Download the "Broken VIX" eBook

Want to save this for later? We’ve compiled it into an eBook. Enter your name and email and we’ll send it to you instantly.

![]() We value your privacy and would never spam you

We value your privacy and would never spam you

I've been avoiding this for a long time. I didn't want to touch this topic.

Why?

First, I didn't want to seem like some Chicken Little who was claiming the sky was falling and that there is structural risk to the markets.

Second, I thought I'd be early. I've been thinking about this since the beginning of the year, but I've kept my head down and just traded.

The VIX is now getting down to levels not seen... ever. The way we're going, we could see an 8 handle before Labor day.

And it's looking awfully dangerous.

Let's look at some key charts and I'll build out the case for how the volatility markets are broken and it poses a structural risk to stocks.

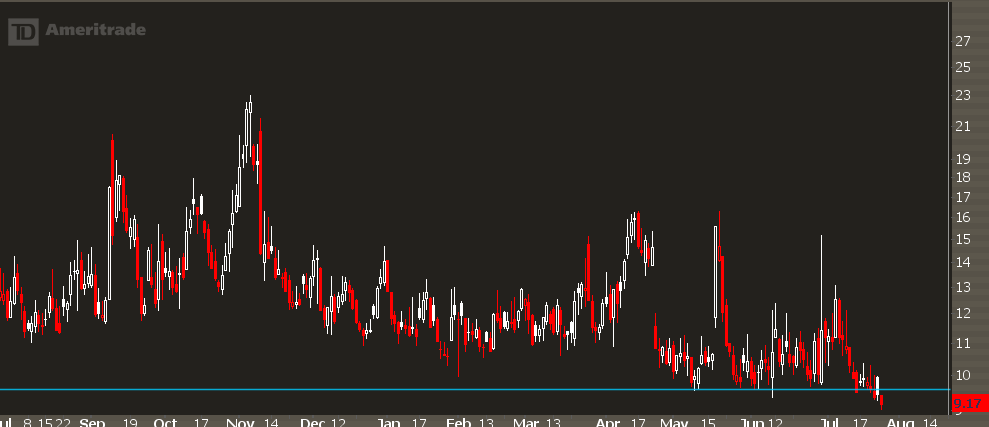

The Current VIX Chart

Last week, the VIX had its lowest close ever.

Part of this makes sense. The S&P 500 is hitting all time highs, and the actual volatility of the market is low. The trading range has been incredibly tight, and there's no signs of weakness out there. US stocks don't look like a top... and even if it was a top, it's a process that takes months before we turn into a cyclical bear.

However things start looking a little "screwy" when we take a look at a different market.

The Current VXN Chart

The VXN is like the VIX... but instead we're looking at the Nasdaq 100.

Spot the difference?

While the VIX is making new lows, the VXN is making higher lows.

What we're going to do now is compare the two.

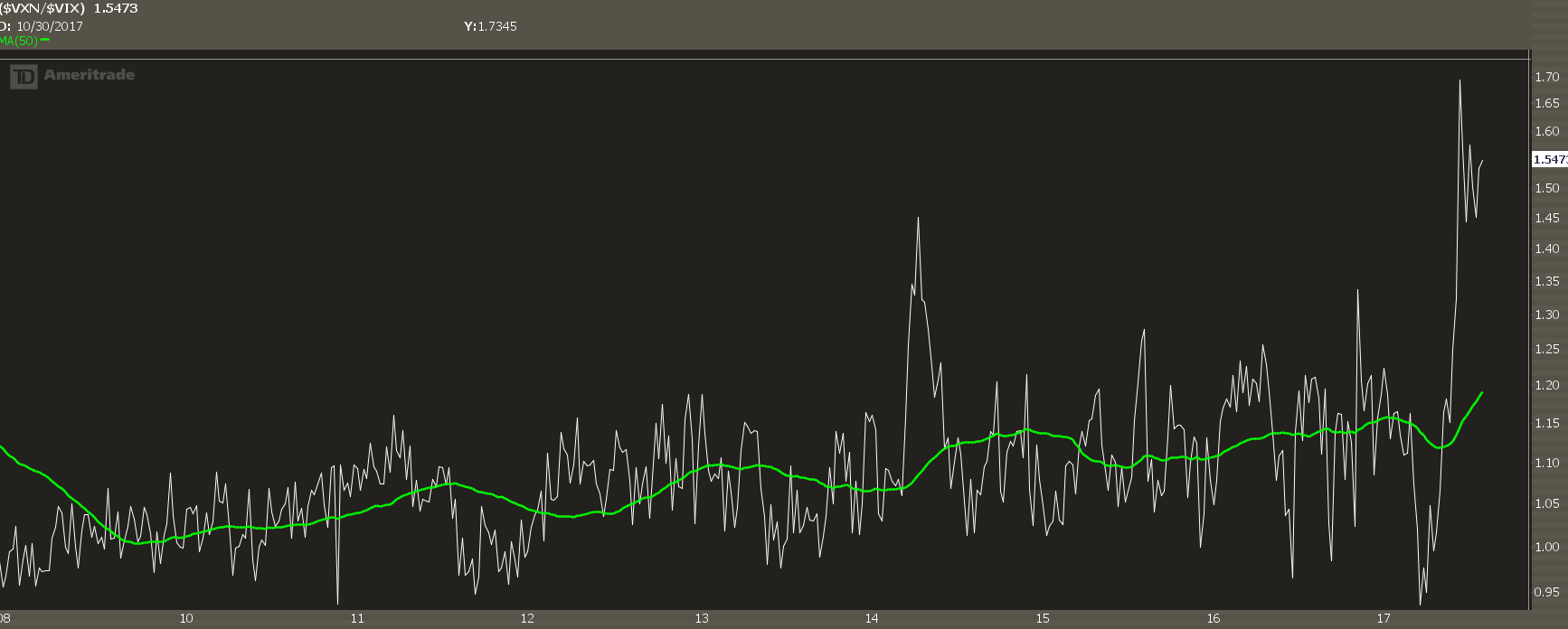

VXN Relative to VIX

Right now, there is a massive divergence between the two values. The risk premium available in $NDX options is much, much larger than the premium available in $SPX options.

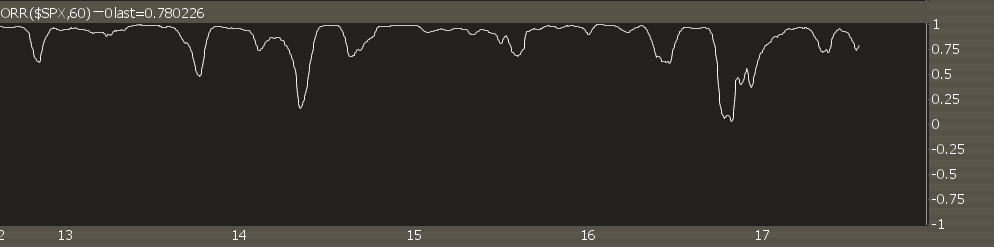

Correlation Between NDX and SPX

One of the reasons I first thought that would be the cause of this risk premium would be a breakdown in correlation between the two markets. And while there has been separation in the past,

Aside from a few times, the Nasdaq and the S&P 500 are strongly correlated. This makes sense

Since I noticed this divergence in June, I've been racking my brain as to why there is such a large risk premium in the Nasdaq. There was a pretty ugly selloff yet the Nasdaq has since broken to new all time highs.

And it's possible that much of that premium is due to earnings coming up in big movers like AAPL and AMZN.

Yet, I'd like to propose another theory...

Structural Risk in Vol Products

There are a few dozen ways for investors to play volatility outside of the VIX.

VIX futures. VIX options. ETPs like VXX and XIV.

All of those are derived somehow from the VIX.

And, from what I can tell, there is no way for investors to gain exposure to VXN outside of trading the actual options market.

All of these derivatives-of-derivatives are driving the VIX down.

Let me explain...

Download the "Broken VIX" eBook

Want to save this for later? We’ve compiled it into an eBook. Enter your name and email and we’ll send it to you instantly.

![]() We value your privacy and would never spam you

We value your privacy and would never spam you

How The Tail Wags The Dog

Say you're an investor looking for a new stock to buy. So you run a performance screener and look for stocks that are up 30% on the year... yes, you're chasing momentum.

Yet in this screener you forget to look at only stocks. So a few ETP's pop up, and you see XIV.

The XIV is an inverse VIX product. This year it's run from 60 to 90... not a bad return.

So you go out and buy some shares.

Now I don't want to get into too deep with the mechanics of this trade, but when you open a new trade, the market maker on the other side goes out and shorts the VIX futures market.

And the market maker for the VIX futures market, who now has long VIX exposure, will go out and trade options to hedge it off.

Which then increases the number of option sellers, and it drives down the spot VIX.

Now multiply that kind of trade hundreds of thousands of times...

And you've got a massive weight on the VIX that is holding it down.

This is A Structural Risk

Tell me if you've heard this story before.

Investors, reaching for yield, discover a suite of products based on the pricing of other products, based on the pricing of risk that they probably don't understand.

Ring a bell?

Remember this scene?

That's right. I went there. I referenced "The Big Short." I compared the current vol market to the 2008 financial crisis.

Now before we move on, I want to make something clear. We're in a secular bull market. Volatility products represent a tiny fraction of what goes on in global finance. Any comparison to 2008 is fractal in nature.

Yet, here's the problem with what we have right now in volatility land.

Say the market dips, just by a normal amount... maybe 3%, nothing big.

And some investors get skittish. They stop buying XIV, maybe some go out and buy SPX puts, maybe some VIX calls.

This causes an uptick in the VIX and VIX products. Maybe some other traders get stopped out of their short vol positions.

Pretty soon, this cascades into a full-blown panic underneath the surface of the market.

Think this is crazy? It's happened multiple times over the past two years.

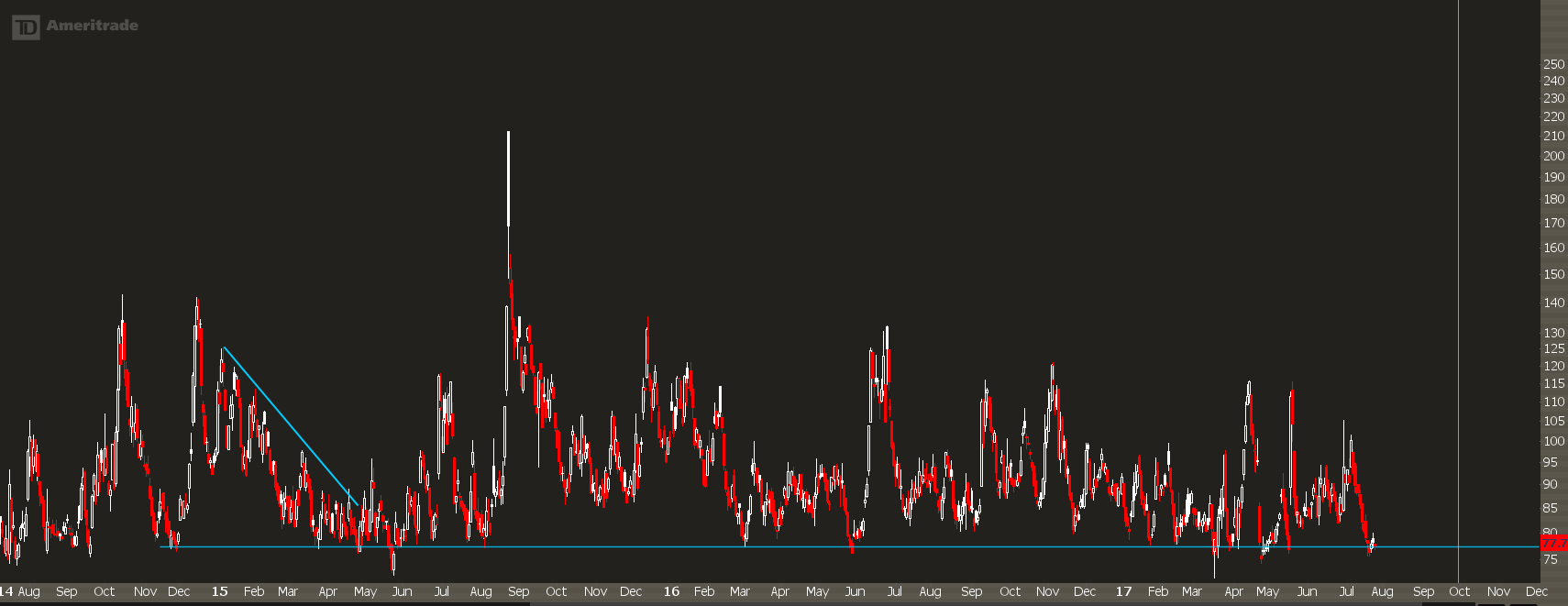

The VVIX

The VVIX is a reading of the risk premium in VIX options.

While the VIX continues to make lower highs, the spikes we see in the VVIX are about the same height.

Think about this!

The S&P 500 has seen no proper selling in 2017. At all. Yet any time we get just a tiny blip lower, the VVIX spikes to nearly the levels we saw headed into Brexit and the US election.

What happens if we get a normal selloff?

Just a run-of-the-mill 5% pullback?

Here's the Rundown

I know I've covered a lot in this post. And it's kind of a complex topic to understand but it's important, especially as we get out of the summer doldrums and head into the fall.

Here's a summary of what you need to know...

- The VIX, a measure of risk premium in the S&P 500, is hitting all time lows.

- The VXN, a measure of risk premium in the Nasdaq 100, is making higher lows.

- There is a statistically significant divergence between the VIX and VXN.

- The VIX has a large amount of products tied to it.

- The VXN is a volatility index unadulterated with any other products besides the options market.

- The VIX is very low, partially because of the low volatility in SPX, but also because of the increased supply of volatility-sellers.

- There exist a significant population of investors who have no idea what's going on behind the scenes in the volatility markets.

- There have already been mini-panics in the volatility market on very small SPX selloffs.

- If the SPX sells off a "normal" amount, a structural instability may manifest that leads to a cascade in all the volatility shorts.

Download the "Broken VIX" eBook

Want to save this for later? We’ve compiled it into an eBook. Enter your name and email and we’ll send it to you instantly.

![]() We value your privacy and would never spam you

We value your privacy and would never spam you

How to Trade It?

I suppose this is where the rubber meets the road. After all, it's one thing to analyze the market, and another thing to create trades to profit around it.

Let's take a look at some ideas.

First, a quick disclaimer... I'm not your broker, and these trades are educational in nature. With that in mind...

1. Long SPY Straddles

Right now, you can buy an Aug SPY Straddle with an implied volatility of about 6.5%. I've never seen that before.

The Aug 248 straddle is currently going for 3.41.

To put that in context, for you to be profitable, the SPY needs to move 1.37% over the next 3 weeks for you to profit on this trade.

If you think the S&P can see a 30 handle move sometime soon, this is a good trade.

2. Long VIX Options Delta

With the spot VIX at 9, and the VVIX at 6 month lows, it makes sense to start looking at making a bet that we'll see at least some selling headed into the fall.

Keep in mind, if you trade VIX options, your underlying is not the spot VIX... instead it's the VIX futures market. And the October VIX is currently at 13.20, so there is a decent amount of premium there.

If you want a "moonshot" trade, you can buy the VIX Oct 20 call for 0.65. A 3% selloff should get you at a double.

If you want a more conservative bet, here's something I like:

- Sell to open VIX Oct 12 Put @0.80

- Buy to open VIX Oct 15/20 Call Spread @0.60

This puts you at a small credit. Now if the VIX stays at 9, then the trade will lose about 300 per spread. I don't think that's likely, headed into October. You'll want to scale out of this trade into any move higher in the VIX.

3. Fade The VIX Pop

Short volatility strategies will probably continue to work... it's just a matter of timing. Instead of forcing your way into a trade late, why not wait for the move?

There's a few conditions to look for...

- a VVIX above 95

- VIX futures backwardation

- VIX/VXV above 1

These are all sufficient to consider entries. My favorite instruments are XIV long and VXX puts.

This kind of trade will be frustrating because I'm going to be early on this call and it will be another month before sellers step in.

4. Nasdaq/S&P Dispersion

This is a little more of an advanced trade. The basic idea is you want to sell vol in the Nasdaq, and buy vol on the SPX.

Here's an example of how this would look:

Sell 2x NDX Sep 5350 Put @15.60 (IV: 20%)

Sell 2x NDX Sep 6240 Call @9.10 (IV: 10%)

Net Credit: $4940

Buy SPX Sep 2475 Straddle @57.40

Net Debit: 57.40

This bet assumes that the NDX strangles will decay faster than the SPX straddle. You'd want to be in this for a few weeks, and you'd need to move your deltas around using the futures market.

It's capital intensive, and if you want to cut your margin, you could do something similar using the ES and NQ futures market.

5. QQQ Ratio

If you think we could pullback but the Nasdaq vol is too high, you could put this trade on:

- Buy 1 Sep 139 put

- Sell 2 Sep 136 put

Credit: 0.43

With this trade, you're covered all the way down to an 8% correction in the Nasdaq.

6. Buy Calls on Your Favorite Stocks

Odds are, this rally is going to continue. And individual stocks are going to run-- this is some of the cheapest premium I've seen.

Right now, it is a much better play to buy calls compared to owning stock. It's much more capital efficient, and if we do tank your risk is limited to much less than what a pullback would cause in a long stock portfolio.

I'd also look into converting any winning stock trades into long call positions. You can take cash off the table, still let the winner ride, and have deployable cash ready in case a dip does happen.

A Final Warning

It's easy to create a narrative that would make you want to go out and buy gold, guns, and ammo.

If I did that to you with this post, then I made a mistake. While I believe a structural risk does exist in the volatility markets, there is no evidence that US stocks are in or approaching a bear market.

Yet it is time to give serious thought as to how you want to play the next 6 months. Volatility moves in cycles, and we're probably near a low. Trade accordingly.

Download the "Broken VIX" eBook

Want to save this for later? We’ve compiled it into an eBook. Enter your name and email and we’ll send it to you instantly.

![]() We value your privacy and would never spam you

We value your privacy and would never spam you