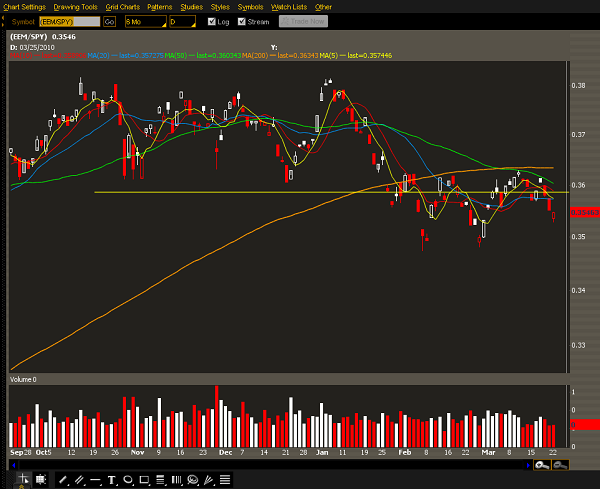

Over the past few videos I've done for stocktwits.tv, I've mentioned a simple dispersion trade that I'm following to see if it will make money in this market. The reasoning behind the trade can be seen via this chart:

This chart shows the performance of emerging markets (EEM) to the S&P. This is one of my "risk-appetite" measures, meaning if there is more demand for emerging markets, that means capital is flowing into riskier assets. Clearly, that is no longer the case. I feel that one of the demand-side components of the rally we've been seeing in equities is the capital flow out of riskier asset classes (emerging) into US based assets.

So my thesis is that the risk from emerging markets is much higher than the risk in domestic markets. Already that is seen through the premiums being offered by the options board. Current EEM vol is 25%, and the SPY vol is around 15%. So this expectation is half-way "priced in" to the market.

Dispersion trading is a fancy way of saying you're going to buy volatility in one asset and sell volatility in another. You make money if the asset you buy vol in moves faster than the asset sold. This strategy has worked very, very well for funds, especially if they have been playing currency risk as well. The giant global dispersion trade is alive and well, and I expect the trend to continue. However, if you're not running more than 50MM, it's hard to structure risk in such a way to play this.

The trade I am following is a retail way of playing this theme.

Sell -5 $SPY Jun 116 Straddle for 8.15

Buy +10 $EEM Jun 42 Straddle for 4.35

This is not a recommendation, I am simply tracking the trade to see if the theme will continue.

The total *net* debit you need for this trade is $275, but unless your broker really likes you, they will treat this as two separate trades, so with the margin required for the short straddles, you need about $15k to put this on.

The ideal scenario is for SPY to chop around, and for EEM to gap and see a rise in implied volatility. In terms of execution, you can manage the trades by delta hedging and adjusting and so on, but I will just track the trade on its own.

Also, there are much more sophisticated ways of putting on this trade, but I am keeping it simple for argument's sake.

So what do you think? Will this trade be a winner or a loser by June?