So apparently the gold head and shoulders pattern failed, and now gold shorts are looking for a "double top marginal breakout" as a reason to short.

I say wait.

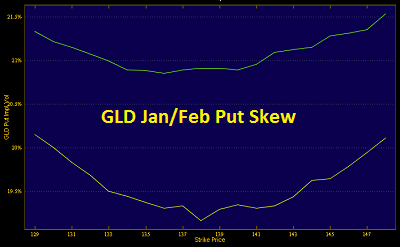

One of my favorite indicators in timing GLD is using the options board. In terms of options gold and other commodities are different than equities-- the implied volatility will "smile" rather than "skew." That's because, unlike fear in equities, the fear in commodities is both to the upside and downside.

So when does gold top out on the intermediate term? When there is upside fear. When investors are fearful of hyperinflation and the crash of the dollar, and they don't want to miss out on the big spike up in GLD, they will go out and buy calls to "protect" their upside. This is very similar to what we see in equities, except it's the put volatility that escalates.

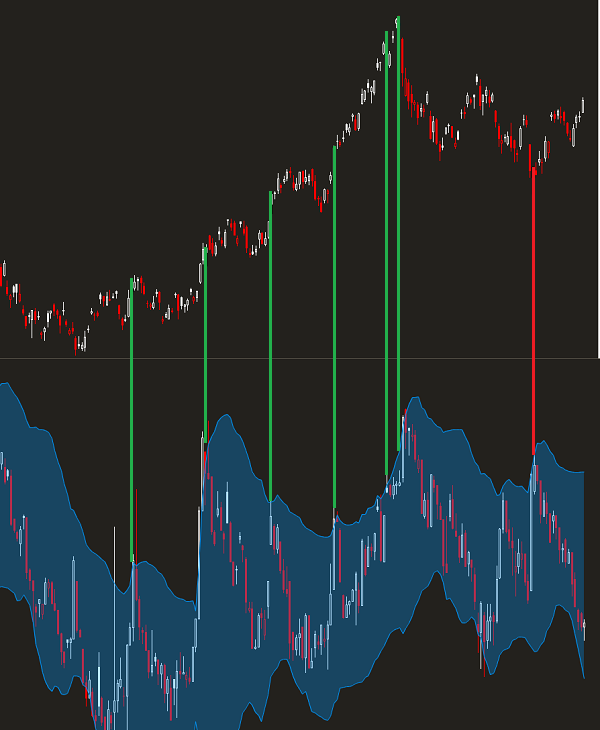

While you can use the smile "steepness" as a way to measure upside expectations in GLD, a simpler measure is to use GVZ. It's like the VIX for GLD options. Generally, when we see a spike up in GVZ, that marks extremes in the range for GLD. The chart below I've posted in the past:

Note that the most recent time GVZ closed outside of its Bollinger band was back on November 9th, which was an intermediate term top in GLD.

As of right now, the otpions market in GLD is fairly calm, which tells me that upside "fear" is not baked in, and that's fairly bullish.