Solar sure has been on a tear in the past few months, with names like FSLR SCTY and JASO all ripping higher.

But many times this kind of run is on the "backend" of a broad market rally, where highly-shorted spec stocks are the last to run.

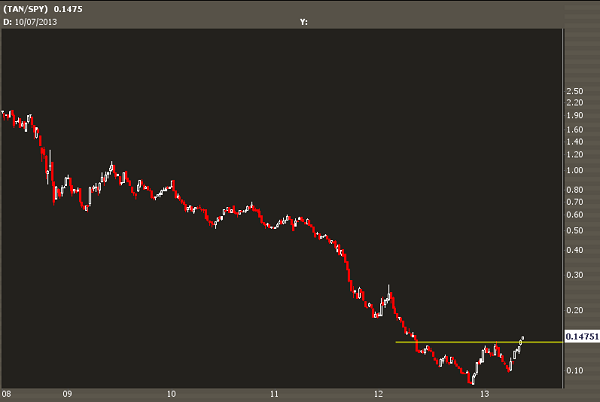

The chart below shows how the longer term trend in solar performance may be making a turn:

This is a weekly chart of TAN performance relative to the SPY. This is the first time a "higher high" has been registered in a very, very long time.

TAN is the Guggenheim Solar ETF with holdings like FSLR, PWER, SPWR, WFR, SCTY GTAT, TSL and YGE.