The slow grind higher over the past few weeks has led to a drop in both actual volatility and implied volatility in the options market.

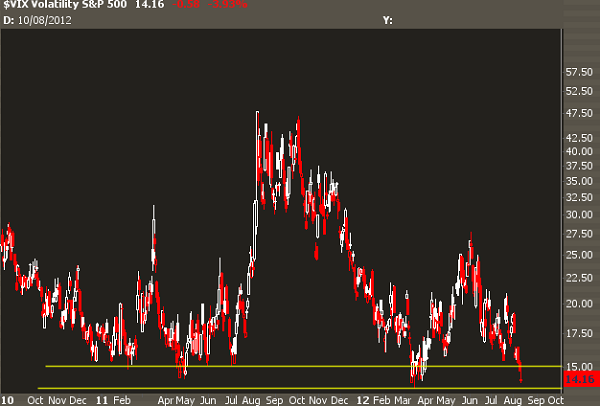

And for the first time in a while, the VIX crossed under 15-- is it time to load up on the short side?

We're starting to see newsflow saying that this is too high of a complacency in the options market and investors would be wise to load up on puts to protect their portfolios.

But not so fast.

There's a couple things to mention as the VIX nears 52 week lows

1. The VIX is a Statistic. Plenty of ink has been spilled over this fact, and I even wrote a book about it. But it bears stating again: the VIX is a normalized reading of the supply and demand of SPX options. No more, no less.

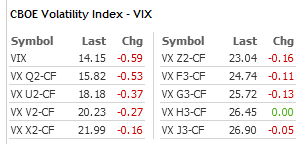

2. You can't just use the VIX anymore. I'd wager that because of a continued interest in varied volatility products, you can't just look at the VIX for your volatility landscape guide. You should also be looking at different term structures, different asset vol (like the RVX) and skew if you want to make informed trading decisions.

3. Volatility bottoms and tops behave differently. Because options decay with respect to value and the amount of protection, the bottoming process in volatility is a completely different animal compared to parabolic spikes in volatility markets.

With that said, here are a few counterpoints showing you why the VIX can stay at this level for a while longer.

Volatility Events Have Been to the Upside

The chart below shows readings of day volatility relative to the overall volatility environment.

Notice that all the major deviation days (>2) have been to the upside. This means that although realized volatility in equities may seem fairly elevated, the volatility has been favorable for investors, with very little downside risk.

Buying Options Aren't That Cheap

The VIX is only on a normalized 30-day reading. What if we go further out in time? Let's take a look at the VIX futures prices:

So yeah, the spot VIX is in the gutter, but Sep vol is still in the 18s, and Oct is in the 20s. While there may not be a high perception of risk in SPX options, there's an anticipation of that to come back in the near term. This is what I call the "just around the corner" trade where no near term risk is seen but still plenty of bid in volatility as we head further out in time.

If you're looking to get a "great deal" on the VIX, you will have to pay up by purchasing at-the-money options to get that 14%, otherwise you'll be picking up a higher volatility if you go further down in strikes.

The VIX Can Stay Oversold

I've seen this a few times before, where a low VIX brings out put buyers, but by the time the market rolls over their options have already decayed to the point where they no longer have effective downside exposure.

Consider the last time the VIX broke 15, back in March:

The entire month of March was spent with a VIX between 14-16. If you had bought puts just on those readings alone, you would have been exposed to time decay and a continued VIX contango that would significantly affect any hedges.

Is it a Terrible Idea?

You shouldn't be dissuaded from buying insurance when it is cheap-- just consider changing around your trade structure so if the market just consolidates for a few months you'll have a better expectancy in that outcome. OTM put calendars are a good trade here, as well as long gamma in a few assets. Also check out this post on hedging in a low volatility environment.

But remember that this isn't some sort of binary event where the markets are about to get zerohedge'd because we're getting too complacent. It requires a bit more nuance than that, and it seems as though we may settle into a "new normal" in volatility for a while.