It seems like a distant memory.

As the teargas slowly fades from the Greek Isles, it seems that the worst of the eurozone crisis is over.

Is it? I haven't a clue.

But if you are expecting volatility to come back and for the term "PIIGS" to be all over the news, then here's a simple trade.

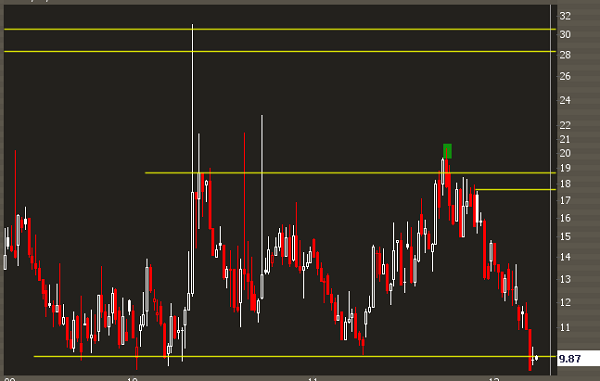

First, here's a look at the EVZ-- it's the VIX for the $FXE (the euro):

Single digit vol readings tend to be a floor.

Now while you can't get long EVZ (or any other spot vol reading), you can be bullish volatility by purchasing a long straddle.

A straddle is a combination of a put buy and a call buy. You make money if there is a sharp move in either direction, or if the implied volatility rises.

A solid trade here would be to get long the Jun 133 straddle for a cost of 5.00. Breakevens are 128 and 138, both of which have been tested last quarter.

And if something gets stupid and the EVZ spikes, you'll stand to profit. A move to 14 on the EVZ would return about 50% on max risk, all else equal.

The main risk? Time. If all is quiet on the western front, then you stand to see your position deteriorate over time.