A Special Report from InvestingWithOptions

The market environment has drastically changed compared to the past few years.

In this report you'll discover the things you should focus on in 2016 and the option strategies to use right now.

The Great Struggle This Year

-

There has been a massive divergence in stocks.

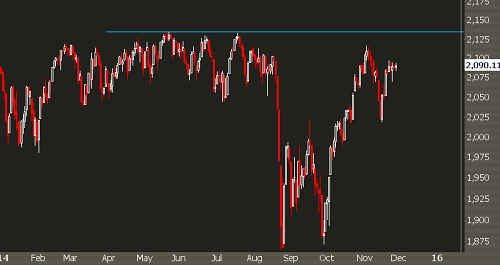

At the time of this report, the S&P 500 is only 1.2% away from its 52 week highs:

Yet, if we look at the individual stocks that are within the S&P 500, only 142 stocks are within 5% of their 52 week highs.

That means only 28% of stocks are close to beating the market!

-

The reason we see this divergence is because indexes like the Dow Jones Industrial Average and the S&P 500 are market capitalization weighted indexes.

That means it's possible for only a few stocks to keep the indexes elevated while the rest of the market is stagnant.

-

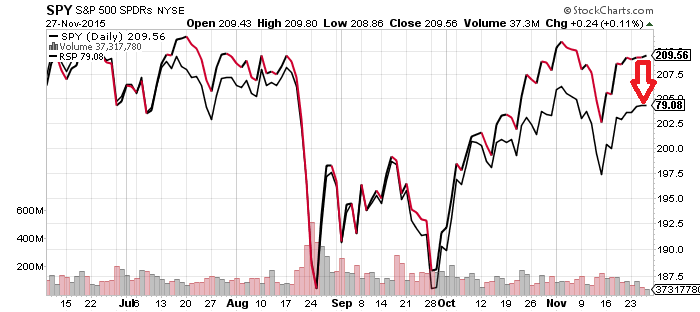

This is more pronounced when we look at RSP, an ETF (Exchange Traded Fund) that tracks the S&P 500 stocks on an equal weighted basis.

This index is over 4% away from 52 week highs.

- Large cap stocks such as AMZN (Amazon), FB (Facebook), and HD (Home Depot) have significantly outperformed other stocks and they are also the names that are keeping this market afloat.

- This has led to many investors significantly underperforming the market.

-

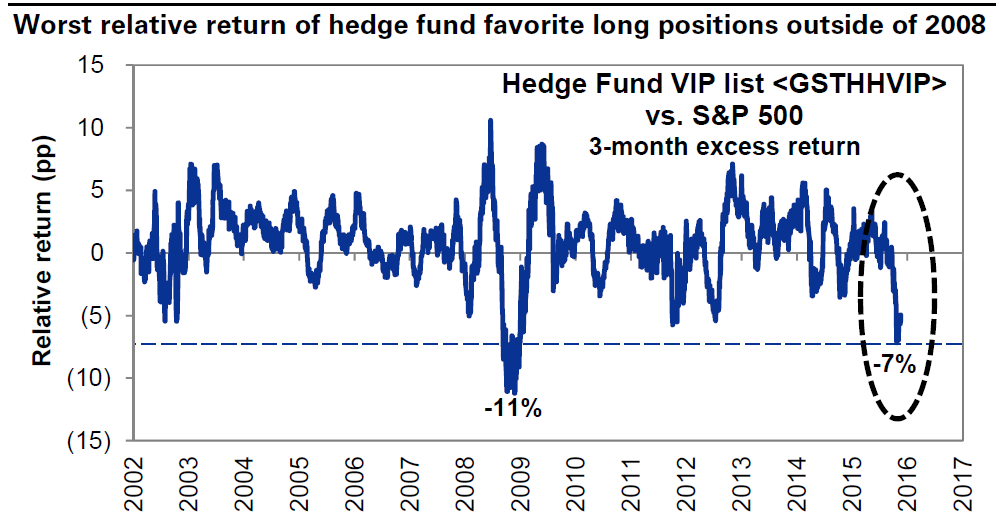

Smart money has been hurt, too.

Goldman Sachs tracks a basket of stocks called the Hedge Fund VIP list, which is a list of stocks that appear most frequently in the top 10 holdings of institutional players.

The chart below shows the damage that has been done:

This is the worst underperformance for this list since 2008.

This is the worst underperformance for this list since 2008. - It's clear that 2015 was not a good year for many people... what do we have to look forward to in 2016?

-

There are a few themes that will continue to dominate the headlines going into 2016.

While these risks should not dictate our actions as traders, it's important to know what larger market participants are focusing on as they are the ones that can move markets.

-

The Fed Raising Rates.

There is an overabundance of analysis on what the Fed will or won't do over the next few months.

The general theme here is that if the fed does raise rates, it will help financials and hurt more interest rate sensitive areas like utilities, commercial real estate, and high dividend yielding stocks like KO (Coca-Cola).

In general, investors are worried that raising rates will make stocks less attractive to portfolios as you can find higher yield in less risky securities.

-

Continued dollar strength.

Here is a chart of the dollar index over the past few years:

If the dollar keeps running, commodity stocks will continue to stay under pressure during 2016, and it hurts the pricing power of US-based exporters.

-

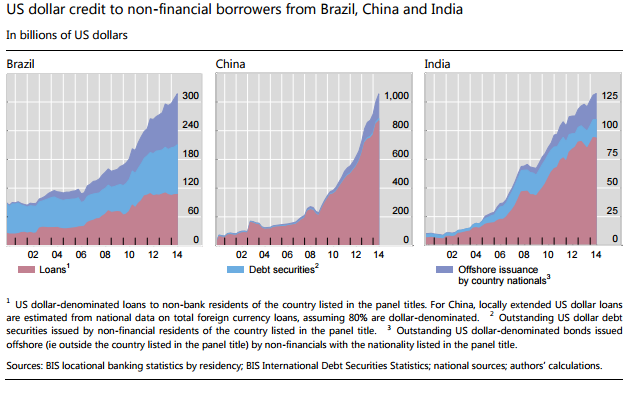

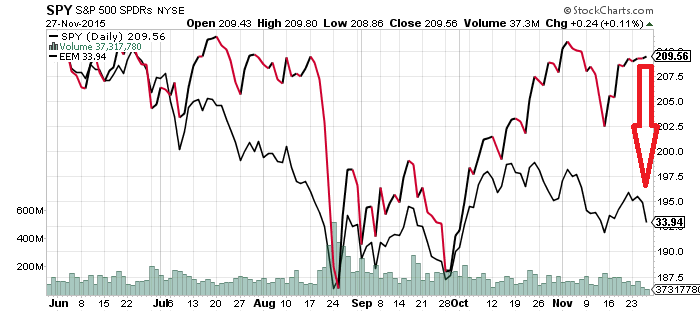

Emerging market currency risk.

A main catalyst associated with the crash in the fall was related to a surprise currency adjustment by China.

If the dollar continues to stay strong there is major risk in emerging market debt that is denominated in US dollars.

US dollar corporate EM debt has grown sevenfold from 10 years ago and is a 1 Trillion Dollar Market.

For now any risks are "contained," but the sensitivity of this market can easily spillover into stocks.

-

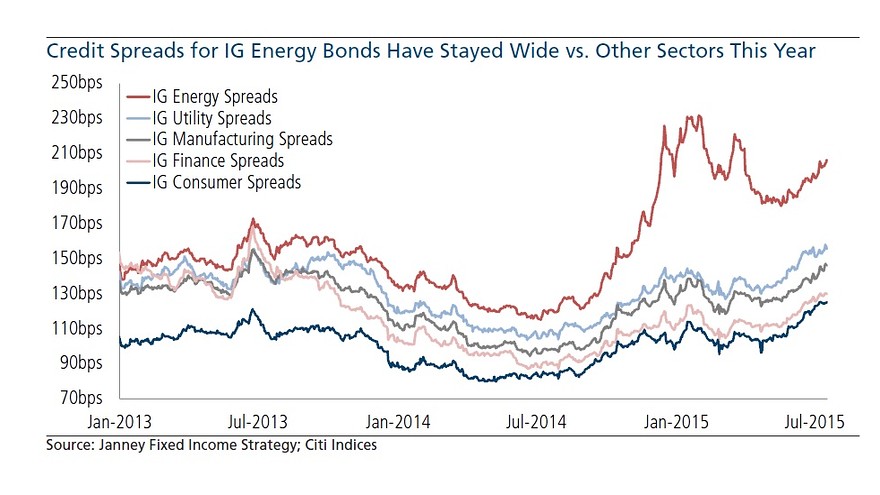

Energy Corporate Debt Risk.

The crash in oil prices has left many concerns about whether oil firms can service the debt they currently owe.

If an oil company has to pay $35MM per year to their creditors, it is easier to pay off that loan when they can sell oil at $50 per barrel, and impossible to do if oil breaks under $40 per barrel.

If high yield debt continues to be in a "risk off" environment, it will be difficult for stocks to sustain current prices.

Expect to see a wave of defaults from distressed Oil E&P names during the first half of 2016 if oil prices don't improve.

- It can be easy to focus only on the bad news of the market, but in order to develop a gameplan into next year and to have a balanced approach, the "bullish" events must be taken into account as well.

-

The Risks Are Getting Priced In.

Many of the bearish themes are already reflected in market pricing.

For example if we consider emerging market risk and then look at EEM (an emerging market etf), we can see that it's currently -13% year to date and -18% from one year ago.

-

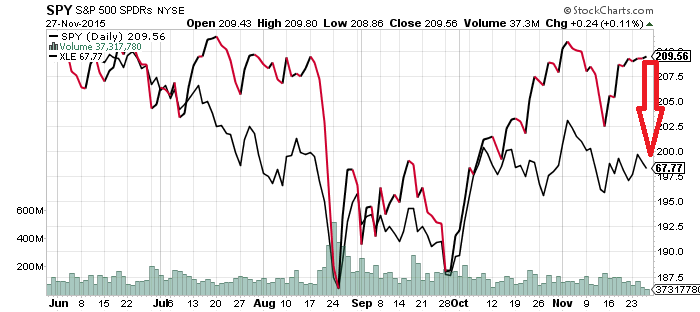

The same can be said of energy stocks. XLE (Large Cap Energy ETF) is down 18% from a year ago:

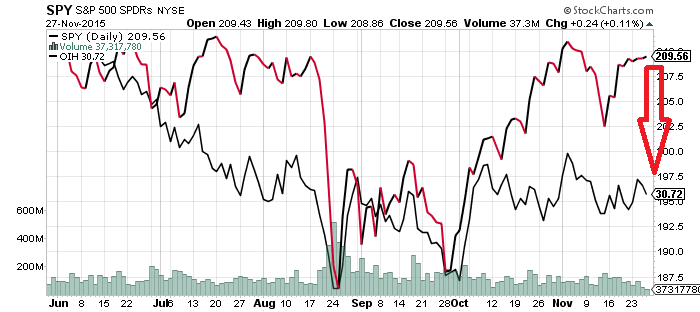

...and OIH (Oil Services ETF) (the oil services ETF) is down 25% during the same timeframe.

-

It's very possible that the market is being efficient here and pricing in all the known risks available in the market.

If those risks aren't realized then it's possible that a floor gets put in many of these beaten down sectors.

-

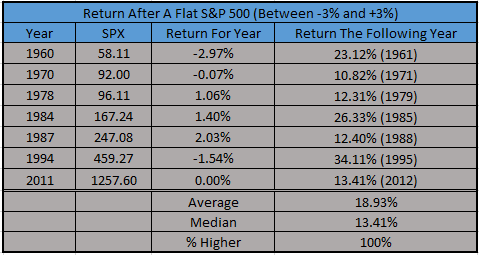

"Flat Years" lead to bullish resolution.

If the markets manage to finish nearly flat on the year, it tends to lead to strong upside followthrough in the next year.

There have been only 7 instances in which the market finished within 3% of the previous year, and the following years have a very bullish tendency.

-

Rising rate environments tend to be bullish.

It seems that so many investors and the entirety of the financial media are focused on the spectre of a rate hike by the Fed.

Yet there is no evidence to suggest that rising rates are actually bad for the markets.

Going back to the 1950s, there have been 14 "rising rate environments."

The average return during these periods for stocks was 20%, and there was only 2 periods in which the return on stocks was negative.

- Whare are some strategies to consider for option traders right now?

-

Income trading.

This set of option trading strategies is profitable when markets are rangebound and not trending.

During the first 9 months of 2015, income trading was a very easy play and incredibly profitable.

The market crash and volatility afterwards has made this trade more difficult, but as we head into the end of the year the lower volatility will set up for some great trades.

-

Play the stop runs.

In certain sectors like healthcare and energy, trying to buy stocks when the strength is obvious has not been a good trade.

It's much easier to avoid the obvious breakout and look for the levels in which the breakout players would be shaken out of their positions.

Because these stocks are not in momentum-driven trends, playing the reversion game continues to work well.

-

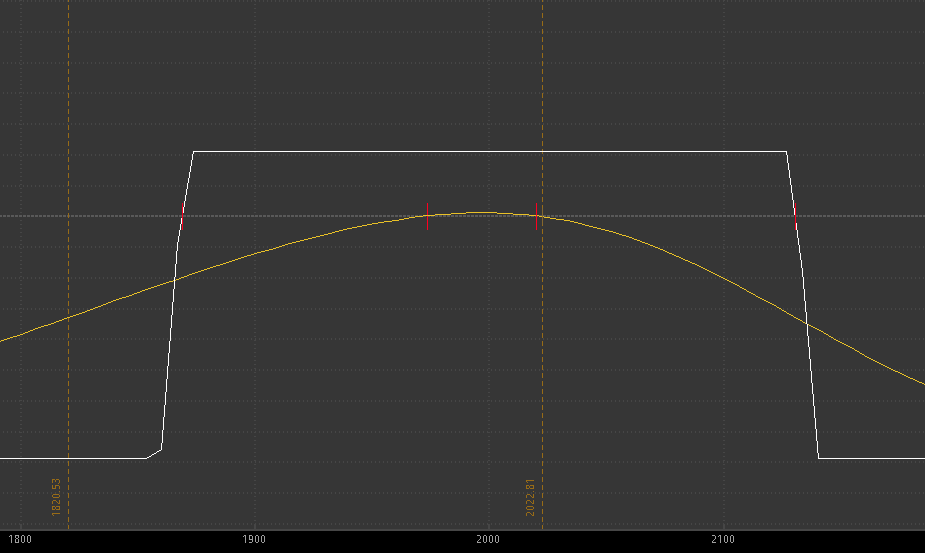

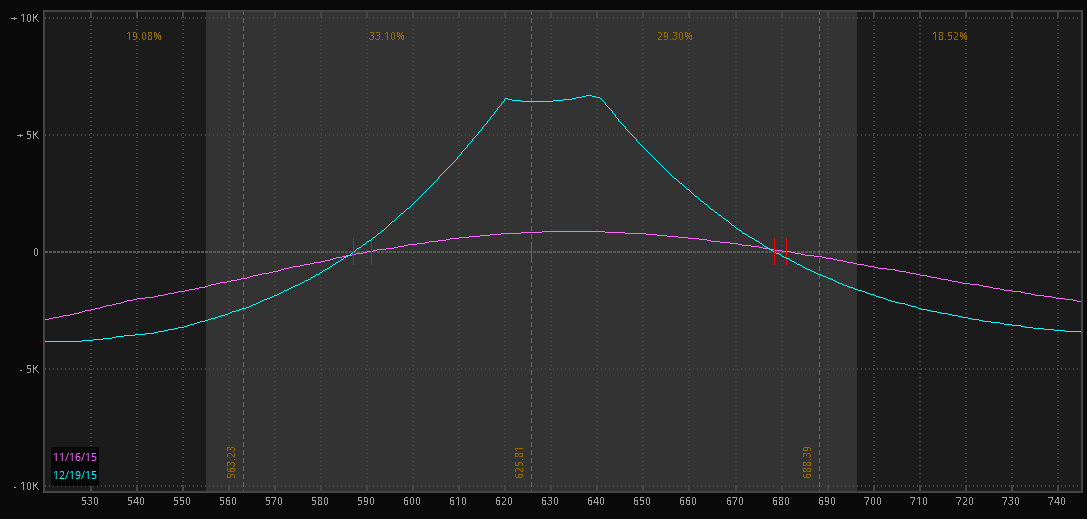

Sideways Plays on "High Beta" Names.

A strategy that has worked well all year, this is a setup where you wait for a large price, large market cap stock to have a strong run on news or earnings.

Once the stock becomes overbought, you can use option calendar spreads to profit as the stock goes rangebound.

Because these aren't low-float penny stocks, they rarely have enough momentum to sustain the run for more than a few weeks.

-

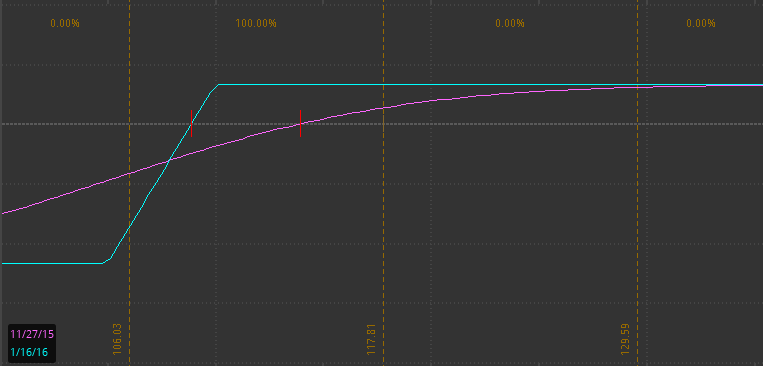

Vertical spreads on relative strength names.

Instead of trying to chase what hasn't been working, focus on the same stocks over and over using vertical spread sales.

This is a kind of option strategy that allows you to place a directional bet and you make money even if you are a little wrong on the stock.

You can easily trade both sides of a stock simply using the ranges they setup.

With proper position sizing and scaling techniques, you can go back to the same stock over and over while pulling out low-risk profits.

The Big Risks In the Market

The Good News We Have To Work With

What's Working Now

How Can You Turn These Ideas Into Profitable Trades?

This report was made so you may be fully prepared into the end of the year.

Yet if you are ready to start taking trades now, you'll want to take advantage of this special end of year offer.

Introducing:

IWO Live Option Strategy Session

Here's What You Will Receive...

- A live strategy session on Saturday, December 5th at 12 PM

- 3 IRA Trades Using Covered Calls And Put Sales

- 5 Directional Swing Trade Setups

- 3 Income Trading Setups With Complete Adjustment Plans

- A 15 Minute Q&A Session During The Strategy Session

- Secure web page with recording for your review

- PDF Download Listing All The Setups

- An Opportunity to Trade With Me Live