We just closed out a low-stress trade in ADBE (Adobe). This kind of setup allows you to earn income-generating profits without putting on a ton of risk.

I'll detail the setup in just a moment, but first allow me to explain how this trade works.

After a big move higher in a large-cap stock, what tends to happen is something called PEAD-- this stands for "Post Earnings Announcement Drift."

The price action that tends to happen is a slow grind higher without a lot of volatility.

This kind of price action allows you to put on a "high-odds" setup.

Here is the video I sent to IncomeLab members:

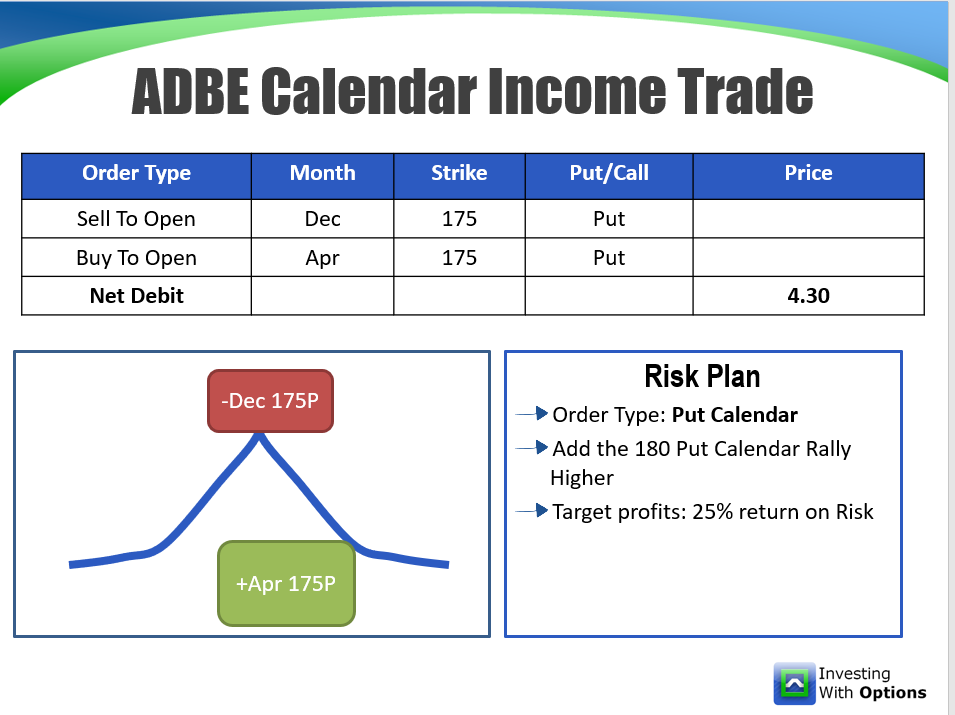

Specifically, here was the trade that was put on:

Over the course of about 3 weeks, the December options we were short began to decay pretty aggressively. We were able to exit out of the trade at a price of 5.70 -- that is a Return on Risk of 32%.

We had a risk plan to add more calendars if the stock moved big, but it never did-- it settled into a grinding range higher.

Any time you see a large cap stock break out big on earnings, you can look to put on this kind of setup.

As an IncomeLab member, each trade I send out comes with a video just like the one above, so you're confident about how the risk and reward is with an income trade setup.

Ready to become an IncomeLab member? Start your $1 Trial Here.