At least not right now.

The demand for GLD as a portfolio hedge can bet split into two sets of "crazies" -- the risk aversion crowd and the hyperinflation crowd. The assumption gold bugs make is that at some point these two crowds will converge and GLD will be at some ridiculous number. But for the time being, we see GLD oscillate between the two. So when GLD was breaking out a month ago, it wasn't due to inflation, it was due to the sovereign debt crisis and some euro voodoo.

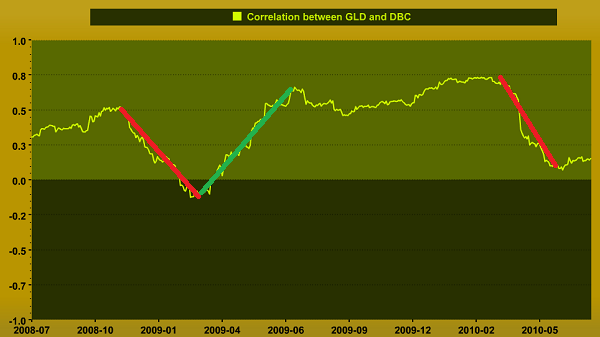

Here is an easy way to see which camp has higher demand:

This is a correlation between two etfs: GLD and DBC. GLD the most popular etf to gain exposure in the asset, and DBC is a commodity etf that has exposure in heating oil, crude, gold, natty, zinc, and others. Basically, when GLD and DBC are highly correlated, that means there is more risk of inflation, and when the correlation breaks down, it means we are in a "risk aversion" mode.

This can actually make for a nice long term timing of the market, and we're coming down to levels in which I feel the risk for reflation could be coming back into play (maybe). A confirmation would be a drop in demand for treasuries.

So next time you hear someone trying to justify a position by the price action of gold, make sure to see if their thesis lines up with this chart.