After retracing a significant part of its rally, crude oil is now retesting the range developed in the fourth quarter of 2012:

The short term trend continues to be lower-- and if China and emerging markets continue to be weak, commodities will continue to suffer. However, there is a major technical support at 84 that will most likely prevent crude from a significant move to the downside.

With that technical analysis, it makes sense to be a little bearish here, neutral on another few points lower, and then bullish a few points lower from that. It may seem like a complicated thesis, but with options trading we can structure our risk to take advantage of that.

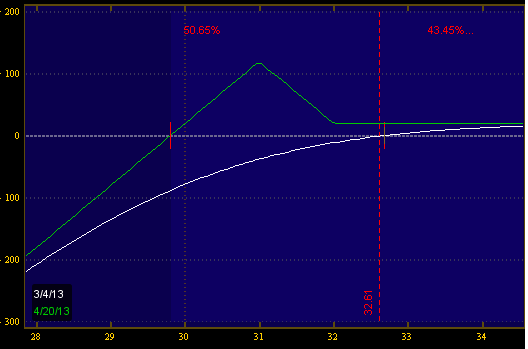

The first trade idea to consider is a put 1x2 sale. This is where you buy a put and then sell twice as many puts further out of the money. Here is an example in USO, a crude oil ETP:

Buy 1 Apr 32 Put

Sell -2 Apr 31 Put

Credit: 0.20

This trade is technically long deltas, which means if a rapid selloff occurs immediately you will be left with a larger unrealized drawdown. The payout at expiration is where it gets interesting-- any price above 32 and you are profitable as you received a credit, and any action around 31 leads to slightly larger profits. Below 30 per share and it gets hairy, but 30 wouldn't be a bad place to own USO.

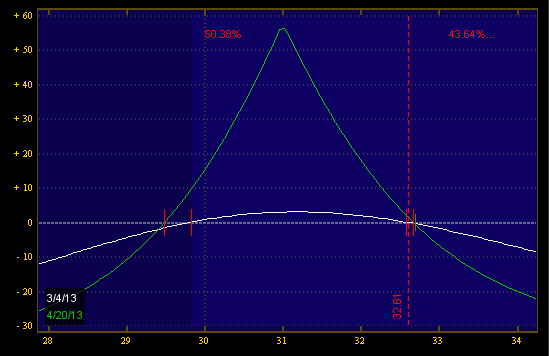

Another idea is to purchase a put calendar:

Buy 1 May 31 Put

Sell -1 Apr 31 Put

This trade has both upside and downside risk, and you make money if USO goes lower from here but stays above 29. This trade is also bullish vega, which means if the implied volatility in USO rises, it will benefit.

If you like the ability to take a more nuanced approach to the markets, then consider IWO's Option Trading Service.