J.W. Jones has a good article about a potential strategy in SLV going into February opex, specifically a front month butterfly spread to take advantage of some of the decay characteristics that options have as we go into the last 2 weeks.

The last two weeks of the monthly option cycle is even called “butterfly season” by many option traders. The classic behavior of butterflies is that they are only slightly impacted by changes in the price of the underlying early in the cycle and exhibit increasing response to price change late in the option cycle.

You can see the full explanation here, but let's look at the setup.

From what I can tell, he's looking at a moderately bearish put butterfly, looking for a roll to the downside. Specifically, it's a Feb 23/26/29 put butterfly. While I like the directionality of the trade, I'm going to take the same risk and go to an ATM butterfly to compare what the risk profile looks like for the front month options vs. the next month options.

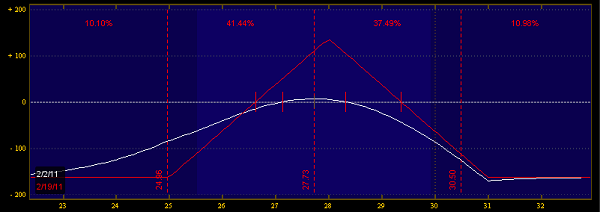

So this is the chart for the 25/28/31 put butterfly:

The risk reward may seem a little skewed to the loss side, but you have to consider the risks in time and volatility. As long as SLV stays within this range for 2 weeks, you're going to make money. However, there is a risk here: gamma risk.

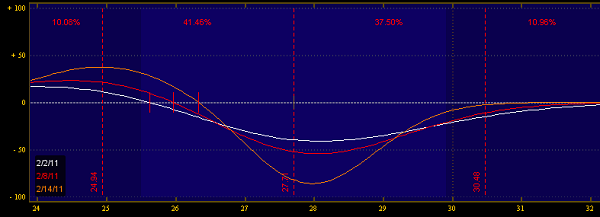

The chart below shows your gamma as the position gets closer to expiration. You can see that just like time decay, the change in gamma over time also has an exponential function:

You can see that the difference between the white and red lines are smaller than the red and orange lines-- that means over time, your gamma risk will increase.

How do we mitigate this risk? Well, you could overbuy the wings, or you could go further out in time and look at a March 25/28/31 put butterfly. That will significantly reduce your gamma risk, but it will also reduce your theta gains.

So even if none of what I said made a lick of sense to you, remember this: there is always a tradeoff between time decay and gamma risk.

And if you want to learn more about how to figure out your option greeks, you can check out my new product here.