Increased market volatility doesn't have to make you upset. If we are in a new cyclical bear market (and the odds are increasing each day) then you need to use a different framework when trading options.

Increased market volatility doesn't have to make you upset. If we are in a new cyclical bear market (and the odds are increasing each day) then you need to use a different framework when trading options.

Stock options give you the ability to make money in any market, but first you must understand what "kind" of market it is, so with the right kind of options training you can adapt to whatever gets thrown at you.

Bear markets behave much differently than neutral markets or bull markets. Aside from the volatility and swift downside action, many traders forget that the largest up days historically will come after a strong period of selling. There are some crucial concepts that you have to use if you are going to trade options in a bear market.

1. Embrace the Volatility

Gone are the days in which you could hold a large amount of overnight directional exposure. With voodoo coming out of Europe (and more out of China) the market suffers large overnight gaps as the result of any headlines that come out while you sleep. The key here is to make sure the positions you are holding are in the right size so if you do see a 3% gap down, you won't be mentally fatigued.

From an options standpoint, this gives you the wonderful ability to trade out of the money options much more compared to a calmer market. Because implied volatility rises, the delta of out of the money options will rise-- this is an option greek called vanna. You can often get more bang for your buck when trading directionally, and better odds if you are selling spreads.

What's more, the "volatility of volatility" increases, because investors really have no idea how to price risk in this market. Check out the realized volatility of the $VIX as it spikes higher during market corrections:

You can capitalize on this by swiftly switching from being a net option seller to a net option buyer, and taking advantage of those pumped up deltas (vanna) when structuring your risk.

2. Become the Market Maker

When a market gets fast and loose, often the liquidity will drop out and the bid/ask spread will widen out. This provides you an opportunity to step in and get much better fills if you use limit orders right. The first part of my Option Training Basics series can take you into more detail, but the idea is that if liquidity is in high demand, you can dictate at what price you are willing to provide it.

Need a simpler explanation? Pick your spots. Model your trade against the best price you're willing to take and set limit orders a little outside of that price. For example, if you are looking to sell bear put spreads at a level in which your option pricing models would say the spread would trade at 1.00, instead offer it out at 1.10 because odds are someone is willing to take that side of the trade to hedge out their position.

3. Start with Small Deltas

This is not a market to be a hero.

Consider this example: a stock has an average range of $5 per share. If you are used to holding 100 shares of the stock, then you should expect swings of +/- $500. But if the volatility increases and the stock's average range runs higher to $10 per share, then you don't need the same position sizing.

This rule also applies in options trading. Instead of loading up on upside calls, consider picking up bull call spreads. Because the premiums are higher, it does make sense to have that extra option sold, and you can even select a further out of the money contract to sell because of the elevated implieds.

If you are used to income trading the front month options, consider going an extra month out to reduce your short gamma exposure.

Another setup to consider is the out of the money calendar spread. This is a great example because it has low initial deltas, and over time the position "matures" if you are correct. There is potential for a loss on extreme tail risk on the other side of the strike price, but the tradeoff has significantly higher rewards relative to your initial risk.

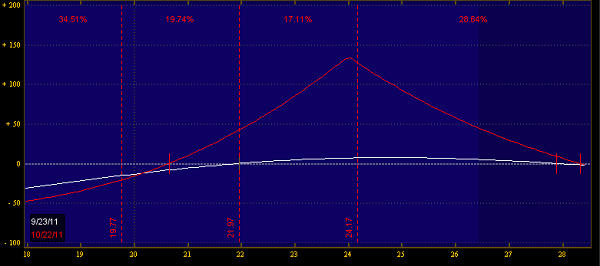

For example, let's say you wanted to knife-catch $X. You could load up on call buys or put sales or another extreme directional trade, but given the volatility it may make sense to have lighter deltas. Instead, look at the 24 Oct/Nov call calendar:

See how your initial deltas (white line) are small relative to what your gains could be in a few weeks (red line)? That's nice because if the market really falls apart, you will have much more limited losses compared to other option trading strategies.

4. Focus on Index Trading

When most investors think of volatility, they focus on the $VIX or $VXX or maybe an ultrashort like $TZA. But another component of bear markets is that correlations run much higher. If a fund has a margin call, they don't care about a company's fundamentals or where they are trading relative to the market-- the buy and sell programs come hard and fast.

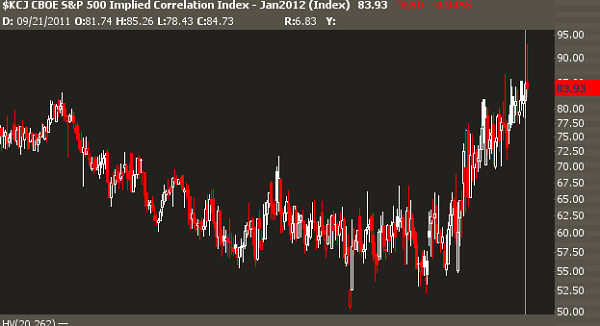

This phonomenon can be charted using $KCJ, which is an implied correlation index for companies with liquid option boards.

The moral of the story? It doesn't matter how good of a stockpicker you are, the accumulation and distribution of equities is occurring on a grand scale.

So if you are looking to trade, you may want to focus more on super liquid index option boards like $DIA, $SPY, $QQQ, and $IWM.

5. Hedge New Trades Immediately

If you are looking to take a trade-- perhaps in some relative strength names like $AAPL, $AMZN, or $MA-- consider taking a little market risk out of the name.

For example, let's say you pick up the $AAPL 400/405 bull call spread. This trade is bullish here but if tech sees heavy selling, even the mighty $AAPL will not be immune. So you could hedge this trade by selling bear call spreads in the $QQQ. How much to hedge? It depends on how aggressive you want to be, and where we are in the current volatility cycle.

Got any more tips on trading a bear market? Let me know!

Options Trading in a Bear Market: 5 Tips to Keep Your Money Safe