Yesterday YGE was starting to coil up in price and was on the verge of breaking out. Several people on the stocktwits stream mentioned it, and it was explicitly called out by alphatrends on stocktwits.tv. I've been stalking this trade since early December, and I found a trade for my subscribers to take advantage of future price while protecting our downside in the event of a volatile move.

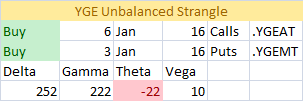

So what we did was picked up an unbalanced straddle-- that is where you buy calls and buy puts, but the amount in each respective option group varies. For this particular trade we loaded up on 2x Jan 16 calls and 1x Jan 16 puts. There was a lot of action in these two sets and I'm pretty sure there was a large player out there taking the same trade; both the calls and the puts were being bought on the ask at a 2:1 ratio around the same time (10:30-ish). With this knowledge in mind, we entered the trade knowing that our downside would be protected via the puts we bought.

The main risk that we had was if we had chopped around; since the options were front month, we were risking a significant amount of time decay. Fortunately, we got the sort of move we wanted, in short order:

Our position sizing is put in the context of a 40,000 portfolio, and we ended up with a $600 (1.5%) gain in a day. As my initial target was the resistance level at 18, we took off our position and locked in our gains. Does the name have more room to run? Probably-- but because we were playing with front month fire, it's best to cut and take profits.

You can see the full trade here.

If you like trades like this and think I can help you enhance your returns, subscribe to my service.