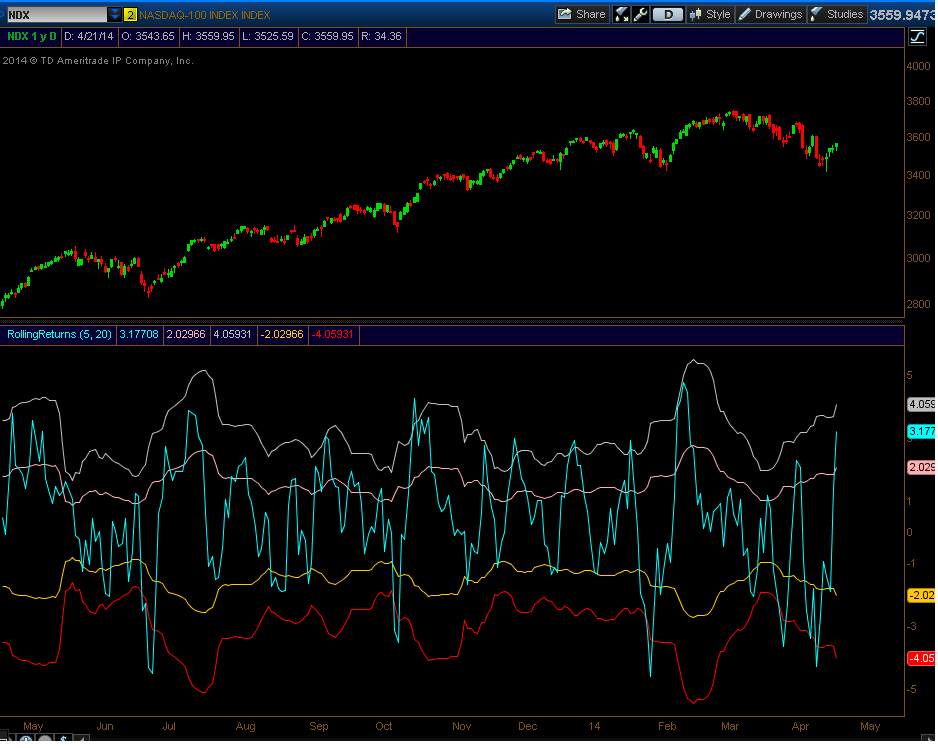

It's been a great rally off the lows, but there is some concern:

The market has now rallied over 3% in the past 5 day period. That's happened only a handful of times, and it normally happens right after selloffs-- see the peaks in October and February came right after market drops.

Odds are good now for a correction. This can be either price-based from a pullback, or time-based from a range. Probably a little bit of both.

Is there an options trade here? Call spread sales or iron condors in next week's options seem like a good bet. And if you have any positions that you hated last week, you probably want to lighten up a little bit.