Just a quick primer for those looking to play RIMM tonight. It's a nice stock because they report outside of earnings season, so it gives traders opportunities normally reserved for other parts of the year.

This is a brief analysis, if you want more indepth information on how to analyze and structure trades around earnings events, check out my video course at EarningsTrades.com

The front month options are pricing in about a 7% move in magnitude. That means if you sell volatility today and the stock stays between 57.5 and 63.5 then you will make money. Therefore, any strong move to the outside of that range will tell us that the option vol sellers underpriced the move.

The current volatility readings are quite low relative to what we've seen in the past going into RIMM earnings. That's telling us that the option market and the market makers are not able to pump any premium into the near term options because there is no outright demand for them. It is also due to the recency bias from last earnings event, in which the move was relatively underwhelming.

With respect to the current option prints, the largest trade today was a spread in the Dec 55/52.5 puts on ratio. The trader bot 1700 Dec 52.5 puts and sold -5100 Dec 50 Puts for a slight credit. The trade has a big kicker if RIMM pulls back under 52.50, but the trade fares much worse if it breaks 49. This trade is a decent way to play earnings, but requires a lot of margin.

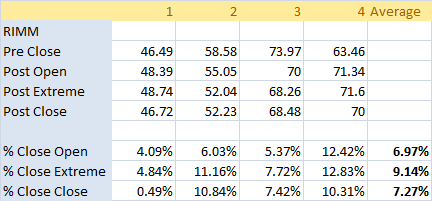

Next, the average moves:

Analyzing the past 4 earnings events, we can see that the average move off the open is around 7%, but after the open the volatility can continue in the direction of the gap. Since the average Close-Open movement expected comes in around the same price as the options expectations, it means that the options market is probably underpricing this move. So if a trader is looking to sell volatility, the risk reward is not as appealing as the past few events.