Mind the Gap

$LULU reported earnings last night, and the price reaction was solid, with the stock moving up nearly 6 points from the close. This stock has the potential to squeeze higher, due to it's large short interest, but also due to the options board.

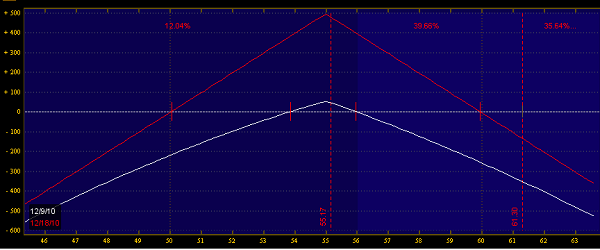

The chart above is the risk profile of the Dec 55 straddle sale. At the close yesterday this was "at the money," meaning this strike was closest to where the stock was trading. The closing price for this straddle was $4.95. That means the options market was pricing in a $5 move between Wednesday and next Friday. We are currently trading well above that upside line. The option market got it wrong.

The Volatility Squeeze

So just like stock shorts are forced to cover, any option trader who sold volatility into earnings will be forced to cover. That means they will either buy stock as a hedge, or they will close out the short calls. If the latter case happens, the market makers will keep implied volatility elevated due to the increased demand for options, and the MMs will also buy stock to make the trade. This option cover will bring extra demand to the stock, which can lead to great upside results.

For a recent example of how a squeeze can be fueled by option shorts, check out CRM post earnings.

If you want to learn how to analyze and trade earnings events, check out my video course over at EarningsTrades.com.