One of my more useful tools when analyzing the vol landscape is comparing the "term structure" of S&P premium and VX futures.

Simply put, when we are in a "normal" market environment, longer dated options tend to have a higher implied volatility compared to short term options. This is a function of investors having a good feel for the risks in the near term (less than one month) but there's always something just around the corner (around 3 months). This puts the VX futures into contango.

But when we end up with near term market risk, like a binary event related to US policy or an ECB risk event, then demand for near term options goes through the roof. This is a point in time where the near term options will have a higher premium compared to longer date options. This causes VX futures to backwardate.

Make sense? Let me try one more thing.

Let's say you buy hurricane insurance in December. That's probably going to be cheaper compared to buying it in June when there's a tropical storm watch for the next week.

It's kinda like that.

How to Measure Term Structure

There's a handful of ways to look at this contango/backwardation, through analyzing option skew charts or looking at VX futures data.

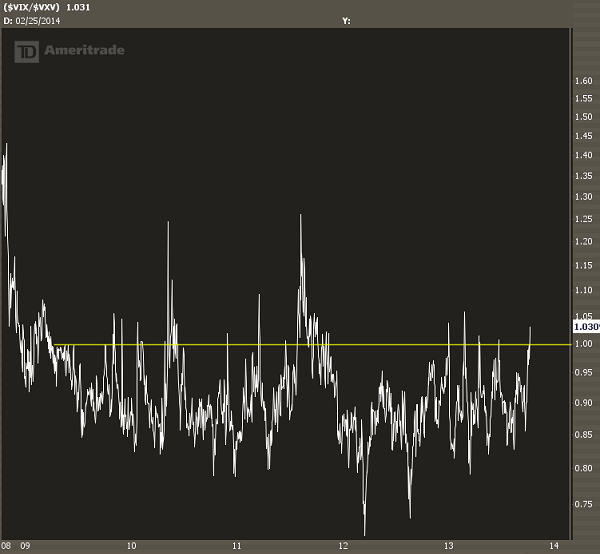

But the quick and dirty way to do this is by comparing VIX and VXV.

VIX is the 30-day implied volatility.

VXV is the 90-day implied volatility.

Here's a chart:

The general idea is... when this ratio is above 1, the market is in backwardation and panicking a bit. When it's below 1, we're in contango and a more "normal" market.

Timing the Markets

Now if you eyeball this chart with the equity markets, you'll see that any move above 1 has coincided with some form of market risk, which supports the idea that when near term options get bid higher, everyone is panicking and looking for hurricane insurance.

Since we've been in a bull market, these areas have often corresponded with market bottoms. That won't last forever, but it's been pretty reliable so far.

Why This Matters

This is a big deal for VXX, because it the ETN does well when we see abnormal term structure, but horribly when we see normal term structure.

So if you've been using VXX as a hedge, then you probably want to cool it if this ratio goes back under 1. This condition doesn't last very long.