If you've traded options for a long enough period of time, there will come a point in time in which you experience the "options squeeze"-- that is where you have a position (probably a sizeable one) in which the underlying takes a strong move against you.

And when you try and exit, your fill is terrible due to the wide bid/ask and the lack of volume.

A major component of risk management in options trading is making sure that the trading vehicle you're using doesn't suck. "Suck" is a formal definition, meaning the lack of ability to manage risk with respect to exiting a position.

So you can manage risk using certain option strategies such as spreads and condors-- but it's nice to have liquidity on your side.

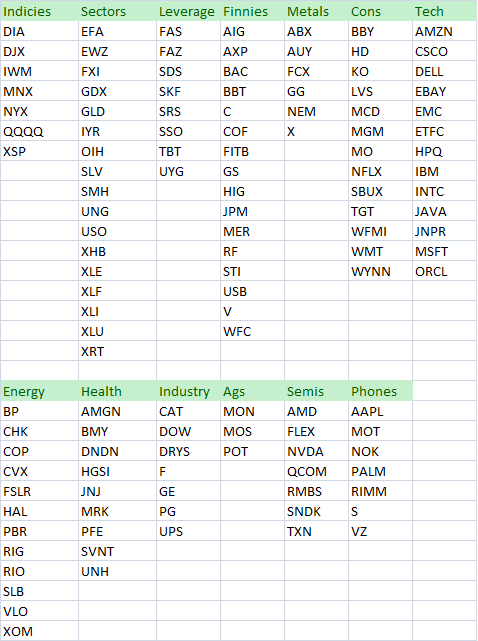

So here's a list of options that are part of the penny pilot program. That means that these options will trade in penny increments under a $3 price and .05 increments above.

This puts you at a great advantage when entering and exiting trades as you can tell much more easily what is the fair value and what is your true exit price.

I've sorted these into appropriate categories-- "industrials" to me simply means "other."