It Smells Like Acceptance

It Smells Like Acceptance

One of the true benefits of understanding the options market is that you have the ability to gauge investor sentiment real time, as measured by the rise and fall in the extrinsic value of options.

We normally see analysis of the VIX, where any strong spike indicates fear in the market as investors look to buy puts to protect their assets from any further downside move.

But with commodities, there's not only fear of the downside, but fear of the upside.

It's the Premium, Stupid

The CBOE gives us two great measurements with respect to measuring Oil and Gold volatlity: the OVX and GVZ, respectively. Just like the VIX, they measure the supply and demand for their options market-- OVX looks at USO options, and GVZ looks at GLD options.

The Big Divergence

But because oil and gold behave differently, we will see spikes in premium when we see a spike in the price of the underlying. Most recently, due to event risk out of North Africa and Japan, we've seen that spike. Check out the chart of USO below:

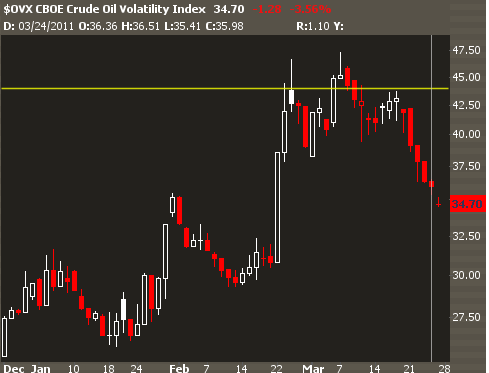

So we have seen two separate moves up, and after a retracement to support, oil is back at prices seen back from early March. Now let's look at a chart of OVX on the same timeframe:

We can clearly see the large spike up in USO option premium on the news, but as we approach the same levels, USO options are significantly dropping in overall premium. What gives? I think two plays are going on here:

Premiums Already Bought. Often when we see a touch of extreme levels, the demand for options premium is a little lower. Think about it like this: the traders who bought options back when oil was spiking don't need to "rebuy" -- they already own the options. That means the net demand will taper off over time as less and less protection is needed. However, the magnitude of the move lower tells me another thing.

Acceptance of Price. Volatility indexes can often be thought of as "fear gauges" where there is fear of a strong move to the upside or downside. As it seems all the news out of Japan and North Africa are "known knowns," there may be less fear from event risk.

Is there a trade here? Possibly-- maybe some volatility buys slightly skewed to the upside could be a good play on the fact that there might be "known unknowns" that come to light and that gets priced in. Instability in Saudi, Syria, and Bahrain come to mind, as well as any supply constraints that may come of Russia.

Are you feeling like all of this is flying right over your head? That's normal-- most traders and investors haven't yet developed the right framework for approaching the options market. If you want to learn about it, check out OptionFu.com and get the best options education available.