping higher, and the trade is right on the upper bounds of the opex breakeven. The call buy to get delta neutral at the beginning has cut the potential loss by half so that worked out well.

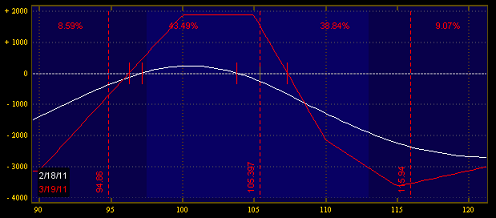

So what we can do now is a butterfly roll, where we take the call side of the position and roll it further out in time. This will reduce our potential profits, but will reduce our risk, both delta and gamma:

Here's what I'm looking to do:

Buy +4 Mar 100 Call

Sell -8 Mar 105 Call

Buy +4 Mar 115 Call

Total Debit: .85

And here's the new risk profile:

Our original greeks were [Delta: -106, Gamma: -7.11, Theta: 5.24, Vega: -15]

The new greeks are [Delta: -187, Gamma -28.50, Theta: 19.34, Vega: -55.87]

That's a problem. even though we widened out the area of profitability, it actually increases our risk both in delta and gamma. Not fun.

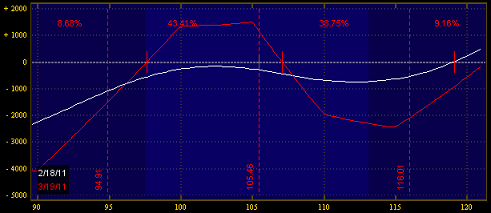

So we're also going to do this:

Sell -1 Mar 100 Call @ 6.35 -- This was our original delta hedge

Buy +5 May 110 Call @3.20

The may calls will give us a nice delta/gamma hedge without a ton of initial time decay. Here's the new risk profile with that added on:

And our greeks: [Delta: -76, Gamma: -17.26, Theta: 10.18, Vega: 36.80]

Notice how this trade ends up sucking really bad on any stronger move in CAT-- the market's got an absurd bid behind it so it's safe to assume that any mean reversion trade like this is not going to be very fun. This is probably the best way to manage the position, but any further rip higher and a close should be considered to prevent any psychological disposition effects to continue.