Right now, market headlines are littered with talk of trade wars and tariffs.

The Fed keeps jamming rates higher and will probably overshoot their target.

The yield curve is threatening to invert, which is a leading indicator for a recession.

I swear, I could spin a tale of woe and gnashing of teeth that would make you want to sell all your stocks and buy lots of guns.

This is normal.

Narratives come and go. Remember fiscal cliff? Surprise Chinese rate adjustments?

Ebola?

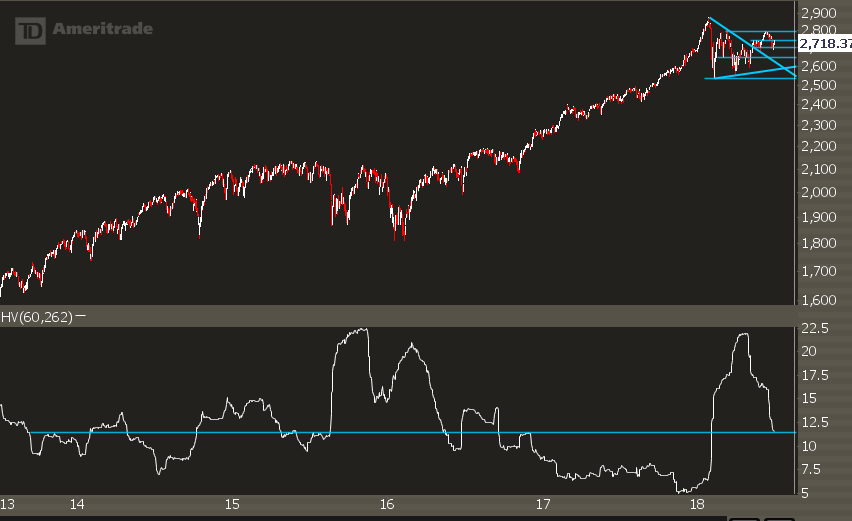

Here's what I'm seeing... this is a 5 year chart of the S&P 500. The lower chart is the rolling 3-month actual volatility of the markets:

This price action?

This is normal. Statistically. We're seeing wider price ranges with buyers and sellers coming into play.

Shocking, isn't it?

Now 2017?

That wasn't normal. That year we saw things happen that I don't think we'll ever see again.

I've talked about this before... the massive influx of capital into short volatility strategies became a "tail wagging the dog" play.

And it artificially kept a bid in the markets into any kind of pullback. That finally broke in February and there isn't any more "dumb retail" that's aggressively long XIV or SVXY.

We're back to a statistically normal market.

If you've been trying to trade 2018 like it's a 2017 kind of market, you're going to have a bad time.

Yet if you understand that this market allows you to be more patient with your entries...

... where you don't have to chase stocks just to get a piece of the action...

... where reversion strategies actually work...

Then it's actually been kinda fun.

(I know it has for me.)