The move in $TVIX is not surprising to those who actually understand how the volatility landscape works.

I can see all the option bloggers out there, with their taped-up glasses and pocket protectors, smugly "tsk-tsking" away at those who thought that the structural inefficiency in TVIX would hold.

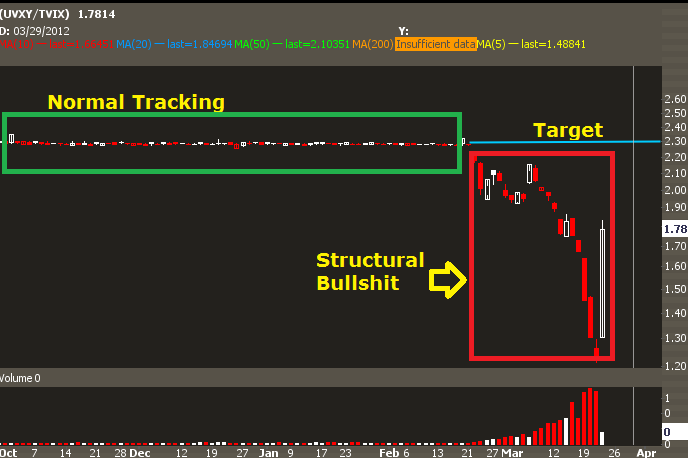

So, what's our target?

Simple. Look at the relationship between $TVIX and $UVXY.

These two ETPs are supposed to track the same thing. So when the relationship normalizes, that's when the volatility in $TVIX will subside to "rational" levels.