The first two trading days of this week have been fairly subdued, with small daily trading ranges as we consolidate Friday's monster "Euro Voodoo" move.

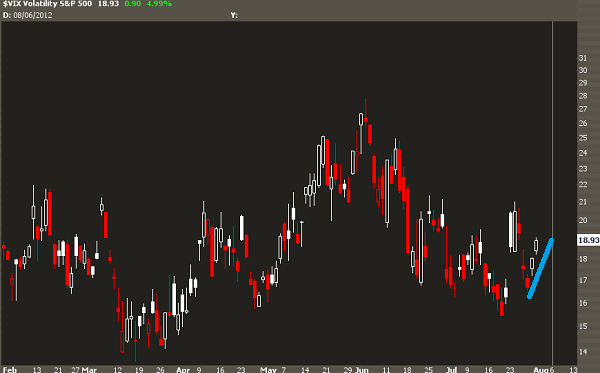

But with the lack of activity in the capital markets, there has been some decent movement in the volatility markets. Consider a chart of the VIX:

It seems that every time the VIX doesn't perform to a perfect 1:-1 correlation in the markets everyone starts to panic, saying how the smart money is planning for an immiment collapse in the market.

Well...

Let's keep a few points in mind:

- The VIX is a Statistic. It simply measures the supply and demand of SPX options on a 30-day normalized basis. You can't trade it, and to get pure vol exposure requires you to use eiher VX futures or VIX options, which are based off future expectations, not "spot measurements"

- The VIX : SPX Correlation is Not Constant. The VIX will not behave like an short index fund. It's a volatility measurement, and direction and volatility are orthogonal components when it comes to options trading.

- There is Event Risk. The reason the VIX is being bid is because investors are concerned about the near term risk with the Federal Reserve voodoo coming up very soon. So these investors may already have long exposure on, but are willing to pay a slightly higher premium for the protection of options.

The big question now is: will these put buyers be justified?

The answer: we won't know until after the fact.

That's because the options market hedges against uncertainty. If it was certain that the market was going to crash today on Fed Minutes, they would be selling stock, not buying insurance.

It's like picking up hurricane insurance when you see a tropical storm out over Cuba. You don't know if it's going to hit your house in Florida or take a big left turn to Texas, but buying that near term protection gives you a little sanity if the event does come your way.

Here's one more very, very, interesting thing...courtesy of LiveVol:

This is a comparison of 30-day implied volatility vs. 60-day implied volatility.

See something interesting here? We rarely break above that zero line.

When that does happen, that means near term options are being bid higher on a relative basis than 2-month options. This normally only happens when the market is getting loose to the downside, and investors are panicking and wan't their "right now" protection.

But with the event risk of today, the market participants sure are skittish of the right now issues compared to what's down the road as we head into Labor Day.

Is there a trade here? Well, IWO Premium members are already in September iron condors that are primed to profit if volatility continues to fall (and a pullback would be OK, too).

A great trade here would be to get short near term volatility and long vol further out in time, looking for this discrepancy to disappear after the fed minutes. So long calendars or diagonals could work-- and if you put a bearish bias to them, they would be great as a hedge.