Over the past 3 years I've developed a "best practice" when looking for trading opportunities in the options market.

Over the past 3 years I've developed a "best practice" when looking for trading opportunities in the options market.

Even before I look at the company or the technicals there must be one thing present:

Volume.

Specifically options trading volume. If the total volume in a stock's option chain is under 3,000, it's pretty much off my list.

This significantly shortens the time I need to use for research.

But, the list of liquid options seems to be shrinking, in more ways than one.

The Great Volume Concentration

Bear in mind that all I have is anecdotal data to back this up and haven't done any empirical studies.

But it seems that the total options volume distribution continues to funnel into the same names.

So it's $AAPL, $BAC, $C, $INTC, $MS and so on.

This makes sense for a few reasons.

First, that's where the majority of trading volume is taking place. Even if it is the robots trading against each other, there is a need to hedge equity positions. If a stock doesn't have a lot of participants, then the demand for options is much lower.

Furthermore, the high-correlation market that we saw back in 2011 seems to have everyone still focused on leveraged etfs rather than individual companies.

That means a good portion of "fun" stocks from a few years ago aren't really playable in any size.

For now all of these points are "known knowns."

But it goes a step further.

Time Concentration

The other liquidity issue has been a direct result of weekly options being introduced into the market.

And this has much larger consequences.

Think about this: what is the purpose of the options market? Hopefully all my OptionFu students reading this are shouting out the right answer.

The options market exists as a risk exchange, where risk is transferred between two parties in exchange for a premium. The pricing of that premium is how you make money in the options market.

So there have to be two parties involved, generally a hedger and a speculator.

I believe that weekly options have created a schism in the market between hedgers and speculators.

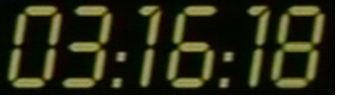

Weekly options have a duration at most of 9 days.

And if you're a fund or larger investor looking to hedge a position, odds are you want protection longer than 9 days.

The problem here is that the liquidity beyond the weekly and front month options have grown anemic. And the majority of weekly options are simply speculator vs. speculator.

So What?

This isn't necessarily a complaing, more an observation about how the market has changed. Certain option trading strategies limited only to expiration week are now playable every week. Weekly options give you the ability to speculate with very limited amounts of risk capital.

But the inability for large players to hedge without significant liquidity risk may keep them away from the market, or at least move them towards market-based hedging rather than covering up a single position.

This has huge implications, not only to the potential volatility of the market, but also to options related data like put/call ratios and the like.