The recent rally in stocks has been relentless.

We've nearly had 95 days in a row since the market has pulled back over 1%. That kind of streak hasn't happened in over a decade.

Yet underneath the surface the rally hasn't been evenly distributed. Tech stocks like NFLX, GOOGL, and FB haven't moved much, while large cap financials like JPM and GS have seen massive moves since November.

One stock sticks out in particular as I am seeing key signals from my indicators.

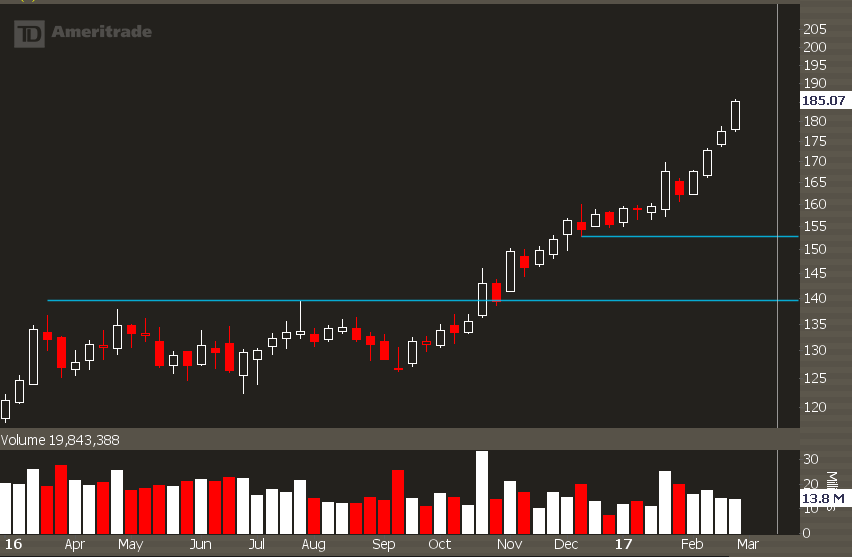

Boeing (BA) has moved from 120 to 185 in the course of a year... that's well over 50%.

And much of that movement started when the stock broke out of a range back in October.

A massive amount of value has been added over a short amount of time... but should we expect the stock to top out anytime soon?

Let's look at some numbers.

Quantitative Levels To Watch

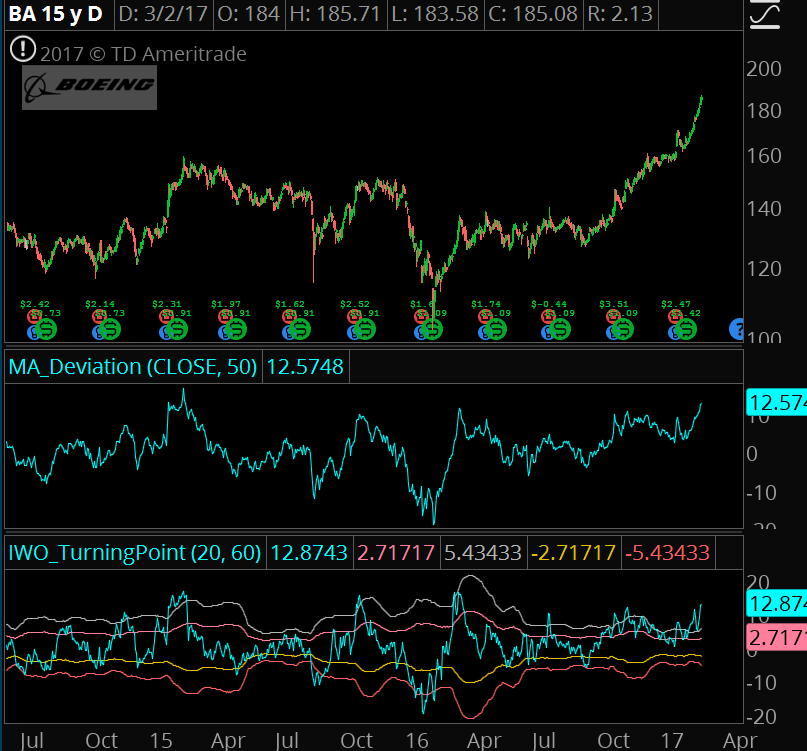

The two indicators underneath the chart can give us a more objective view of how the stock has traded in the past.

The first indicator is a Moving Average deviation. It simply looks at how stretched we are relative to the 50 day moving average.

Currently we are 12.5% above the 50 day moving aveage. This is towards the higher end of the readings that we see in this stock.

The second indicator is the IWO Turning Point indicator. This shows us percentage movement relative to previous volatility.

Over the past 20 days (1 calendar month) the stock is up over 12%. Again, we're coming into levels that are exceedingly rare.

But here's the kicker...

Normally when we see elevated levels on the Turning Point Indicator, it usually is after a strong selloff in the market or an earnings catalyst in the stock.

Within our one month window, it has been a consistent markup higher without any kind of reversion whatsoever.

The next question is... what should we expect?

How this Stock Will Trade

Markets can correct 3 ways:

- Price

- Time

- Momentum

That means, if a stock is this overbought, there is no guarantee that it will selloff. It could simply go sideways, or it could rally but with a lower rate of change.

If you're going to try and step in front of this freight train, you need to make sure that you structure your risk the right way.

How to Trade It With Options

Here is a setup to consider:

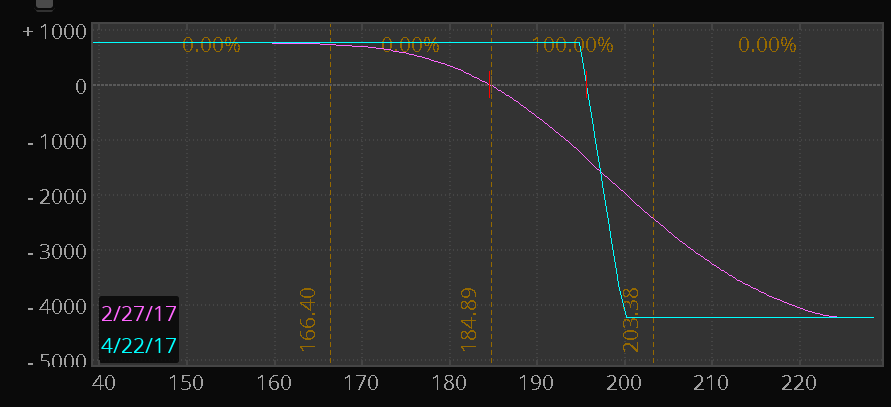

Sell to Open BA Apr 195/200 Bear Call Spread

This is a limited risk, limited reward trade that makes money as long as BA stays underneath 195 by April expiration.

To put this in context, the 195 strike is currently 10 points higher than the current market price of Boeing.

You'd need to see another 5% higher for the outcome to be unfavorable to you.

Now is it possible that we rally 5% higher? Sure.

But is it probable for a 5% rally without some kind of sideways action or a pullback? No-- and that's where we make our money.

There are a few things to get you a slightly better edge in this trade...

Perfect Execution For Faster Profits

Too many traders treat credit spreads as a "set and forget" strategy. That opens you up to a lot more risk than you should be.

After all, the goal of financial speculation is to earn as much money as quickly as possible. You don't need to hang around in a credit spread for another month trying to milk out that last 0.10 in a trade.

This is why it makes sense to trade like a market maker.

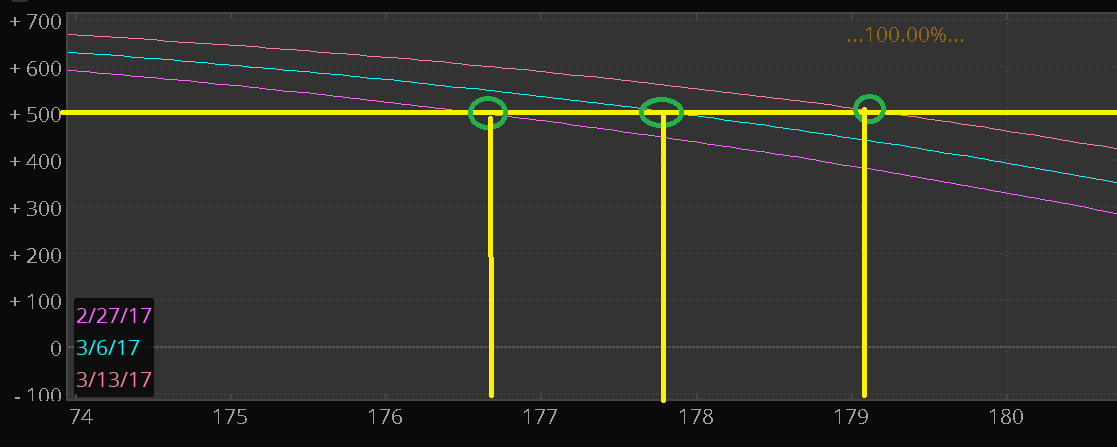

Scale in, scale out.

The current mid on this spread is 0.75.

If you enter here, then add at 1.05 and 1.35 then you won't be as concerned about getting runover by a strong, strong move.

It's even better if you aggressively take profits on those adds to continue to cut your basis down.

And the final thing-- scale out of the trade, say at 0.25 on that first round.

To get an exit of 0.25, you'd need to see a move to 176 today... about a 5% pullback.

But in two weeks, you'd only need to see a pullback to 179. That's pretty reasonable, don't you think?

Get More Trades Like This

If you're looking for a method to earn consistent trading profits on large cap stocks, then you'll absolutely love the results you get from our Proactive Spreads service.

Twice a week, you get a newsletter going over exactly what stocks, price levels, and spreads to trade over the next few days.

The best part is, you can place your trades and walk away-- our system makes the stocks come to you.

Learn more About Proactive Spreads Today