In my member's video last night, I laid out in very clear terms that 2 things will most likely happen:

1. The SPX will bounce this week

2. It won't be the bottom.

Of course these claims are not set in stone as anything can happen, but given the way the market has traded pullbacks for the past few years, this is the highest odds play.

But these claims lead to questions... where will the bounce stop and where will the bottom be?

One of the cool things about technical analysis is recognizing that certain levels will act as magnets.

That these levels are so overwatched, price will move to those levels just to see if it is accepted or rejected.

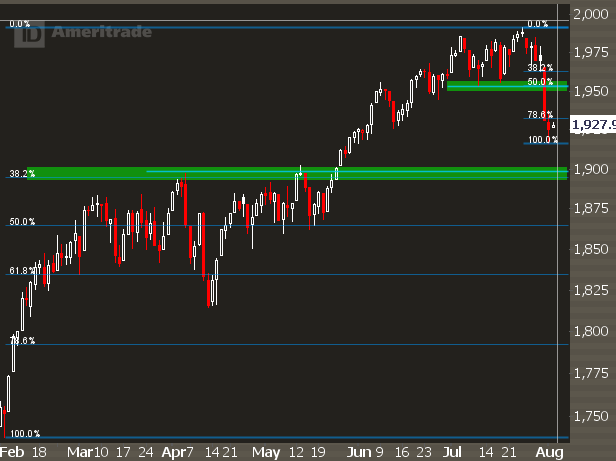

There are two of these "magnet" levels right now for the S&P: 1900 and 1950.

1900 is previous resistance from the Mar-May base and the 38.2% fib retracement from the Feb lows to the recent highs.

1950 is previous support from the July top and the 50% retracement from the current lows to the July highs.

The market thesis is this:

If the SPX does bounce but fails to retake 1950 within the next two weeks, we will go and test 1900.

With this thesis, the gameplan now is:

1. If we flush into 1900 in short order, load up on bull put spreads.

2. If we rally into 1930-1950, take long risk off and buy some SPX hedges-- 1900 put butterflies are a great trade.

3. Odds are we fart around in this range for a bit (provided no news catalysts) and IV is high so iron condors work here.

If you want to see how we do this in real time, get a 2-week pass to IWO Premium. Trade alerts, nightly videos, video training, and a chat room. Get the pass here.