Warning: the content below is super-advanced, but I wanted to get it out there to show how there's more to options than just buying calls and puts.

Earlier this week I discussed the potential for a nice volatility trade in $NFLX.

With the breakdown today, it worked... but is there a way to improve the position?

Of course.

Here's what it looks like right now:

Depending on what price you were looking at, you are now up about 20% on the max risk. Not bad for a few days.

What's more, the term structure we discussed has reverted, which has helped the overall structure of this risk.

However, we have the risk of mean-reverting, and taking back your profits.

So all you have to do here is neutralize the directional exposure by trading stock.

For each time spread sale, simply get long 10 shares of $NFLX.

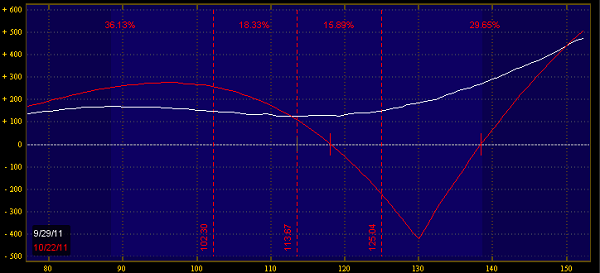

Here's the new risk profile:

So you've kept the long gamma, you end up with long theta on a further move lower, and you have the potential for higher profits if it runs back to 130.

If you eyeball the chart right, it resembles something like a call ratio buy... if we drift back towards 120 I wouldn't look to hold it but for another week as time decay will start to erode your profits.