After Reed Hasting's 5th apology, the price action in $NFLX started to calm down.

And when looking at options on different months, we've seen a very interesting change in the term structure.

Since September 20th, $NFLX has been rangebound between 125 to 135, with a failed upside breakout not too long ago.

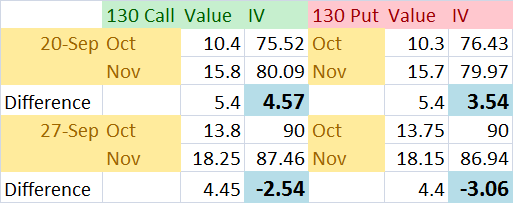

Let's compare the at the money contracts in both October and November between then and now:

If this chart makes sense to you, congratulations-- it confused me while creating it.

The key here are those values in blue. Essentially a week ago there was a very high premium in front month options compared to November. Now that $NFLX has settled down, option sellers are coming in heavy on the front month as the near term perceived risk seems to be dropping.

I think there's a play here-- a time spread sale.

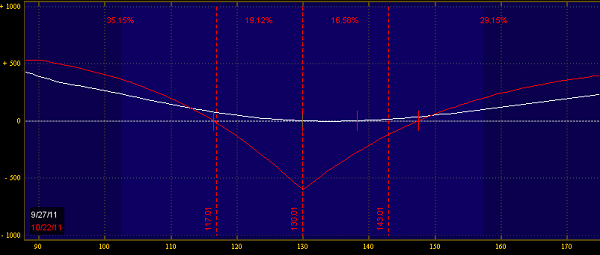

I know it's confusing, but stick with me. A time spread sale is where you buy the front month and sell the next month. It is long gamma and short theta. Here's an example, the Oct/Nov 130 Put Time Spread Sale.

Now this kind of trade will require some extra margin, but you can see how the maximum risk here is if NFLX stays here through October opex.

Odds are, we're going to break out of the 10 point range we've been in. This trade will profit if that happens, and if the front month options find more demand due to fast price action, this will benefit greatly.

It's a bit more advanced of a trade, but definitely worth a look if you think $NFLX is primed to move