SYMC reported earnings yesterday, and the Street did not like what they had to say. The stock currently is trading down about 9%, and the options market was pricing in a move of about 5%.

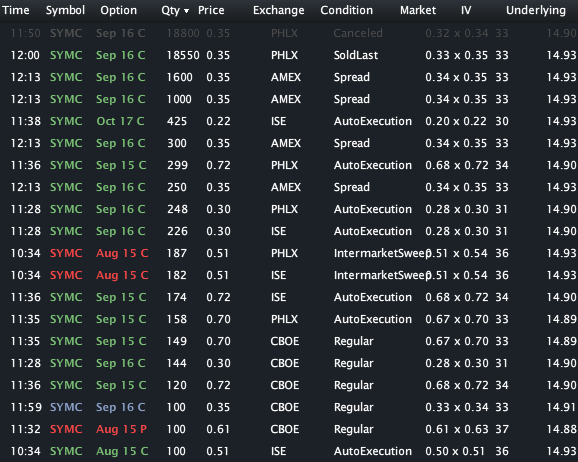

The options activity, taken in a vacuum, was very bullish yesterday. The SYMC board saw calls being bot on the ask. Specifically, there was a trader that bot >18000 Sep 16 Calls on the ask (thanks @optionradar).

However, on closer inspection of the stock movement, we saw that the big order was tied to stock-- about 560k shares. This made sense; the Sep 16C had a delta of about .30, and someone putting on 18550 contracts would have a directional exposure of about +560000. So instead of this being a screamingly bullish trade, this was a bullish trade on volatility.

At least that's what I told reuters, you can see the article here.

The trader who put this on is currently at a profit of about 360k. Not bad in a day's work.