The IMAX Buyout

Over the past 24 hours, news has come out that IMAX may be receiving a bid from either DIS or SNE. [EDIT: the company putting a "no comment" out there and it's sending the stock to LOD] It seems their business model has seen a great turnaround in the past few years-- I can remember back in 2005 they only showed movies in museums and had very few deals with big labels.

Aside from that, one trader was able to bank huge coin anticipating... something. I wouldn't call this insider trading, but on December 28th there was a sizeable bet in the stock and the options of IMAX.

The IMAX Bet

On December 28th at 12:36, a trader went and bought 5,000 March 30 calls for .70. Since the bid/ask spread was 55x70, we know that these options were bought aggressively at the offer-- and that is a lot of slippage (.15) for a stock that size.

Tied to that buy was a short sale of -115,000 shares, which is very unusual volume for lunchtime trading in IMAX.

The Risk in the Trade

This trade is what I call a short + call overbuy. In a normal protected short, you sell 100 shares of stock and buy a call to hedge. Anything above this ratio and you are playing long gamma.

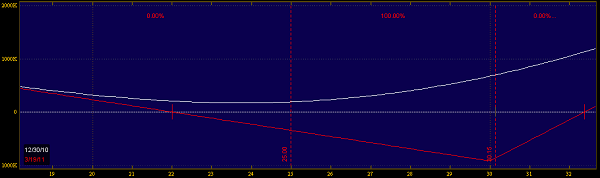

Here's the risk profile:

So you can see how if IMAX went to 0 the trade would still make money, but because the long calls are the component with all the gamma, you'll see more "acceleration" of profits if it runs higher.

The IMAX Profits

The current position is up about 730,000 but it peaked out at about $1MM, which is about a double on the max risk. The lost money on the short stock, but made it back and then some on the long calls.

The most interesting part about this trade was the vega profit. Back when the trade was put on the implied volatility of the calls was about 45%. It's currently at 58%. So when you are long options and the IV rises, that means you make money. At the time of this writing, about 25% of the option profits come from the IV boost.

Shenanigans?

So did the trader have access to non-public information? It's possible, but a stretch. This wasn't strictly a big directional bet, it was more a bet on volatility. However, it's very suspect to get long vol during a boring holiday trading season-- and I've seen plenty of plays just like this days before stock takeout news comes out.