China brought us a present with raised rates, and while this wasn't big news, it gave the market a reason to selloff a bit premarket.

Let's assume we see a little pullback, where are some support levels? Let's take a look at some measurements, looking at fibonaccis, percentage pullbacks, and measured moves:

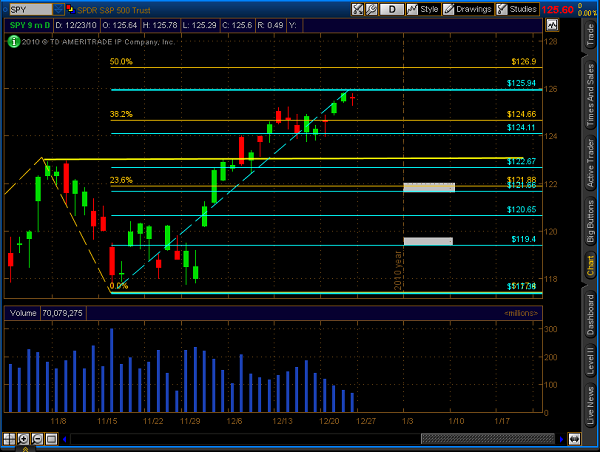

The yellow lines are fib extensions from the run starting back in September, the blue lines are fib retracements on the interemediate term, and the grey boxes indicate a 3% and 5% pullback.

So the first level to watch is 123.75. There is a pivotal level there with price history for the past month, as well as the first fib at about 124. From there we've got previous resistance and the 61.8% retracement at about 123.15.

Under that is the 50% retracement and the 23.6% extension, as well as a 3% pullback at 122. Under that it gets a little hairy, and a lot of second derivative indicators will have rolled over, making it a little tough to keep a long thesis. A 5% pullback off the highs puts us 119.50.

So there's some decent levels setting up, which tells me if we are to actually roll over, we will see a distributive range get knocked out in the market first, which means time is on your side if you're a net seller of options.