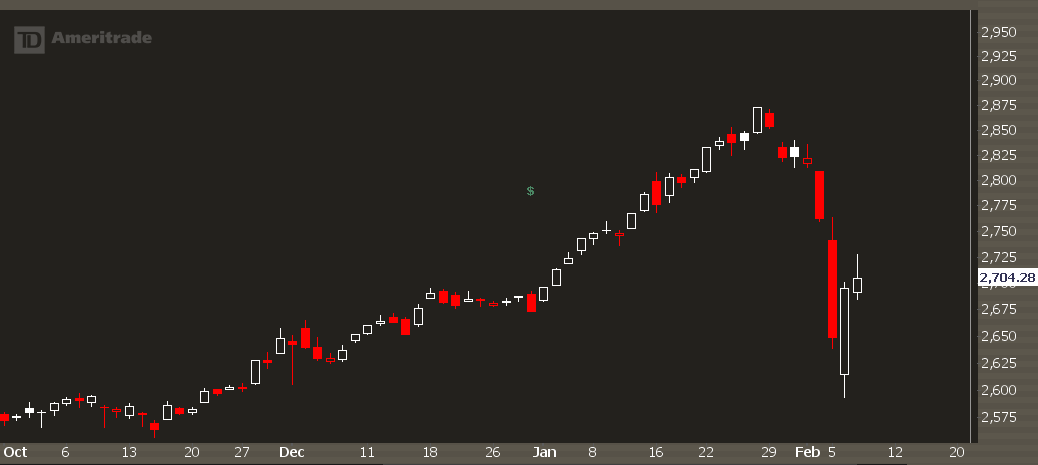

In case you weren't paying attention, we just crashed.

A nice, tidy 10% pull in just a few days. Blood in the streets, yadda yadda yadda.

If I'm not seeming too panicky, that's because I'm not. It had been a very long time without a decent correction in the market, so some kind of pullback was to be expected. The speed and length of the pullback is fast and large, but I tend to underestimate how far we can go... both to the upside and downside.

For some reference, here's the 5-day rate of change for the S&P 500 going back to 2011:

While pretty infrequent, it does happen every few years. This is the "tail risk" that we hear about in the market all the time.

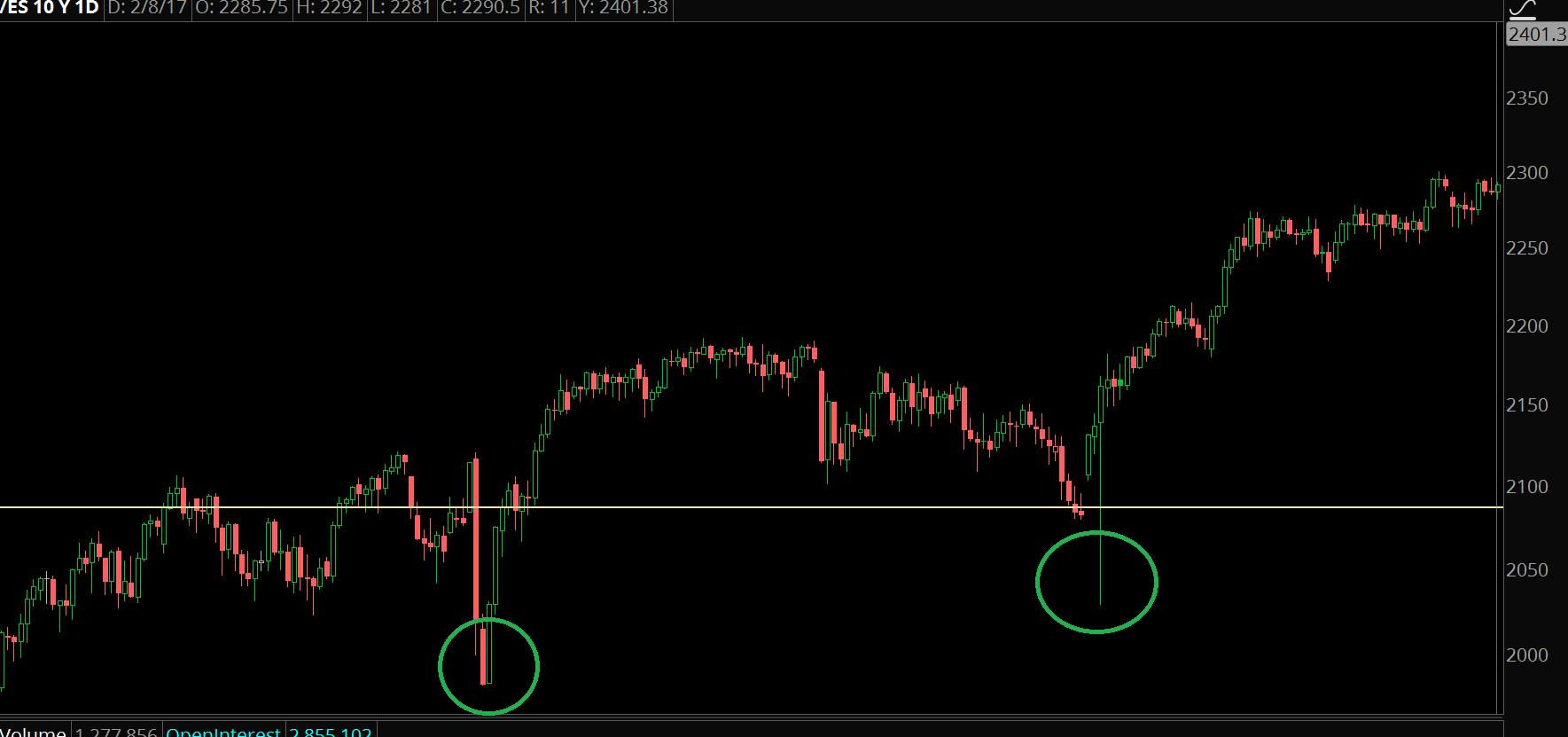

Normally, when we see this kind of move there's a very high chance of retesting the lows... here's some examples:

2015-2016

2011:

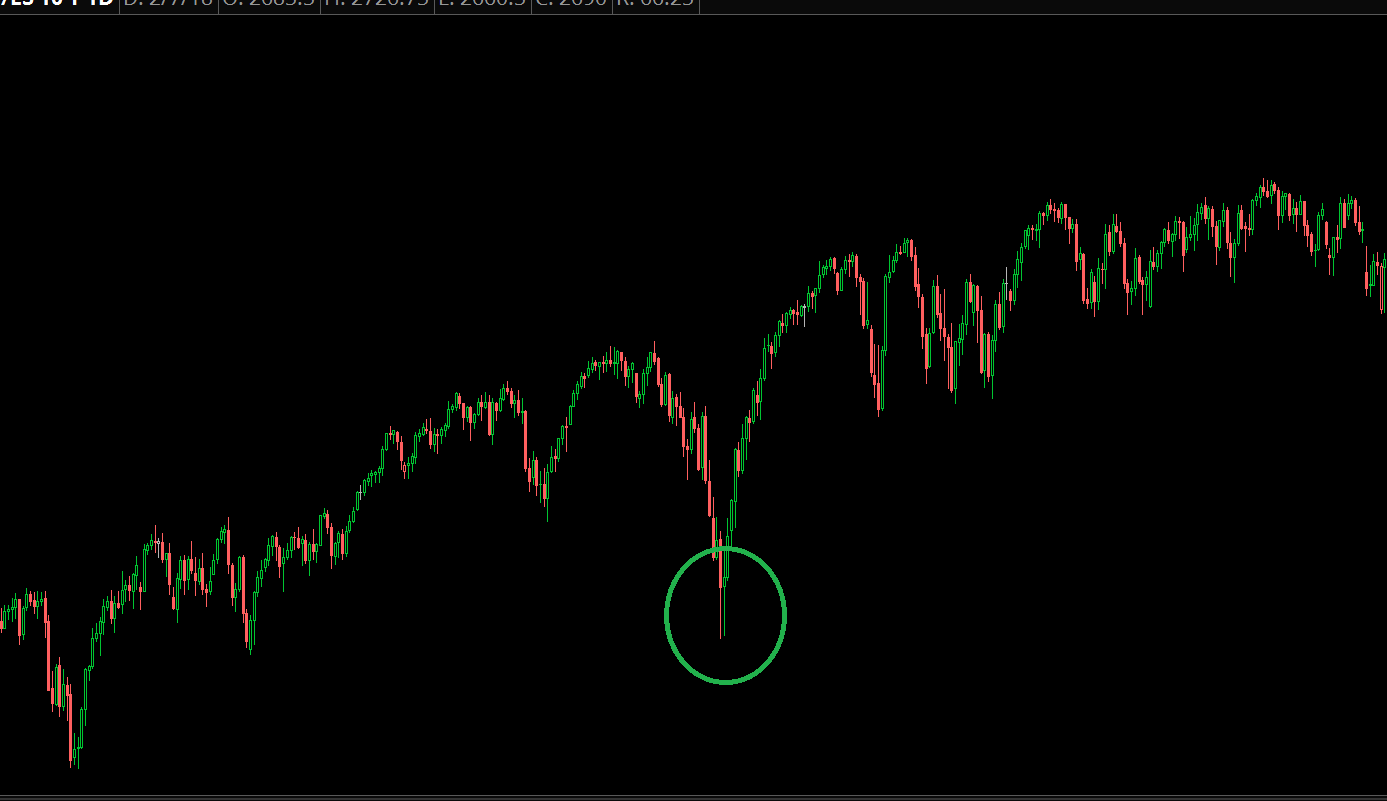

Yet a retest isn't guaranteed. For good examples, you need to actually look at the futures market to see the overnight trading sessions in 2016 where we had big bounces after Brexit and the US Elections

And there was also the Ebola scare in late 2014:

So are we going to retest the lows or not? I'm leaning towards the second choice for a few reasons.

Before we consider what a "retest" means, there's actually two levels to watch. You have the overnight low, and the low put in during regular trading hours (RTH).

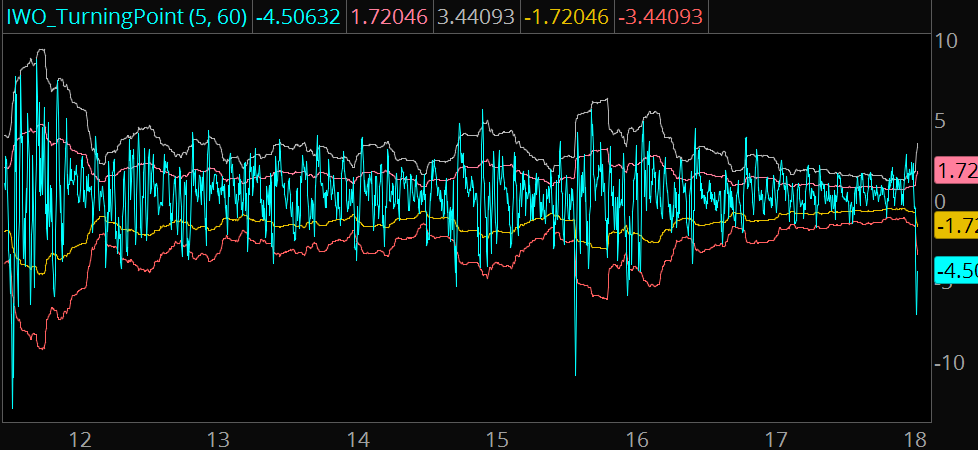

The overnight low is actually drastically lower than what we saw in RTH:

For now, let's just consider some reasons why the odds are against a near term retest...

No Event Overhang

If you look at some of the recent large pullbacks, there was some kind of an ongoing catalyst driving the overall macro landscape.

Fiscal cliff. Eurozone crisis. Chinese interest rates. Fed decisions.

As it stands right now, there are no near term market moving events that pose a "clear and present danger." The one possibility is a US government shutdown, but that's all I can think of.

The real reason we saw an acceleration to the downside was related to market structure. There were too many volatility shorts, and they got runover-- the VIX squeezed, and XIV failed.

The short volatility blowout is now a "known known." The catalyst is already past us, and we've got a pretty good idea how bad it was. Once a catalyst becomes a known known, it quickly becomes priced into the market.

BFC's Are Holding Up

Not just a month ago, the Dow Jones Industrial Average looked unstoppable.

Why? Because Boeing was getting absolutely jammed higher into earnings. And since the DJIA is a market-cap weighted index, very large companies can significantly influence the market.

I call these stocks BFC's, which stands for Big F*cking Companies. Their weighting swings the S&P and Dow and Nasdaq so much.

Now many of these BFC's barely got hit, or have already recovered their gains. Here are some ones to watch:

Boeing (BA)

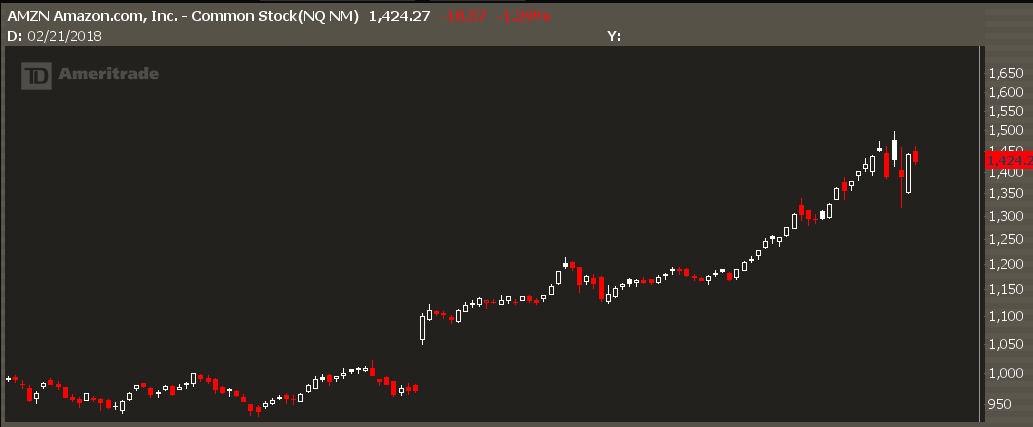

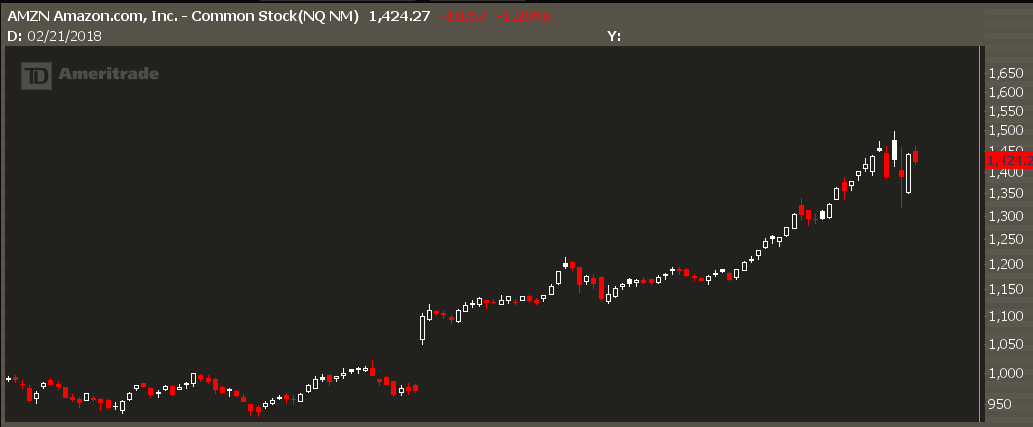

Amazon (AMZN)

JP Morgan (JPM)

Facebook (FB)

Microsoft (MSFT)

It's pretty simple here... even if much of the market is trading like hot garbage, the big indexes will still have a bid because these BFC's are bid.

Taking the Other Side

Personally, I'm not hoping for straight up action like we've seen over the past year. I would prefer two-way action, and would welcome a retest of the lows.

Yet my current thesis is that unless we see more instability in the volatility markets and a breakdown from these BFC's, it's going to be VERY VERY HARD for the market to have the same kind of sellers that it experienced earlier this week.

The inverse here is true. If these BFC's start to break key support levels, and if volatility futures go back into squeeze mode, then we'll start seeing quick drops again.