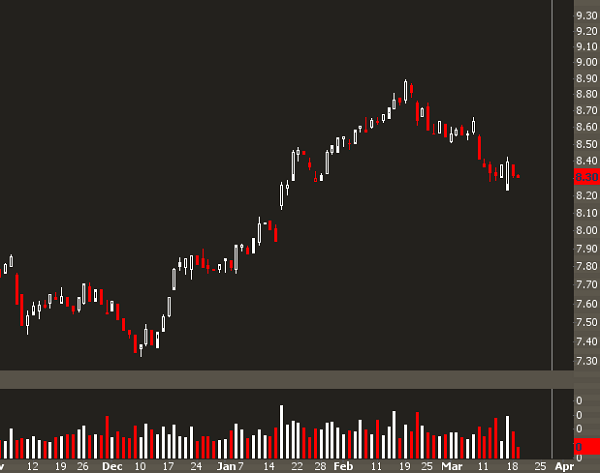

After taking the lead in the first 2 months of the year, GS has been underperforming its sector and the overall market:

And volatility has been compressing, even with the pullback seen back at the end of February.

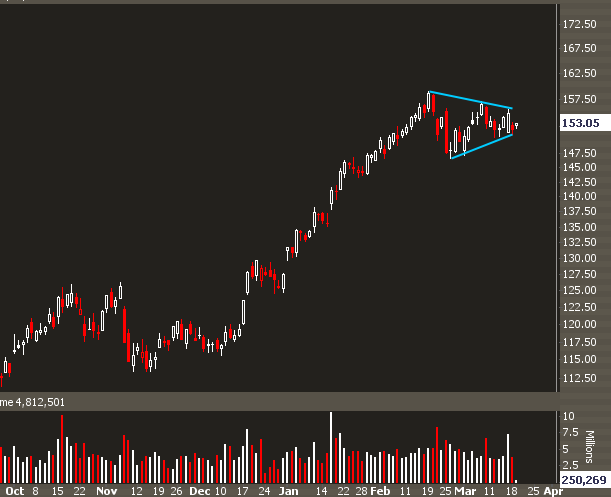

The technical patterns suggest that a volatile move is coming very soon for Goldman, although the direction is uncertain.

The volatility markets seem unaffected by this-- the VXGS (VIX for GS options) is near it's lows, even though the index was in the 30s on that light pullback in February.

A strategy to consider here would be a long May strangle:

- Buy the May 155 Call

- Buy the May 150 Put

- Debit: 8.50 or lower

A move to recent highs around 160 would yield a return of 18% on max risk, and a retest of recent range lows would see a return of around 8%.

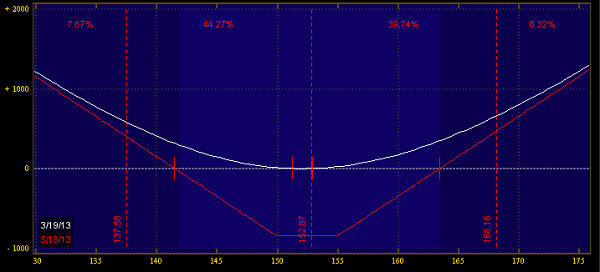

It seems as though the downside reward doesn't seem as great-- but if the option implied volatility rises on a pullback, then the position will make more money.

The IV on this straddle is around 22%. If the IV rises to 27, then the position stands to gain 23% in value, without any needed price movement.

A major risk here is that time decay kicks in and the position loses money over time-- this risk is reduced given the technical pattern, but also because the option duration is further out in time and that earnings is coming up in a month, which will help keep IV bid.