Just like price, volatility moves in cycles. When we see volatility compression for too long, it becomes a high odds bet to get long volatility.

Take a look at a daily chart of NFLX. I've put on a few Bollinger Bands on here to show you how tight the price range has become.

Basically, the stock had a nasty gap down on earnings, faded that downmove, and hasn't done anything since.

First up, I'm looking for a little shake and bake this week as options expiration is Friday and we'll probably see some shenanigans.

If a big move doesn't happen by Friday, then you really need to look at buying volatility goingn into Christmas.

Update to the Call

I've received a handful of emails asking specifically what trade was taken here.

Since I had a feeling that there would be a large move in the near term, I sent out this trade alert to IWO Premium members:

Buy to open NFLX Nov 382.50 straddle @9.40

Sell Nov 395 call @0.98

Sell Nov 370 put @1.04

This trade is known as an iron butterfly buy. It could also be called a "covered straddle."

I really like this trade structure because it eliminates the time decay risk faster than if you had put on a straight up straddle. The tradeoff here is that it limits your maximum profit potential, but because this is such a short term trade it doesn't matter that much to me.

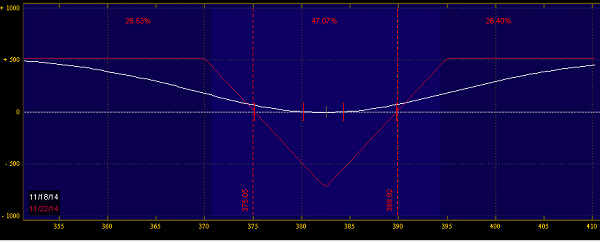

Here's what the trade looked like:

After a single day, NFLX had sold off aggressively and the trade did great.

Here was the closing order:

BUY to close Nov 370 Put @7.00

SELL to close Nov 382.50 straddle @ 17.71

BUY to close NFLX 395 Call @0.17

Which ended up being a return on risk of around 40%.

Here's what the trade looked like after:

Want more trades like this? Click Here to start your trial of IWO Premium today.