"The VIX is a BUY" the headline screams.

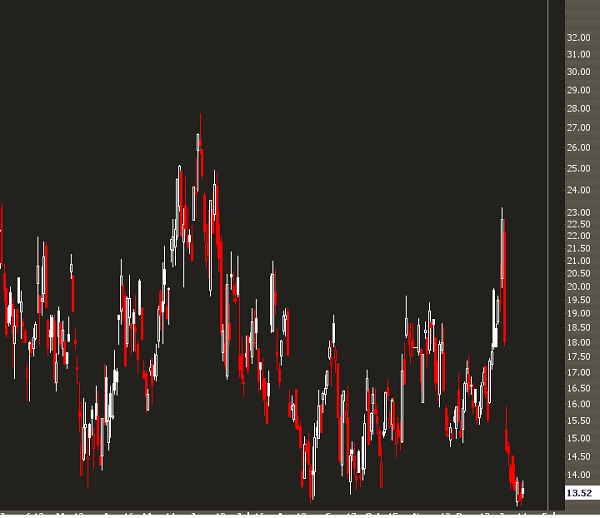

And if you look only at the VIX, it appears so:

If that's not "support" then I don't know what is.

But we know better.

Looking at the VIX in a vacuum is a poor idea.

The Actual Market Volatility

When we say "volatility is a buy," we must ask-- relative to what?

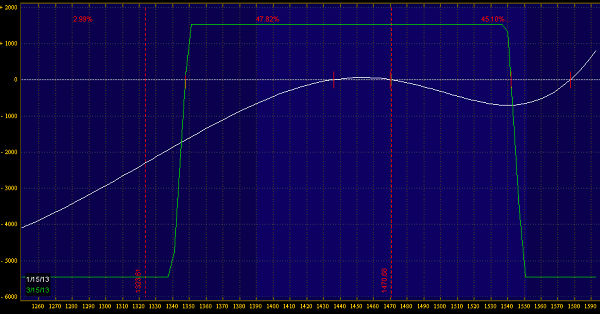

Below is a chart of the 8-day realized volatility in the SPX.

What we're looking at here is the actual volatility that has occurred since the beginning of the year:

So yeah, the VIX is trading at 13, but the actual vol is trading around 6. This may change soon, but probably not to the levels the market is expecting in longer duration risk assets.

Take it Further

A major drawback in the VIX is that it just looks at one timeframe, and technically isn't tradeable.

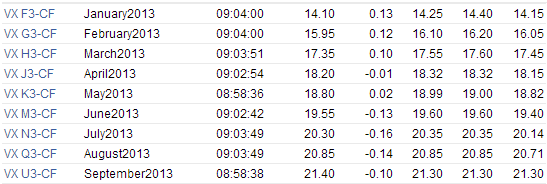

A better tool would be to look at the VX futures market:

Even though the spot VIX is trading at 13, the Jan futures are already higher than the spot at 14-- so you technically couldn't get any exposure at those levels.

What's more, there is a huge difference between the expected volatility now and what's expected in March.

The March VX contract is trading at 17.35. And we have a current volatility of 6.

How to Trade It

One slightly complex strategy would be a time spread sale-- this is where you would end up bearish implied volatility, but bullish realized volatility.

Because of the capital-intensive nature of this spread, you would need a healthy amount of margin, or you could brave the futures options market.

A simpler trade would be to sell March iron condors.

This is a trade that is limited risk, limited reward-- and is bearish volatility.

If the current volatility stays this low, this kind of trade is a layup.