"Buy when there's blood in the streets..." - Baron Rothschild

Success in financial speculation means you have to step up when the perceived risk is high... but the potential rewards are higher.

Like after a stock has just sold off.

Yet many times it's not as simple as "buy the dip." Sometimes a selloff builds on itself as more investors exit a position, and if you're not careful you can get blown out of a trade.

This guide will give you show you how to safely profit in a stock after it has had a massive selloff. You'll see how to find these stocks, how to avoid the riskiest parts of the trade, and how to use options to optimize your risk and reward.

How to Find Big Selloffs

Opportunities like these don't happen very often. You need to be prepared when they come along.

These three screeners can help you start your search for the best trading setups.

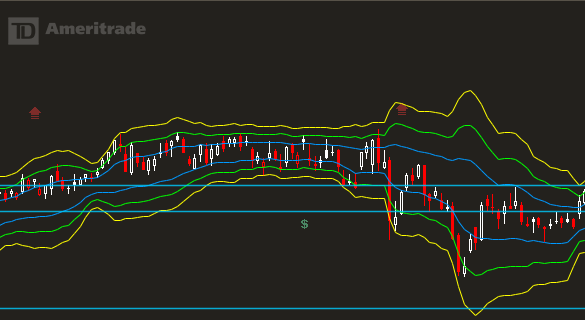

Bollinger Band Screener

A Bollinger Band is an indicator that tells us how much trending volatility is in a stock.

When a stock hasn't moved much, it means that the Bollinger Bands are tight.

But when the stock starts to move big, the Bollinger Bands will open up.

A simple screener to use is to look for stocks where the low is below the 3rd standard deviation Bollinger Band.

That will give you plenty of setups to start your search.

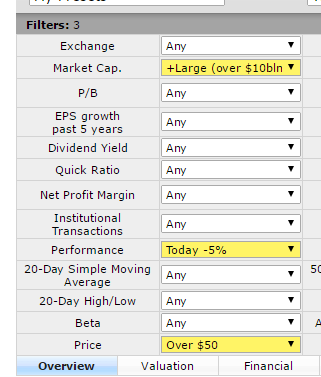

% Selloff Screener

Another simple setups is to look for stocks that have sold off a large percentage during the day.

My favorite tool to do this is using Finviz.

Simply go to the screener and select the "Performance" tab and choose "Today -5%."

One more thing you'll want to do is add two more filters-- price and market cap.

You'll want a "+Large" Market Cap and a Price "Over 50."

You won't get many setups per day, but when they show up... these setups tend to work very well.

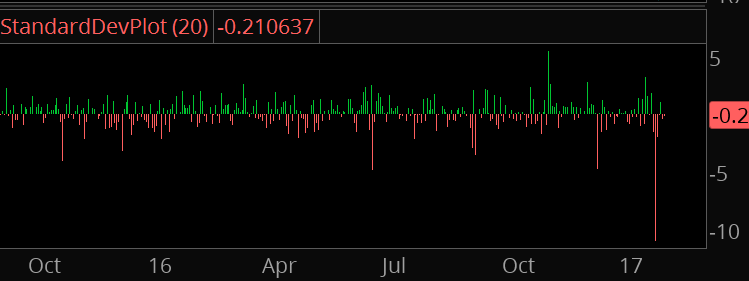

Standard Deviation Screener

One more screener to use is to calculate the standard deviation in the stock.

If you find a stock that has a standard deviation reading under -3, then it's something to put on your watchlist.

Calculate the Risk In The Stock

Blindly going out and buying the dip on every single setup you see is a recipe for disaster. You must make sure that you answer these key questions before you make any decisions.

How Big Is The Company?

Not all stocks trade the same. The patterns and trends play out differently for large stocks vs. small stocks.

It's best to focus on stocks with a high float and large market capitalization.

In other words, pick big stocks that have a lot of shares out on the market.

They have a higher odds of reversion.

What Event Just Happened?

When a stock has a large selloff, it's generally due to some kind of catalyst.

Normal markets stay in equillibrium until something knocks it out. That's why we get the big kinds of moves.

The "kind" of event matters. If a stock just announced that it's going into bankruptcy... that's probably something you want to avoid.

However if the stock had earnings and it beat on earnings but missed on revenue... that's going to be a better condition to trade.

Is it A One Off Event?

This is crucial to understand. Let me explain with an example.

Back in 2010 I was sitting in my living room, glued to the TV screen.

They had a live feed of the oil well at the Deepwater Horizon.

It wasn't just an oil leak, it was a massive torrent of pollution headed into the water.

The biggest stocks hit were BP and Transocean (RIG).

Every time they tried to plug the hole, the stock would bounce a bit.

When it didn't work, the stocks would see massive selling.

It took nearly two months and many many points lower before these stocks bottomed.

When you look at the news on a stock, you need to ask...

"Is the uncertainty gone?"

When a stock reports earnings and sells off, most everything becomes a "known-known."

But if bad news hits a stock and we still don't know if the news is resolved... that's when you want to stay away.

What is the Trend?

Simply put, it's easier to play good news on a bad stock.

If a stock is in a long term uptrend, then it has higher odds of institutional support as it falls back to previous levels.

The simplest way to filter these stocks:

Make sure the stock has a rising 200 day moving average.

Is It A Sector or Market Play?

When the Chinese adjusted their currency rate in 2015, it caught everyone by surprise.

The markets sold off 3% in a single day... I don't think a single stock was spared.

So if you see the market getting hit like that, then you have to worry about correlation risk.

That means it doesn't matter how much you like a stock, 90% of the stock's movement will be driven by the market.

In this case, you should focus on trading the indexes or the most liquid stocks in the index.

Trade This Market Structure For Easy Profits

I'm going to show you a simple template you can use to make buying the dip much easier.

Know How Stocks Trade

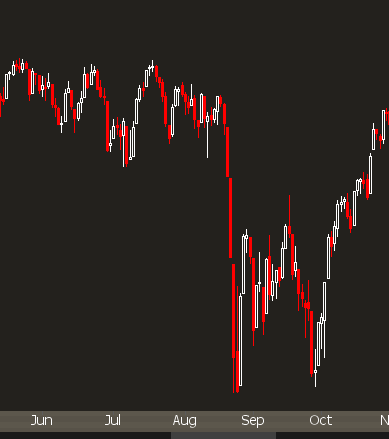

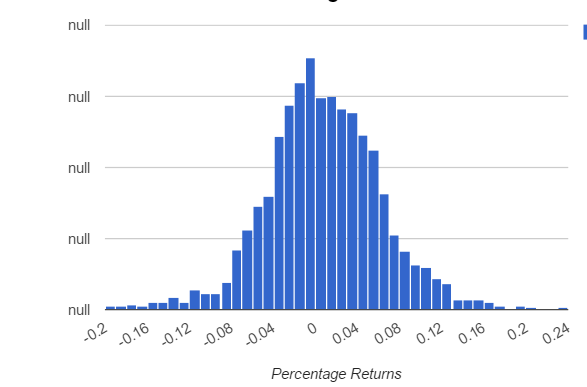

There is a concept called Levy Flight.

It's a statistical term that means a stock will tend to stick around in a range until a catalyst comes out.

After that catalyst the stock will quickly move and establish a new equillibrium range.

A great example is back when the market corrected in 2011. We had been in a range for the better half of the year when a new catalyst comes out, and then we see "Levy Flight."

We can use that to our advantage in the markets. Large, volatile moves tend to be "clustered" and then we settle down into a new range.

Here's how we can apply that to our trading setups...

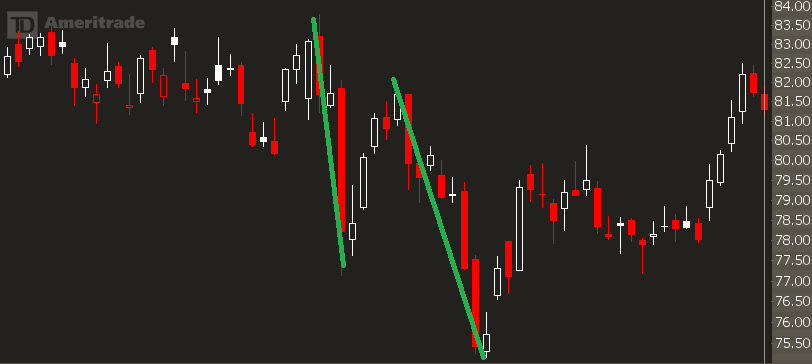

The First Move is Not The Last Move

When a stock has a downside catalyst, there tend to be two lows.

First you have the momentum low. This is after all the aggressive selling has been done and the stock takes a quick bounce.

The second is the price low. This is where you have a lower low in price, but the momentum has pulled in.

That is where you want to start initiating positions.

Stocks trade differently on the first test of a price level compared to the second because the market participants and their emotions have changed.

It's easier to manage risk on that second test versus the first.

Use Previous Support Levels to Dictate Entries

If you're buying the dip on a stock that has long term trend support, you need to know where the odds are highest for institutional buyers to step in.

Here are some of the indicators I use:

Previous support. If a stock found buyers at a key price level, then you have a higher odds that buyers will step up into those levels.

Moving Averages. For large selloffs, my main key is the 50, 100, and 200 day moving averages.

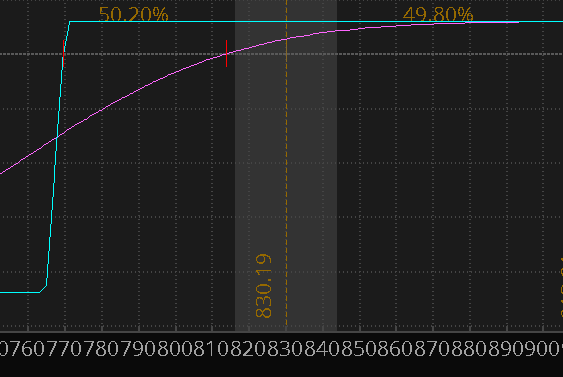

Statistical Analysis. I use an "Oddsmaker" to see how the stock has traded in the past to get an idea what my statistical margin of safety is.

So if a stock has sold off 5% and I know that within a month it rarely sells off under 12%, then I know if it heads just a little bit lower, I have good odds of starting a position.

Know the Exceptions

Of course, there's always going to be special circumstances. Sometimes the stock never retests the lows because a new market catalyst comes out.

Sometimes the stock gets a second round of bad news and has a second leg lower that you didn't anticipate.

That's why it's important to know how to keep your potential losses low while guaranteeing the odds are in your favor.

Use the Options Market To Limit Your Risk

The best way to buy the dip in a stock is to use a put credit spread, also known as a bull put spread.

This is an option strategy that gives you a little more wiggle room to the downside, just in case you're early on buying the dip.

Simply put, as long as the stock stays above the short strike of the spread, you make money. It also helps if the market rallies.

There are some ways to further increase your profits with bull put spreads...

Be Smart About Your Executions

The biggest mistake I see traders make is that they use an "all in" approach when selling put spreads.

This can be bad for you because...

- You don't know where the bottom of a stock is going to be

- If you hold on to expiration the odds further go against you

- You can't take advantage of volatile price movement while you're in a position

That's why I do three things to help my execution:

- Scale in

- Scale out

- Use GTC LMT orders

Those three things can increase your profits by 50% and massively decrease your risk.

Learn How to Be A Proactive Trader

Twice a week, I send out my best spread selling ideas. Many of these are "dip buy" candidates.

What makes this trade service unique is that we are Proactive Traders.

We anticipate what price levels will get hit, plan our trades, and set LMT orders so we can go on with our day.

If you're ready for consistent trading profits in the options market, then become a client and get profitable trade setups sent directly to you twice a week.